Interest rate cut imminent! How close is the Fed to turning on stimulus mode?

2025-09-17 16:37:42

Putting aside the huge political pressure, the fundamental reason for the Federal Reserve's decision to resume interest rate cuts on September 17 local time (September 18 Beijing time) is the weak U.S. job market, persistent housing affordability problems, and concerns that the economy may decline by this time next year.

However, the extent of the employment problem remains controversial, as immigration has stagnated and weak employment may be largely due to labor supply and demand. The real estate market also remains slightly distorted, as mortgage rates have fallen sharply during the COVID-19 pandemic, making homeowners reluctant to sell their properties.

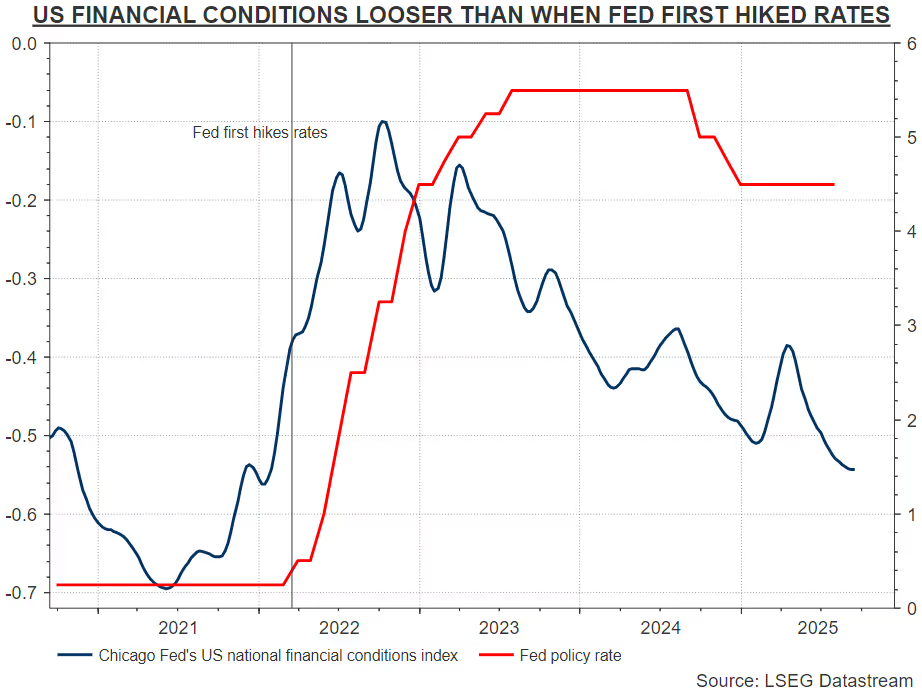

On the other hand, regardless of the lasting impact of trade tariffs, U.S. retail sales still grew 5% year-on-year, the stock market soared to a record high, overall financial conditions were the loosest in three years, and inflation continued to run above the Federal Reserve's target.

