The divergence between the Fed's easing expectations and the Bank of Japan's interest rate hike prospects pushed USD/JPY down to 147.

2025-09-16 13:19:34

Recent weakening U.S. job market data has intensified market bets on the Federal Reserve cutting interest rates three times this year, putting pressure on the dollar.

Institutional View: An international investment bank stated: "The Fed's dovish outlook diverges from the Bank of Japan's inclination to raise interest rates. This policy divergence is becoming a key factor driving the yen's temporary strength."

In Japan, although the resignation of Prime Minister Shigeru Ishiba has increased political uncertainty and may make the Bank of Japan more cautious in raising interest rates, the tight domestic employment environment and inflation gradually approaching the target provide a realistic basis for raising interest rates this year.

Market pricing shows that investors expect the Bank of Japan to implement nearly two 25 basis point interest rate hikes by July next year.

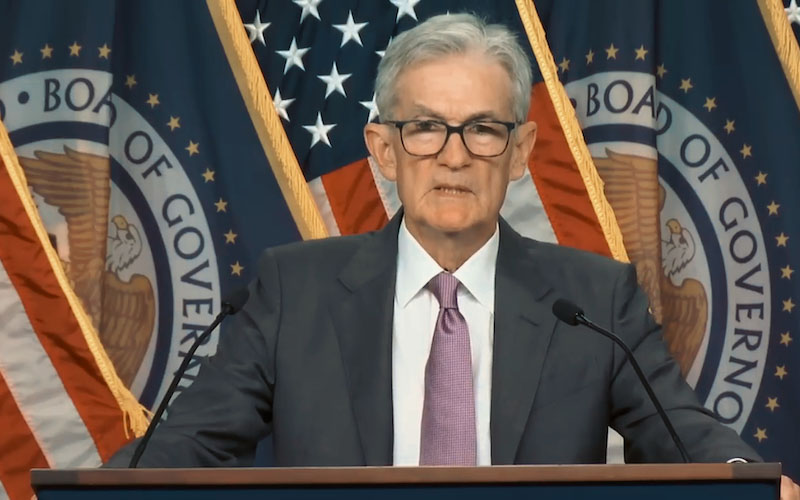

Meanwhile, the US Congress confirmed Stephen Miran, a former Trump advisor, as a member of the Federal Reserve Board, heightening market attention on the Fed's policy outlook. If the Fed sends a stronger dovish signal this week, downward pressure on the US dollar will intensify.

The USD/JPY pair has recently encountered resistance near its 200-day moving average, indicating significant upward pressure. If the 147.00 level is successfully broken, the pair could quickly decline to the 146.30 range, potentially breaking below or touching the 146.00 level, or even extending to the 145.35-145.00 support zone.

On the other hand, if there is a short-term rebound, 148.00 will be the first resistance level, and above it 148.75 (200-day moving average) will be the watershed between bulls and bears. Once broken, it may trigger short-covering and push the exchange rate back to the 149.00 area.

An Asian market strategist commented: "The USD/JPY pair remains weak in the short term, but a break below 147 requires further confirmation from volume. If there is stimulus from the central bank, the downward trend may accelerate."

Editor's comments:

The current USD/JPY trend is primarily driven by the diverging policies of the Federal Reserve and the Bank of Japan. If the Fed signals further rate cuts while the Bank of Japan maintains its rate hike stance, the yen could see some temporary strength.

However, considering the political uncertainty and fluctuations in global risk sentiment, the market may still fluctuate in the range of 146-149 in the short term. Closely monitor the central bank's resolutions and news this week.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.