Tonight's CPI sets the market on fire! The Fed is counting down to rate cuts, but beware of inflation.

2025-09-11 11:55:24

The report comes days before the Federal Reserve is due to announce on September 17 whether it will cut its benchmark interest rate.

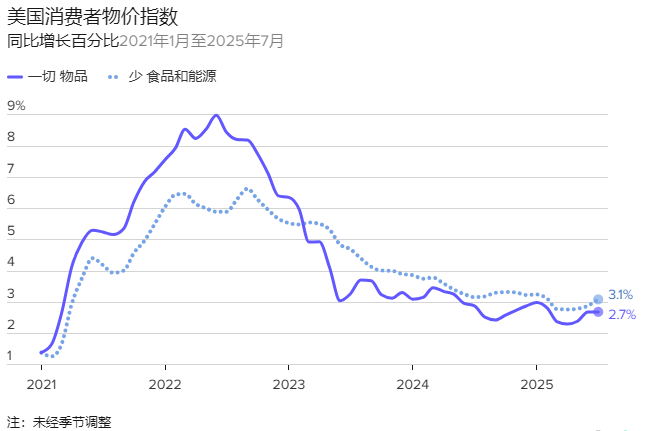

Economists surveyed by Bloomberg expect the CPI data to show overall prices rising 2.9% year-on-year, accelerating from 2.7% increases in June and July. Combined with Wednesday’s 2.6% year-on-year reading for the Producer Price Index (PPI), the data is likely to indicate that price increases remain well above the Federal Reserve’s 2% target level.

Although inflation has fallen from its peak of 9.1% year-on-year in June 2022, the cumulative price increase since July 2022 has still reached about 9%, continuing to put pressure on household budgets.

At the same time, job growth has slowed, which New York Fed President John Williams noted highlights the challenge the Fed faces in balancing its dual mandates of stable prices and maximum employment.

As a result, Thursday’s CPI report will be one of the “most consequential” economic data releases of the year, said Stephen Cates, a financial analyst at Bankrate.com, particularly given the deeply concerning prospect of a reacceleration in prices for essential goods like groceries and services like electricity, especially amid slowing labor market growth and rising unemployment.

Core CPI is key

“Core” inflation, which strips out volatile food and energy prices, is forecast climbing 3.1% in 12 months, matching July’s gain and the highest level since February.

If the report meets expectations, it would show inflation remains above the Federal Reserve's 2% annual target and moving in the wrong direction. Tariffs implemented by U.S. President Donald Trump earlier this year have raised prices as businesses pass on the cost of import taxes to consumers.

Economists are watching the impact of tariffs on the "core goods" inflation category, which measures the goods people buy (as opposed to services and housing) and excludes food and energy prices, which can fluctuate due to factors other than inflationary trends. Before the pandemic, core goods prices tended to be flat or negative, as cheap imports depressed the prices of goods like clothing and electronics, thus holding back overall inflation. But this summer, core goods prices have risen, and forecasters expect that trend to continue .

"We will be watching primarily for continued signs of tariff impact in core goods categories," Brett Ryan, senior U.S. economist at Deutsche Bank, wrote in a commentary.

How the Fed Responds

The inflation report will almost certainly influence the outlook for interest rates and will be closely watched by Federal Reserve officials, who meet later this month to set the Fed’s monetary policy.

Financial markets widely expect the Federal Reserve to cut its benchmark interest rate for the first time this year at its September meeting, a move aimed at lowering short-term borrowing costs to stimulate economic growth and prevent a summer slowdown in hiring from translating into a surge in unemployment. The Fed is mandated by Congress to maintain low inflation and high employment .

Federal Reserve officials may be reluctant to lower their benchmark interest rate too much from its current range of 4.25% to 4.5%. Rates are currently high because they want to keep inflation down to their 2% target by discouraging borrowing and spending. Policymakers may be concerned that cutting rates too sharply and too quickly could further increase inflation, which hasn't been at or below 2% since 2021.

“The combination of tariff-induced inflationary pressures on goods and sticky service prices is likely to keep policymakers wary of inflation risks,” David Seif, developed markets economist at Nomura Securities, said in a commentary.

Inflation data in the coming months will guide the Fed's policy direction for the rest of the year .

Interest rate cuts are imminent: Borrowing costs are expected to fall, but the future path remains uncertain

Despite concerns about rising prices, the market believes that a 25 basis point rate cut is basically a done deal, according to the CME FedWatch tool, which tracks Fed policy expectations in real time.

The move will lower the Fed's benchmark interest rate to a range of 4% to 4.25%, making borrowing costs lower for credit cards, auto loans, and other types of financing. Looking further out, the market is pricing in at least one or two more rate cuts by 2026 .

For households, the impact won’t be immediate: Credit card interest rates may fall within one or two billing cycles, while auto and personal loans may take months to adjust. Initial savings may be modest—a few dollars less in monthly credit card bills, for example—but they will increase with subsequent rate cuts.

Federal Reserve Chairman Jerome Powell has called the current benchmark interest rate of 4.25% to 4.5% a “restrictive level.” The rate cuts are aimed at preventing the economic slowdown from worsening as the job market weakens .

Federal Reserve Governor Christopher Waller supported the move, telling CNBC last week that “there has been significant slack in the labor market.”

“Typically, when the labor market deteriorates, a recession sets in quickly... So I think we need to start cutting rates at the next meeting,” Waller said. “I don’t see a recession at all in my forecast, but I do see slower growth throughout the year, largely due to the tariff impact.”

While Waller acknowledged that tariffs could push up prices, he also said that was more likely to be a one-time shock than a persistent source of inflation.

"While a September rate cut is almost certain, further cuts are far from guaranteed," Katz said. "A string of higher-than-expected inflation reports could shift the focus back to controlling price spikes ."

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.