Daily RSI overbought, but still bullish? Gold opens low and rises, hinting at potential gains. US PPI leads the way tonight.

2025-09-10 18:02:44

Meanwhile, last Friday's weak US non-farm payroll data further reinforced market expectations of more aggressive Federal Reserve easing, limiting the dollar's overnight rebound and boosting demand for non-interest-bearing gold. Furthermore, ongoing trade uncertainty, escalating geopolitical tensions, and political unrest in France and Japan are further supporting the safe-haven precious metal. This, in turn, reinforces gold's positive short-term outlook and suggests that any corrective pullbacks could present buying opportunities.

Here is a summary of recent market dynamics:

Gold bulls await new momentum from U.S. inflation data

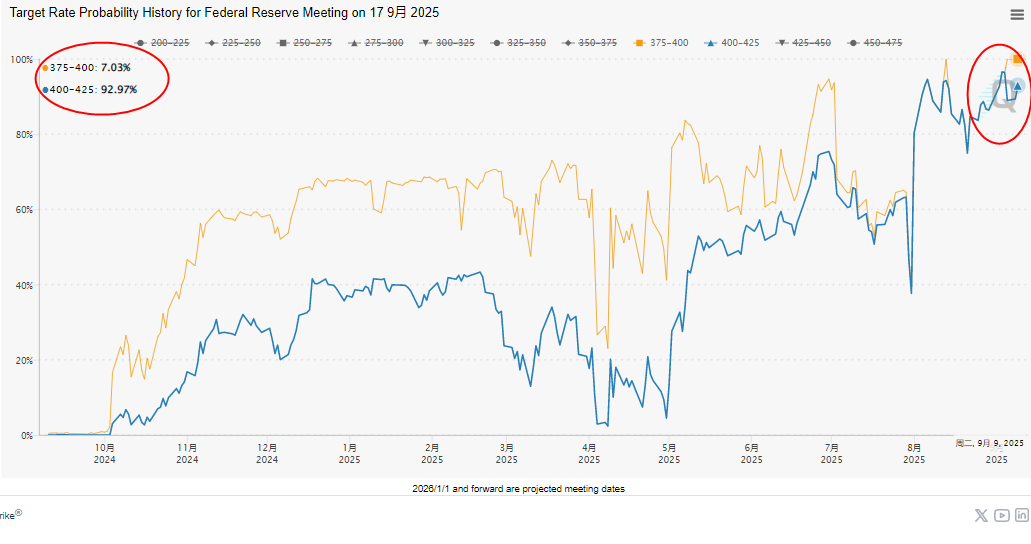

Unexpectedly weak U.S. employment data released last Friday further confirmed a cooling labor market, leading to market expectations that the Federal Reserve will implement three interest rate cuts before the end of the year. Furthermore, the CME Group's Fed Rate Watch tool indicates a small probability of a 50 basis point rate cut at next week's Federal Open Market Committee (FOMC) meeting.

(CMEFedWatch interest rate futures chart)

Policies and markets around the world boost risk aversion

The Financial Times reported on Tuesday that former US President Donald Trump has urged the European Union to impose 100% tariffs on goods from India and other countries. The report further stated that the Trump administration is ready to take "mirror" measures against any tariffs imposed by the EU on Indian imports.

On Tuesday, a federal judge temporarily blocked Trump from removing Federal Reserve Governor Lisa Cook. This ruling eased market concerns about the Fed's independence being undermined. Combined with position adjustments ahead of the release of key U.S. inflation data, it helped the dollar maintain its rebound yesterday, while potentially limiting gold's upside.

French Prime Minister François Bayrou resigned after losing a confidence vote in the National Assembly, while Japanese Prime Minister Shigeru Ishiba announced last weekend that he would step down as president of the ruling Liberal Democratic Party (LDP).

Geopolitical uncertainty supports gold prices

Israel launched an airstrike in Doha, Qatar, targeting Hamas leadership, sparking widespread international condemnation. Qatar's Prime Minister stated that his country reserves the right to respond to this blatant Israeli attack. Given Qatar's role as a key mediator in the ceasefire negotiations between Israel and Qatar, this incident could have a substantial impact on the negotiations.

Poland placed its air defenses on high alert in response to Russia's heaviest air strikes on Ukraine in recent weeks, which have sparked concerns about the attacks being carried out close to the Polish border. Separately, the Ukrainian air force issued an early warning of a suspected Russian drone entering Polish airspace.

Trading reminder, please be patient and wait for the data to be released

On Tuesday, all three major Wall Street indexes hit record closing highs, and this transmission effect pushed Asian stocks further higher.

This market environment may further suppress demand for safe-haven gold, and traders need to remain vigilant. Currently, traders are focusing on the US Producer Price Index (PPI) to be released later today for new trading guidance.

Market focus will turn to Thursday's release of the U.S. Consumer Price Index (CPI) - this data will play a key role in guiding the short-term trend of the US dollar and determine whether spot gold will break out further.

Technical Analysis

From a technical perspective, the daily Relative Strength Index (RSI) remains in overbought territory, suggesting a potential short-term consolidation or further correction is more appropriate. Despite this, the 5-minute chart shows a strong bullish outlook. 3640 marks the neckline of a short-term double bottom pattern, and gold has already successfully broken through it (the subsequent price increase is at 3660). 3640 currently represents significant support, and until it is breached, the bullish outlook remains strong. For gold to maintain its bullish trend, 3626 must hold.

If it falls below, gold prices will find support near the $3,600 mark. If this mark continues to fall, the weekly low of around $3,580 should be watched. If it breaks further, gold prices may continue to fall back to the medium-term support level of $3,565-3,560, and then test the swing low of around $3,510 last Thursday.

(Spot gold 5-minute chart)

On the other hand, the $3,645-3,655 range may become a short-term resistance level, with yesterday's all-time high of approximately $3,675 above it. If sustained buying momentum continues, gold prices could continue their upward momentum, targeting the $3,700 mark, which also marks the point of the recent triangle consolidation. However, the overall technical pattern suggests that bulls may be hesitant to enter a large position for the time being, suggesting that the aforementioned level may become a strong resistance level in the short term for spot gold.

(Spot gold daily chart, source: Yihuitong)

At 17:57 Beijing time, spot gold was trading at $3654.71 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.