Sterling strengthens ahead of Fed and Bank of England monetary policy decisions

2025-09-15 18:29:27

Central Bank Policy

Traders are pricing in a 94.2% chance that the Fed will cut interest rates by a quarter point in its policy statement on Wednesday, bringing the benchmark rate to a range of 4.00% to 4.25%, according to the CME FedWatch tool. Speculation that the Fed will adopt a dovish stance has intensified as concerns about the labor market intensify.

At the same time, as inflationary pressures in the UK economy persist, the market expects the Bank of England to maintain its interest rate at 4%.

Nick Rees, head of macro research at Monex Europe, said commentary on the policy decision was unlikely to spur a noticeable reaction in sterling as attention remained focused on the UK budget due in the autumn.

British Chancellor of the Exchequer Reeves will deliver her annual budget on November 26. Britain's public finances remain weak, and analysts say Reeves will have to raise taxes by at least 20 billion pounds (about 27 billion U.S. dollars), or even double that, to continue to meet her fiscal goals.

Key Data

The pound could see significant volatility this week, with investors closely awaiting the release of UK labour market data for the three months to July and consumer price index (CPI) figures for August, due on Tuesday and Wednesday respectively.

The UK Office for National Statistics (ONS) is expected to report that the International Labour Organization (ILO) unemployment rate remained unchanged at 4.7%. Average wages excluding bonuses, a key measure of wage growth, are expected to rise by 4.8% year-on-year, down from 5% previously. Including bonuses, the wage growth measure is expected to rise from 4.6% to 4.7%.

Recently, Bank of England Governor Andrew Bailey warned of downside risks in the labor market and said the path of monetary policy will remain on a downward trend.

Meanwhile, the UK's headline CPI is expected to accelerate to 3.9% in August, the highest level in 19 months. If inflation data shows signs of growth while the labor market faces a slowdown, Bank of England officials will have to perform a delicate balancing act.

In the U.S., investors are awaiting Tuesday’s release of retail sales data for August, a key measure of consumer spending, which is expected to rise a modest 0.3% in August, down from 0.5% in July.

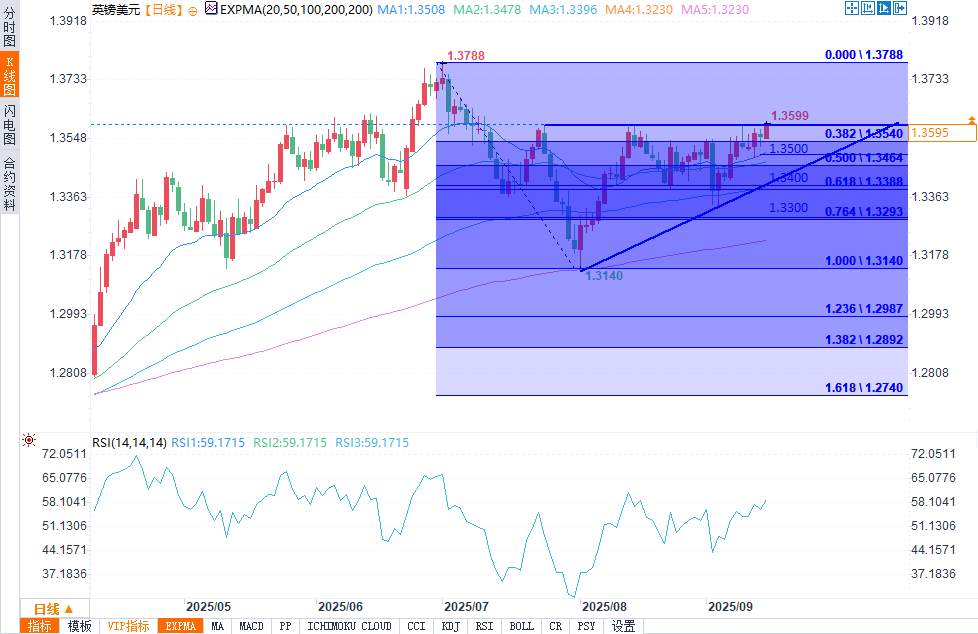

Technical analysis: GBP holds above 20-day exponential moving average

(GBP/USD daily chart source: Yihuitong)

GBP/USD rose slightly to around 1.3600 on Monday. As the exchange rate approaches the 20-day exponential moving average (EMA, around 1.3508), the short-term trend of GBP/USD remains sideways.

GBP/USD is trading within an ascending triangle pattern, which suggests a wait-and-see attitude among investors. The pattern has horizontal resistance from the July 23 high (around 1.3585), while the ascending support line is from the August 1 low (around 1.3140).

Combined with the Fibonacci retracement lines, key resistance and support levels are clearly visible. Above, 1.3640, 1.3700, and 1.3788 are important resistance levels, while below, 1.3500, 1.3464, and 1.3400 are potential supports. If the price moves towards these levels, it may be affected by the corresponding resistance or support.

The 14-day Relative Strength Index (RSI) fluctuates between 50 and 70, indicating that GBP/USD is currently in a relatively strong and volatile state, but has not yet entered the overbought area. In the short term, the price may still be dominated by a volatile and strong trend.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.