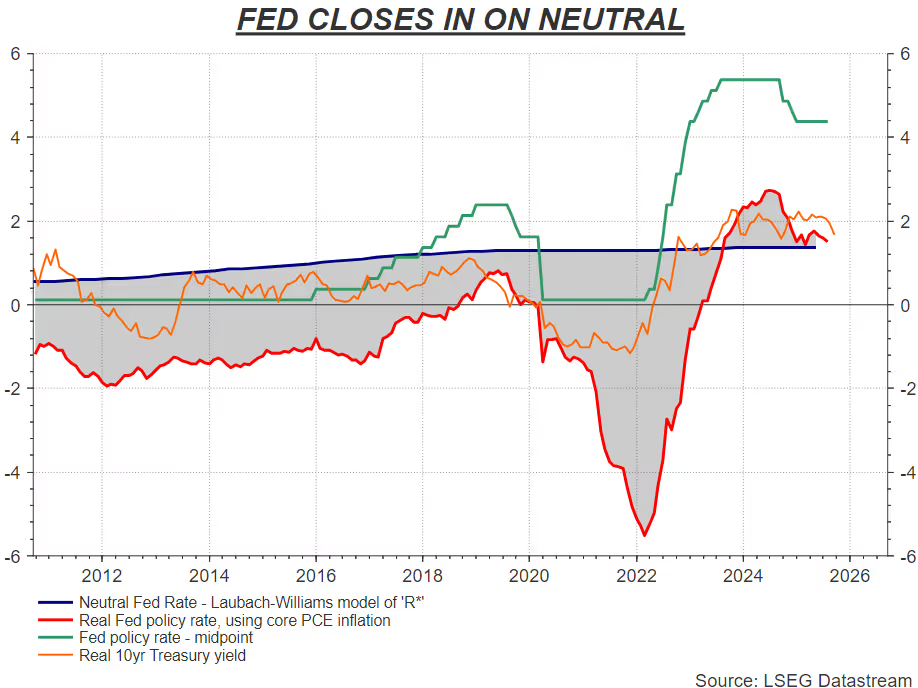

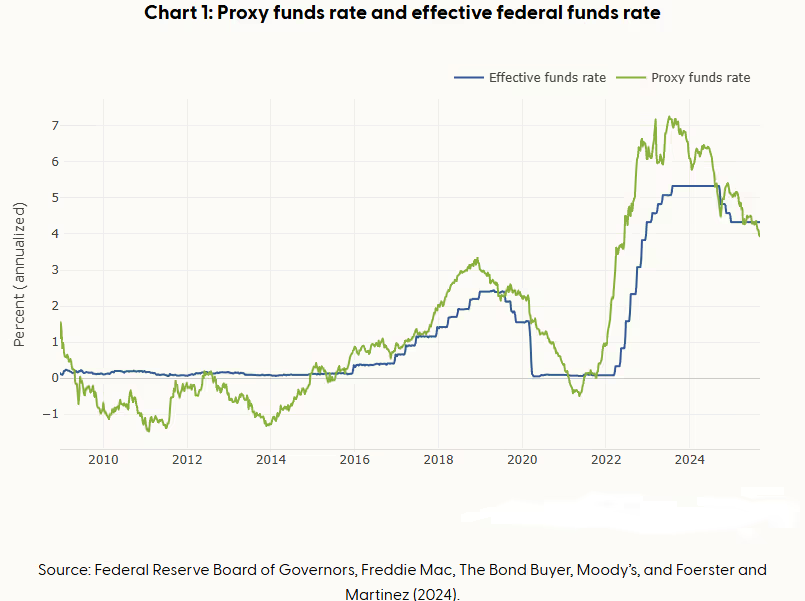

Given this mixed bag, the Fed’s best course of action may be to move toward neutral—an interest rate that neither stimulates nor suppresses the economy. But as always, determining the holy grail of the neutral rate is a complex and thorny task.

By some measures, the Fed's quarter-point rate cut this week would push interest rates close to or even below neutral. A forthcoming half-point cut, or a second quarter-point cut in October (which the market currently sees as an 80% chance), could put the Fed in stimulus mode, raising questions about whether complying with the White House's demands has exceeded the Fed's traditional assessment.

neutral interest rate

The Fed’s long-standing model for determining the elusive neutral real interest rate — the Laubach-Williams model, in which New York Fed President John Williams is a key figure — currently estimates the R-star neutral rate at 1.37%.

If the midpoint of the federal funds rate target range falls by 25 basis points to 4.125%, the current real federal funds rate based on the latest year-on-year increase in the core personal consumption expenditures (PCE) price index in July will fall to 1.225% - this is only a mild stimulus, but not a super stimulus.

However, if the consensus forecast for core PCE in August is 2.7%, the resulting real federal funds rate will remain at 1.425%, strengthening calls for further rate cuts.

