Trump increases pressure on the Federal Reserve, and the Federal Reserve is in trouble. Will the US dollar weaken further?

2025-08-14 20:05:05

The Federal Reserve's dual mandate is shifting further toward prioritizing full employment, a stance shared by a growing number of Federal Open Market Committee members. Next weekend's Jackson Hole symposium will provide Fed Chair Jerome Powell with an opportunity to adjust the policy narrative. Historically, this gathering of central bank governors in the Rocky Mountains has often marked turning points in U.S. monetary policy.

Consumer price growth slowed

In July 2025, the headline CPI rose by 0.2% month-over-month, compared to 0.3% in June, and the year-over-year increase remained stable at 2.7%, in line with expectations. Core inflation edged up to 0.3% month-over-month and 3.1% year-over-year, compared to 0.2% and 2.9% in June, respectively, with the annual figures slightly exceeding expectations.

Price breakdown – Energy prices fell, food prices remained flat

Energy prices fell 1.1% month-over-month, while food prices remained flat. The growth rate of core goods prices (excluding autos) slowed to 0.2% month-over-month from 0.55% in June. Prices of furniture (0.9%), used cars (0.5%), sporting goods (0.4%), and apparel (0.1%) rose. Home appliance prices unexpectedly fell 0.9%.

Seasonal upturn in services sector

Airline fares rose 4% month-over-month, while medical costs rose 0.7%, primarily due to dental services. Housing costs edged up just 0.2%.

Tariffs haven't triggered inflationary pressures

The lack of signs of rising inflationary pressures following President Trump's tariffs suggests that businesses are absorbing higher costs through their profits rather than passing them on to consumers. This is supported by the latest National Federation of Independent Business (NFIB) survey, which showed that the proportion of small businesses planning to raise prices over the next three months fell from 32% to 28%, indicating demand-side constraints.

Inflation and the Fed's Policy Outlook

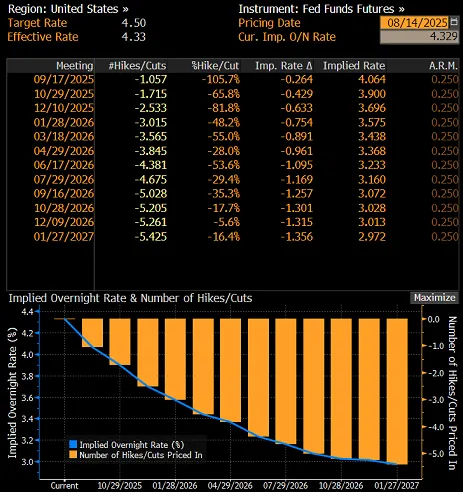

Analysts believe there is little risk of inflation exceeding 4% this fall, and an increasing likelihood of inflation falling below 2% by the end of 2026. These data reinforce market expectations of a 25 basis point rate cut by the Federal Reserve in September and another in December. Currently, federal funds futures suggest a 26 basis point rate cut at the Federal Open Market Committee meeting on September 17, bringing the cumulative rate cut to 63 basis points by the end of the year.

(U.S. interest rate path market pricing based on federal funds futures, source: Bloomberg)

Trump steps up pressure on Powell

U.S. President Donald Trump stepped up his calls for a quick interest rate cut and even hinted at possibly suing Federal Reserve Chairman Jerome Powell for his alleged incompetence in overseeing renovations of the Federal Reserve building.

Remarks by FOMC Members

Thomas Barkin noted that the balance of risks to the labor market and inflation remains unclear, and the Federal Reserve is fully prepared to respond appropriately. Stephen Milan, a new Trump-appointed member of the Federal Reserve Board of Governors, stated that there is no evidence of tariff-induced inflation, adding that rising rents are partly linked to illegal immigration. Jeff Schmid believes that while economic growth remains solid, inflation remains excessive, necessitating a moderately tightening stance. However, he added that he would be prepared to change his view if demand weakened significantly.

What's next for the US dollar?

In the week ending August 5, net short positions in the US dollar fell sharply by $4.3 billion – the fourth consecutive weekly decline. Net short positions now stand at $7 billion, down from a local peak of $18.6 billion in early July.

(Source of EUR/USD daily chart: Yihuitong)

It's important to note that these data are lagging indicators and don't yet reflect the latest forex market trends. The July pullback in EUR/USD saw some unwinding of short positions, but the latest disappointing non-farm payroll data has reignited selling pressure on the dollar. The pair's uptrend remains technically intact, and August's inflation data will only strengthen its case for a rally. The next upside target for EUR/USD is 1.18; a break above this level would pave the way for a move towards 1.20–1.23.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.