Expectations of a Fed rate cut and geopolitical tensions pushed gold prices to new highs, with prices approaching $3,700, but technical indicators indicate overbought risks.

2025-09-16 13:13:50

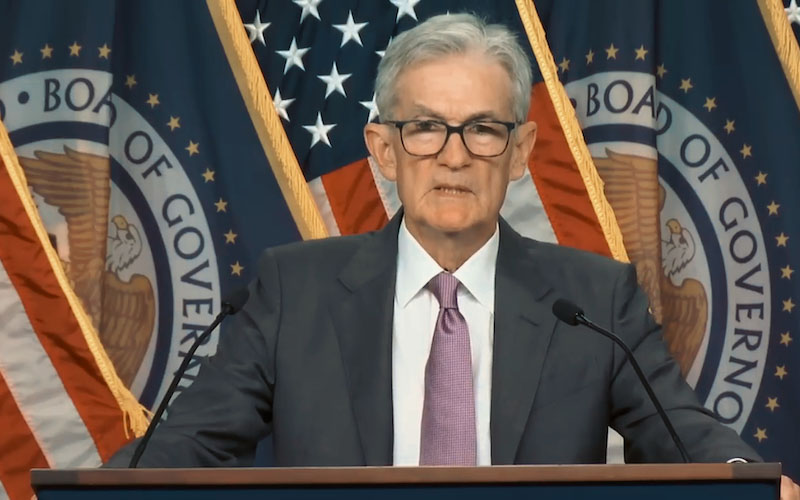

The Federal Reserve's two-day meeting will end on Wednesday, with markets widely expecting a 25 basis point rate cut, and the focus will be on economic forecasts and a press conference by Chairman Powell.

Expectations of Federal Reserve rate cuts continue to weigh on the dollar, benefiting gold. Driven by weak non-farm payroll data, the market has strengthened bets on multiple Fed rate cuts this year. The CME FedWatch tool shows that investors expect three rate cuts in 2025. The US dollar index fell to a new low since late July, providing support for non-interest-bearing gold.

Market commentators pointed out: "The Fed's dovish expectations coupled with the continued weakening of the US dollar are becoming the core driving force for gold's continuous breakthrough."

Geopolitical risks are driving demand for safe-haven assets. Russia launched a large-scale offensive against the southeastern Ukrainian city of Zaporizhia, while Ukraine continues to attack Russian energy facilities, increasing supply chain risks.

In addition, the emergency summit of Arab and Islamic countries strongly condemned Israel's military action in Doha and called for the suspension of its membership in the United Nations. These factors have increased safe-haven demand and provided downward support for gold prices.

The policies of several central banks will further increase volatility. In addition to the Federal Reserve, the Bank of Canada (Wednesday), the Bank of England (Thursday), and the Bank of Japan (Friday) will all announce interest rate decisions. This divergence in policies could exacerbate gold price volatility in the short term.

Judging from the daily chart, gold rose rapidly after breaking through the flag consolidation pattern, but the daily RSI was above 70, indicating severe overbought, and it may be difficult to continue to rise above $3,700 in the short term.

If a pullback occurs, the first support level is $3,645, and further support is $3,633. A break below this level could lead to a drop to the $3,600 range, or even test the $3,560 and $3,500 round numbers. If the gold price stabilizes and rises again, $3,700 will become the new key resistance level, and a break above this level may open up further room for growth.

Editor's Note: Gold is consolidating at a high level in the short term. This is ostensibly due to profit-taking and overbought pressure, but it also reflects market concerns about central bank policies and geopolitical tensions. If the Federal Reserve sends a strongly dovish signal, gold prices are expected to stabilize above $3,700.

If Powell's attitude is cautious, it may trigger a short-term correction. However, considering the overall weakness of the US dollar and the continued risk premium, the medium-term trend of gold is still bullish.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.