But doves point out that the revised R-star model for 2023, which has been adjusted for pandemic-related supply distortions, estimates the neutral rate to be as low as 0.85%. Indeed, Williams himself recently suggested that the "growth-adjusted" neutral rate may still remain around the pre-pandemic low of 0.5%.

Assuming that the revised Laubach-Williams model is a more accurate estimate, then after the 25 basis point rate cut on September 18, the Federal Reserve's monetary policy is at least 50 basis points away from moving out of the restrictive zone, and two more 25 basis point rate cuts by the end of the year will be needed to return it to neutrality.

Overall, a rate cut of about 125 basis points by the end of next year would likely have the desired effect. Markets are pricing in a 150 basis point cut, suggesting they believe the Fed will be in stimulus mode by then .

It may be more important to pay attention to the situation of the Federal Reserve

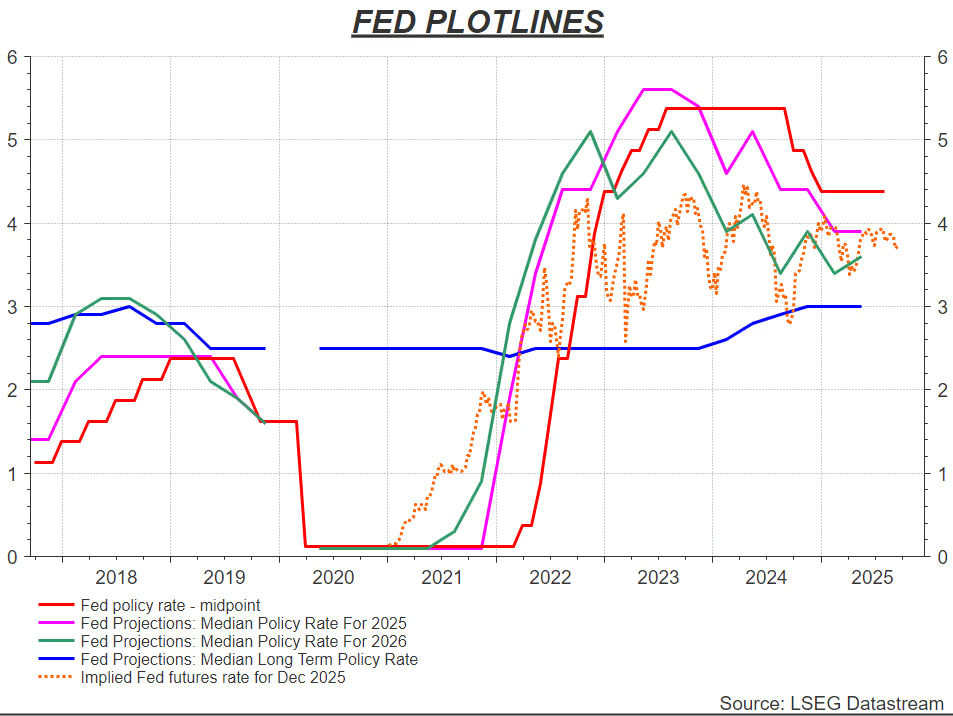

The Fed's meeting will also update its "dot plot" forecasts, but it's important to note that according to the June forecast, Fed officials expected two rate cuts this year. The corresponding "neutral" long-term policy rate is 3%, and the R-star neutral rate estimate is 1%.

The focus on Wednesday will be on whether the median forecast for rate cuts this year will shift to three from two, as markets have yet to fully price in such a shift.

