Trade talks stall! Why can't South Korea learn from the US-Japan agreement?

2025-09-16 13:36:37

What terms did Japan agree to?

South Korean officials, who have argued for a deal covering mainly loans and guarantees rather than large direct investments, made clear last week that they could not accept terms similar to those in the $550 billion investment plan between Japan and the United States.

According to the Japan-US agreement, Tokyo agreed to complete the fund allocation within 45 days after the United States selects the project, and the free cash flow generated by the investment will be distributed evenly. After reaching the agreed amount, the United States will obtain 90% of the profits .

U.S. Commerce Secretary Mattis Lutnick took a tough stance last Thursday, saying he would not give South Korea any flexibility. He added: "Japan has signed the agreement, and South Korea must either accept the same terms or face tariff costs."

Key Differences Between South Korea and Japan

Since the announcement of South Korea's agreement at the end of July, the market has continued to worry that the resulting large demand for US dollars may severely impact South Korea's foreign exchange market and cause further depreciation of the won .

If turmoil occurs in the Korean foreign exchange market, it may trigger an increase in the volatility of Asian currencies and drive funds to traditional safe-haven assets such as the Japanese yen and gold.

South Korea, which suffered greatly from capital flight during the financial crisis of the late 1990s, has maintained strict foreign exchange controls. While South Korea began opening its financial markets to the outside world last year, there is still no offshore won trading market.

According to the Bank for International Settlements (BIS) triennial survey for 2022, the Korean won's daily global trading volume averaged $142 billion, while the Japanese yen's was $1.25 trillion. The won accounts for only 2% of global foreign exchange trading, far less than the Japanese yen's 17% share .

South Korea's deep concerns

The won fell to a 15-year low of around 1,476 against the dollar late last year and is currently hovering around 1,390.

Market analysts point out that South Korea's National Pension Fund alone requires $40 billion in overseas investment annually, placing heavy pressure on the Korean won. Citigroup estimates that if the South Korea-US investment plan is implemented, it could generate approximately $100 billion in additional US dollar demand annually between 2026 and 2028.

South Korea's economy is much smaller than Japan's , with a current account surplus of $99 billion last year, compared with Japan's nearly $200 billion. As of the end of August, South Korea's foreign exchange reserves were $416 billion, while Japan's were $1.3 trillion.

South Korea's response strategy

To mitigate potential shocks, South Korean Presidential Policy Office Director Kim Yong-beom publicly proposed last week the idea of establishing a currency swap facility with the United States. He emphasized that the yen's status as an international currency and the unlimited swap agreement between Japan and the United States put Japan in a more advantageous position.

South Korean Finance Minister Koo Yoon-chul also said foreign exchange measures will be announced when tariff negotiations are completed. He revealed on Monday that the US may "seriously consider" the currency swap proposal after local media reported that the South Korean government had formally submitted the request to the US.

Which countries have currency swap mechanisms with the United States?

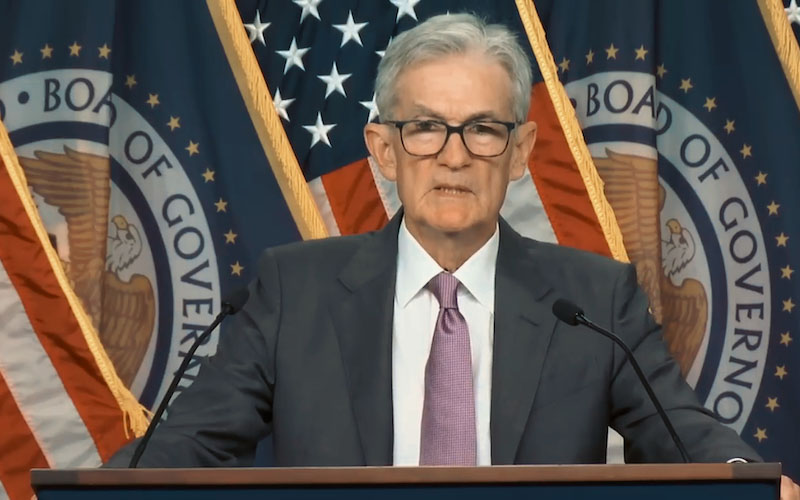

The Federal Reserve has standing swap line arrangements with the central banks of Canada, the United Kingdom, Japan, the European Union and Switzerland.

During the epidemic, the Federal Reserve established temporary swap lines of US$60 billion with nine central banks including the Bank of Korea in March 2020.

After the mechanism expired in December 2021, the Federal Reserve provided the Bank of Korea with a $60 billion liquidity support safety net through the repurchase mechanism, allowing South Korea to borrow US dollars using its holdings of U.S. Treasury bonds as collateral.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.