The US dollar is at a crossroads, testing support for its 13-year uptrend.

2025-09-10 18:56:45

The short-term outlook for the US Dollar Index (DXY) is quite concerning. Late last week, weak labor market data caused the DXY to break the upward trend that had been building since its July low, dropping to 97.5. A further drop below the July low of 96.3, the lowest level since March 2022, would confirm a downtrend.

The reason for the dollar's weakness is clear: labor market conditions are much worse than previously expected, prompting a rapid reassessment of the outlook for U.S. monetary policy. However, this relatively small decline may have important technical significance.

From a technical perspective, this means that the US dollar has room to fall further: it may fall to the 2021 low of 90, or even to the 88 range - this range corresponds to the 161.8% Fibonacci retracement target of the decline in the first half of this year.

(US Dollar Index Trend)

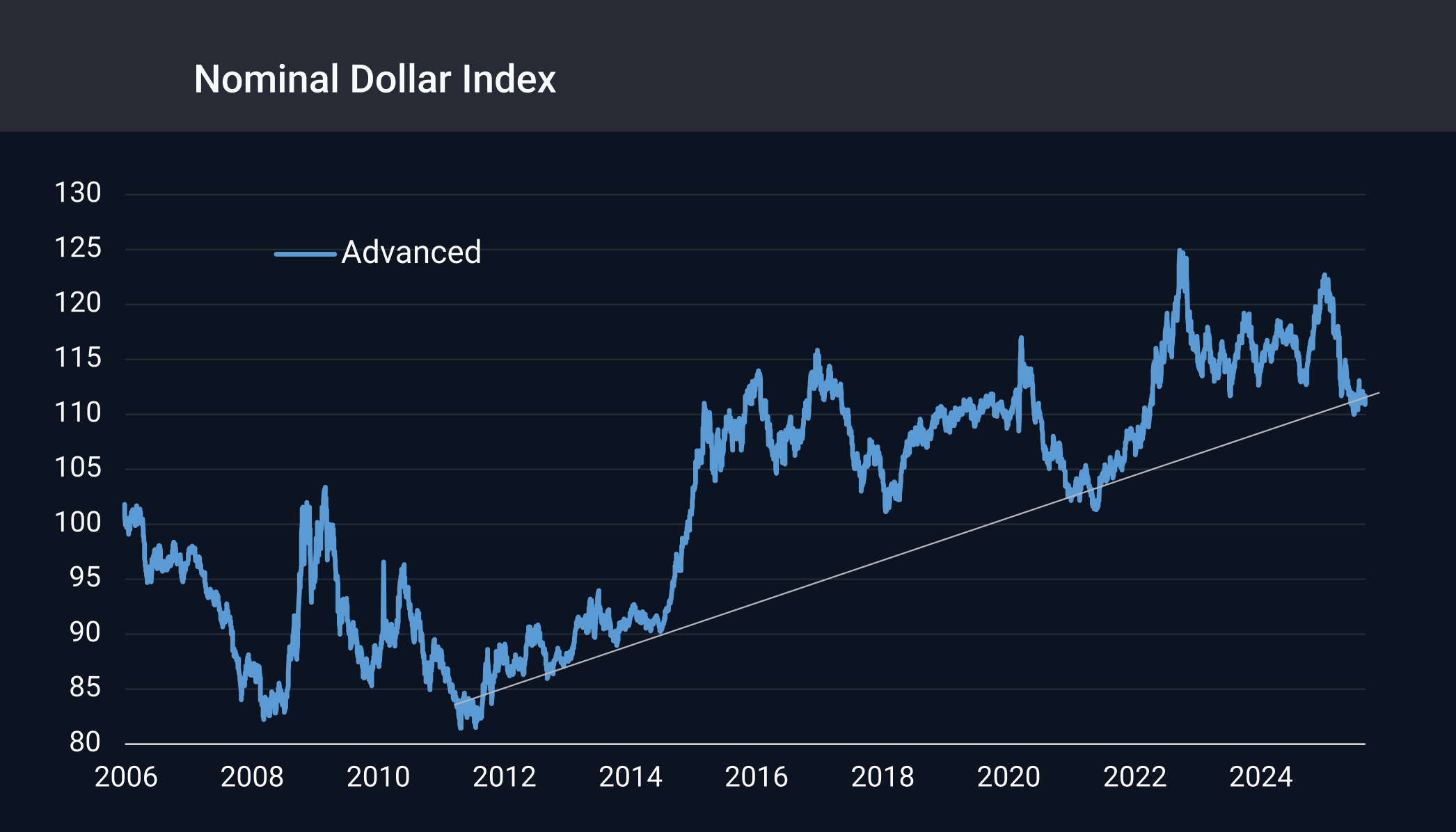

This could mark the beginning of a significant decline for the US dollar. The US dollar trade-weighted index (compared to a basket of developed economy currencies) compiled by the Federal Reserve has exhibited periodic fluctuations and wide ranges: over the past three years, the index has primarily fluctuated between 110 and 120; from 2015 to 2022, it has largely remained between 100 and 110; and in 2014, its fluctuations began around 90. If the index falls another 2% or so from its current level, it would fall below the long-term upward trend line that began in 2012.

