USD/JPY stabilizes near 148: Volatility subsides, but risks remain

2025-09-19 18:52:10

Japan's core inflation rate slowed to 2.7% in August, the lowest level since November 2024. The decline was primarily due to the resumption of government subsidies for electricity and natural gas, as well as adjustments in food prices. Meanwhile, rising rice prices remained the main source of inflationary pressure: in August, rice prices rose 68.8% year-on-year, compared with increases of nearly 100% in June and 90.7% in July, respectively.

Soaring rice prices have sparked public discontent and led to a decline in support for the ruling Liberal Democratic Party. Under pressure, Prime Minister Shigeru Ishiba resigned after his coalition government lost its majority in both the House of Representatives and the House of Councillors. The Japanese government has taken emergency measures, including appointing a new agriculture minister, releasing rice reserves, and revising a decades-old policy to encourage the cultivation of alternative crops.

Despite the impact of US tariffs, Japan's economy grew by 1% year-on-year in the second quarter, beating expectations. However, exports to the US fell by nearly 14% in August, with auto shipments plummeting 28.4%. The automotive industry, which accounts for one-third of Japan's exports to the US, continues to be under pressure from the 27.5% tariff. While this tariff was recently reduced to 15% as part of the trade agreement, providing some relief, the burden on the industry remains significant.

Two Bank of Japan officials support rate hike

USD/JPY fell 0.5% after the Bank of Japan (BoJ) kept its short-term policy rate unchanged at 0.5%, in line with market expectations and marking the fifth consecutive meeting of the Bank of Japan to adopt the same policy rate.

The main driver of USD/JPY weakness was the voting results of Bank of Japan (BoJ) officials. At today's BoJ monetary policy meeting, two officials (Takada and Tamura) voted to raise interest rates to 0.75% for the first time since 2025, arguing that Japan has achieved price stability (long-term inflation target of 2%) and that the risks of further price increases are increasing.

Interest rate differentials put downward pressure on the USD/JPY exchange rate

Japan's overnight index swap (OIS) market for short-term interest rates still expects the short-term overnight policy rate to rise by 25 basis points (bps) to 0.75% by the end of 2025.

Over the past two weeks, the spreads between the 3-month, 6-month, and 1-year OIS rates relative to the 1-month OIS rate have continued to widen. The 1-year OIS rate has risen from 0.67% on September 8, 2025, to 0.73%.

The yield on 2-year Japanese government bonds (JGBs), which are more sensitive to changes in the Bank of Japan's (BoJ) monetary policy stance, continued its upward trend, climbing to 0.91%, the highest level since 2008.

As a result, the yield premium between the 2-year US Treasury bond and the 2-year Japanese government bond has continued to narrow steadily since the beginning of the year. During the week of August 18, 2025, the yield premium fell below the previous key support level of 2.90% (bearish breakout), which may provide momentum for the yield premium to narrow further towards the lower support level of 2.05%.

This continued narrowing suggests that the attractiveness of 2-year US Treasuries has declined relative to 2-year Japanese government bonds, weakening the US dollar's yield premium. Therefore, this development could put downward pressure on the USD/JPY exchange rate.

Technical Analysis

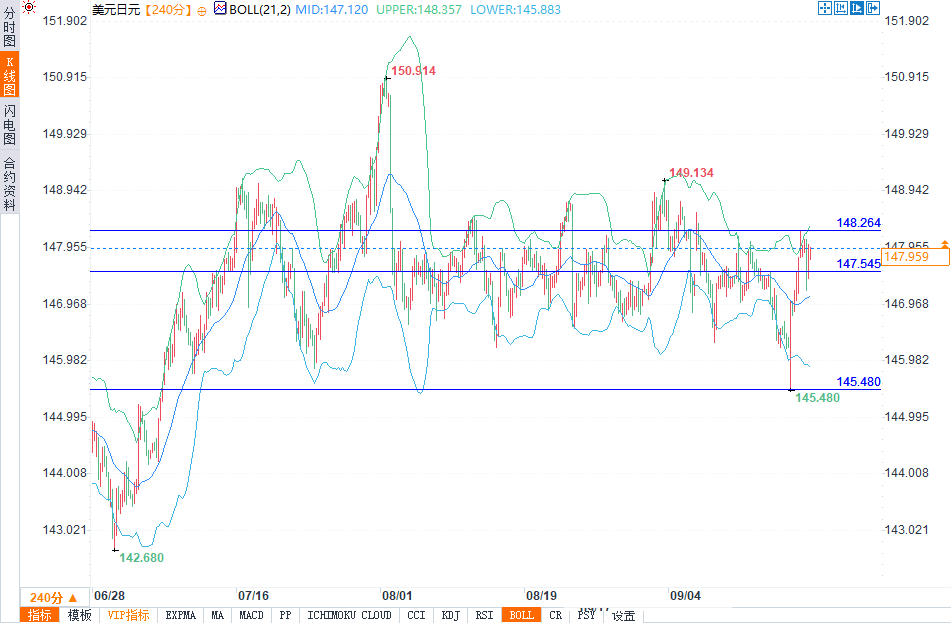

(Source: 4-hour USD/JPY chart)

On the 4-hour chart, the USD/JPY exchange rate rebounded after falling to 145.41 before stabilizing around 148.00. Initial resistance lies at 148.26; a break above this level could trigger an uptrend towards the 148.80–149.00 range. Support lies at 147.55; a break below this could trigger further declines to 146.90.

The overall trend is neutral to bullish: the exchange rate has rebounded from local lows, but the subsequent direction will depend on the policy signals of the Bank of Japan and overall monetary policy related news.

Summarize

After mid-week fluctuations, the USD/JPY exchange rate has stabilized. The forecast for September 19, 2025 (today) indicates that the exchange rate could move towards 148.26, or even higher.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.