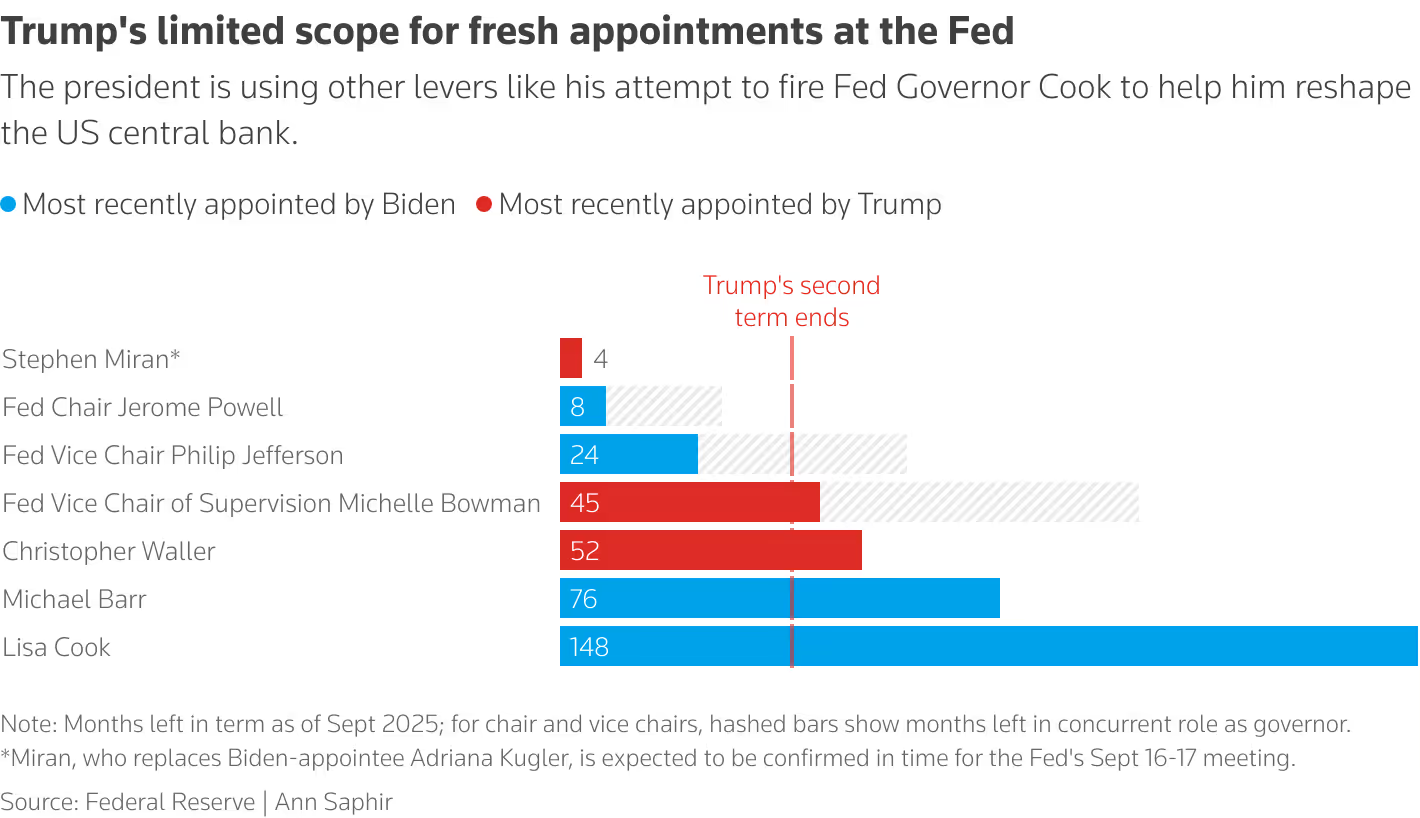

Because of the enormous political pressure the Fed faces, all of these predictions may ultimately become irrelevant and the outcome of the meeting remains uncertain.

President Trump’s eye-popping call for a policy rate of 1% suggests that he has no time for models, or that he really means a real interest rate of 1%, which means he thinks rates should fall quickly to 3.7%.

If that’s true, then perhaps he’s not too far off from what the market is pricing or what the Fed is moving toward (but that’s a pretty idealistic “if”).

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.