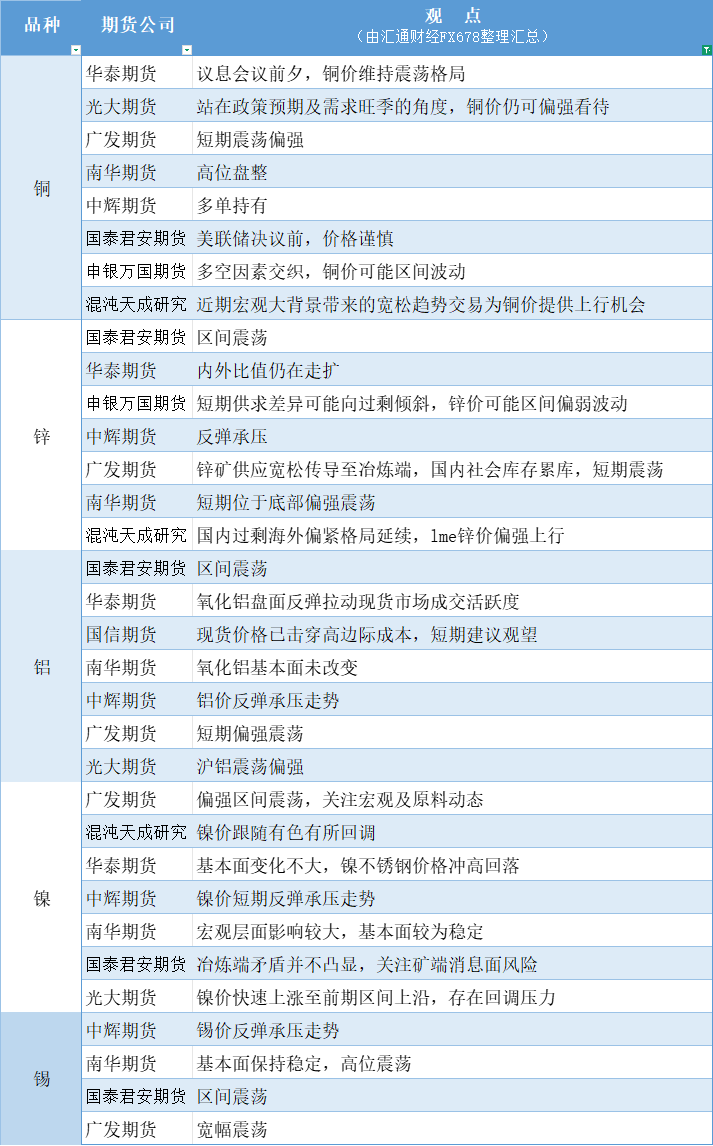

A chart summarizing the views of futures companies: September 17 nonferrous metals (copper, zinc, aluminum, nickel, tin, etc.)

2025-09-17 13:44:18

Copper: The recent loose trend trading brought about by the macroeconomic background provides an upward opportunity for copper prices. From the perspective of policy expectations and the peak season of demand, copper prices can still be viewed as relatively strong; Zinc: The short-term supply and demand gap may tilt towards surplus, and zinc prices may fluctuate in a weak range. The loose supply of zinc ore is transmitted to the smelting end, and domestic social inventories are accumulating, resulting in short-term fluctuations; Aluminum: The spot price has broken through the high marginal cost, and it is recommended to wait and see in the short term; Nickel: The macro-level impact is large, and the fundamentals are relatively stable. The short-term rebound of nickel prices is under pressure; Tin: The fundamentals remain stable, and the price fluctuates at a high level.

This chart is specially created and compiled by Huitong Finance, all rights reserved.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.