(Traces of the U.S. dollar against a basket of developed economy currencies)

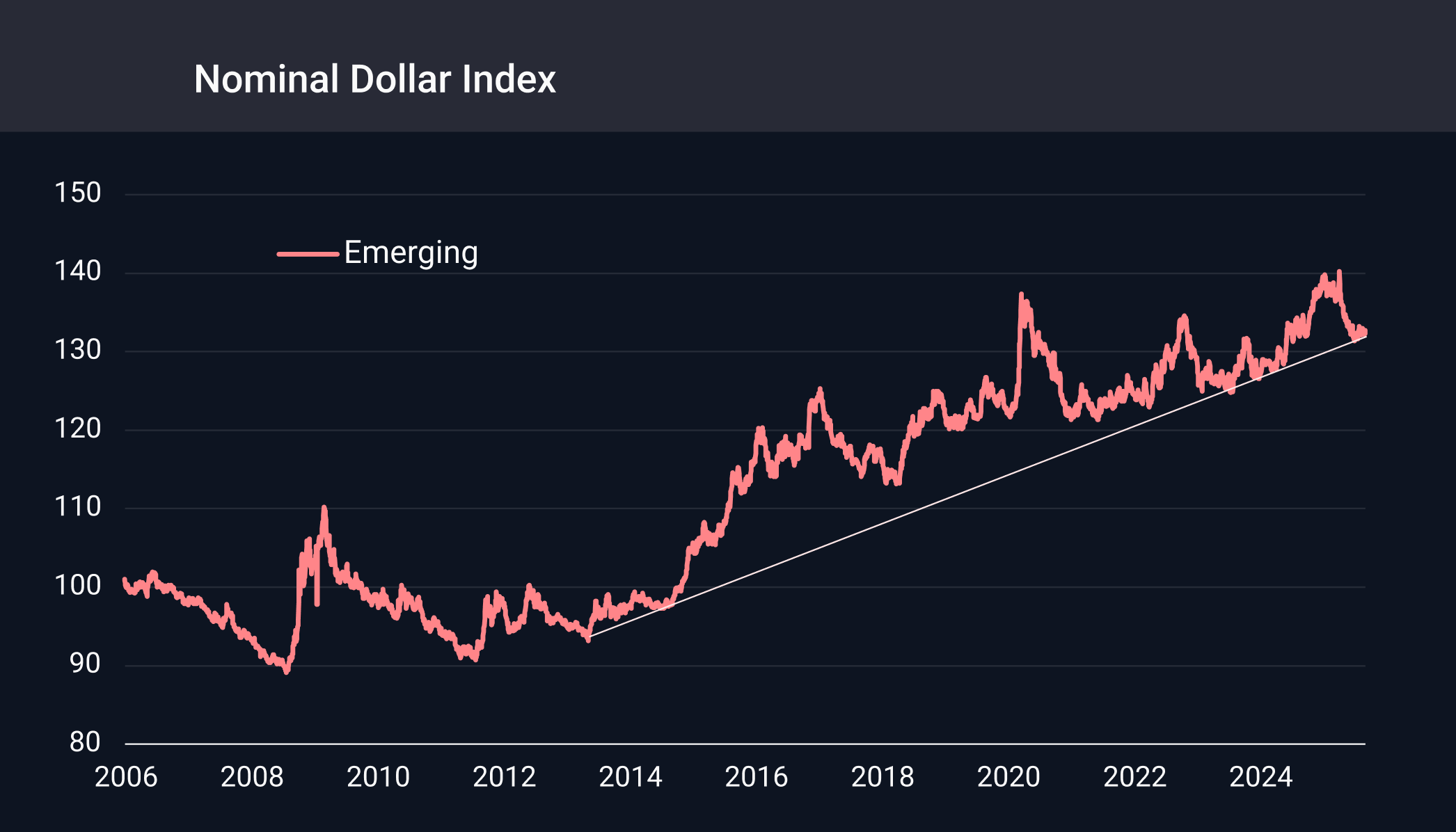

The US dollar's exchange rate against a basket of emerging market currencies is showing even more severe trends. Historically, emerging market currencies have mostly depreciated against the US dollar. The latest upward trend in the US dollar against emerging market currencies began in 2013, but the support line for this trend has been repeatedly tested over the past two years. Since July of this year, the US dollar index has again been fluctuating around this support line. A break below this support level would signal the beginning of a multi-year downward cycle for the US dollar against emerging market currencies.

The U.S. dollar exchange rate against a basket of emerging market currencies

Considering that August and September (the end of the fiscal year) are typical periods for the market to form new trends, the above risks need to be more vigilant.

Strictly speaking, it is premature to declare a “decline” in the dollar until it breaks below key support levels. From its current position, the dollar may even become an ideal entry point with long-term upside potential.

However, to drive the dollar's strength, bullish investors must change the prevailing market view—that the Fed will cut interest rates more aggressively. Furthermore, as the proportion of officials appointed by the new Trump administration at the Fed continues to increase (including the upcoming change in the Fed chair in May), reversing this market view will become increasingly difficult.

These Fed personnel changes are by no means populist. Given the United States' massive national debt and the impossibility of fiscal consolidation, the US government has limited policy room to maneuver. The only viable strategy left is to reduce the debt burden and correct the trade deficit by devaluing the currency and tolerating higher inflation—the very path Britain took in 1938.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.