Technical analysis: A weaker dollar and Fed rate cut expectations push gold to a record high

2025-09-16 20:39:00

The dollar weakened again ahead of Wednesday's Federal Reserve interest rate decision (the market generally expects the Fed to cut interest rates by 25 basis points, with the possibility of a smaller 50 basis point cut), providing new impetus for the precious metal. Furthermore, the deepening political crisis in the United States and some EU countries, as well as signs of worsening geopolitical tensions, also supported gold prices.

At present, the expectation of interest rate cuts has been almost fully digested by the market. Investors are waiting to hear the Fed’s recent policy guidance, and expectations for the Fed to maintain a dovish stance are growing - this will provide further support for gold.

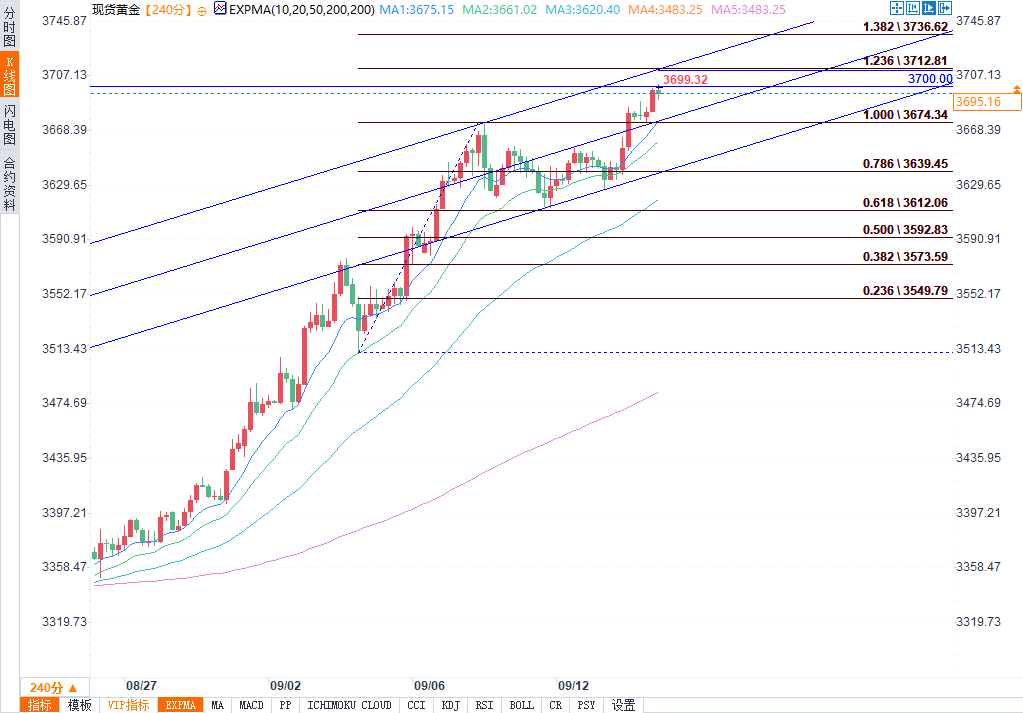

The pressure on the psychological barrier of 3700 continues to increase.

A rising channel defines the current uptrend, with the upper boundary located at the 123.6% Fibonacci extension level of the September rally at 3712. If the price breaks above 3700, it will test resistance there.

If it breaks above 3712, the next target will be 3734 (138.2% Fibonacci extension level of the September increase).

The middle axis of the rising trend line is at 3674 (previous high point), and the lower boundary is at 3639 (78.6% Fibonacci level). If the price pulls back, the above positions will form strong resistance.

As of now, the bulls have not reacted to the overbought indicators on the daily chart, but if the current fundamentals remain unchanged, some degree of consolidation or a minor pullback is to be expected in the short term.

Resistance levels: 3700; 3712; 3736; 3750

Support levels: 3674; 3639; 3612; 3600

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.