The Fed's first rate cut is expected to happen tonight! Market divergence intensifies, could the US dollar index be priced in early?

2025-09-17 16:54:53

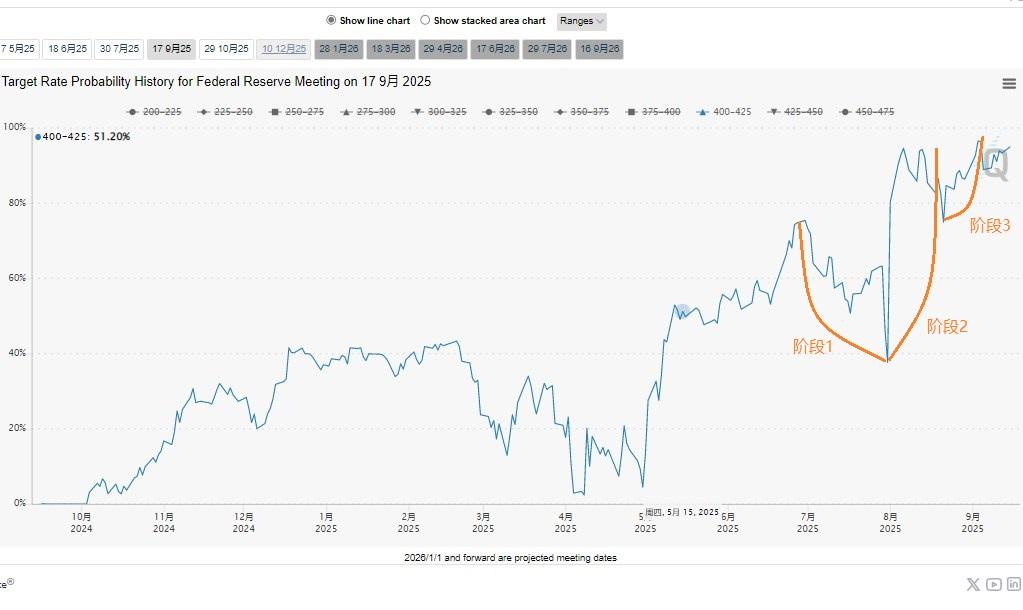

Three phases of US dollar index trend (event + fermentation)

The first phase was the impact of U.S. tariffs on various countries on multiple currencies. On July 28, local time, French Prime Minister François Bayrou called the agreement "a dark day for Europe." Combined with Federal Reserve Chairman Jerome Powell's statement at the time that he had no preference for discussing interest rate cuts at the September meeting, the U.S. dollar index rose to around 99.98.

On July 30th, the US PCE data exceeded expectations, supporting the Federal Reserve to keep interest rates unchanged and the dollar to close above 100.00. However, by then, Trump and Benson had clearly expressed their support for a weak dollar, and Trump had already begun nominating a new Fed chair.

(Daily chart of the US dollar index, source: Yihuitong)

Then, on August 1, the second phase, as the U.S. non-farm payroll data for July was significantly lower than expected (only 73,000 new jobs, far below the market expectation of 110,000), coupled with the significant downward revisions to the May and June data (a total decrease of 258,000 jobs), the market was concerned about the risk of a U.S. economic recession. The U.S. dollar index plunged 1.39%, marking the end of the strong dollar trend around 100 in the first phase and the beginning of the second phase.

(CMEFedWatch interest rate tool trend chart)

The Fed's third phase of interest rate policy saw a significant shift in tone. Powell, at the Jackson Hole symposium on August 22, stated that while the labor market appears stable, it faces downside risks. He also concluded that the impact of tariffs on inflation is a one-off, rather than a sustained pressure. Powell noted, "Given that policy is already in a restrictive range, shifts in the baseline outlook and the balance of risks may require adjustments to our policy stance." The US dollar index subsequently fell 0.95% to 97.71.

At the same time, on September 9, local time, the U.S. Bureau of Labor Statistics (BLS) released preliminary results of the annual benchmark revision, which showed that in the 12 months ending in March this year, the United States added 911,000 fewer non-farm jobs than previously estimated, equivalent to an average of 76,000 fewer jobs per month.

This means that previous job growth was significantly overestimated, with the actual expansion rate far lower than initially reported. This further validates the Fed's policy shift. Meanwhile, the CPI data on September 12th met expectations, dispelling the Fed's concerns that rate cuts might trigger inflation. The US dollar index did not show any significant movement that day.

Current situation:

The market generally expects that the Federal Reserve will implement its first interest rate cut in 2025 this week, but for investors, the more core question is: when the central bank needs to deal with a weak job market, sticky inflation and continued pressure from the White House at the same time, how many interest rate cut windows will be opened in the future?

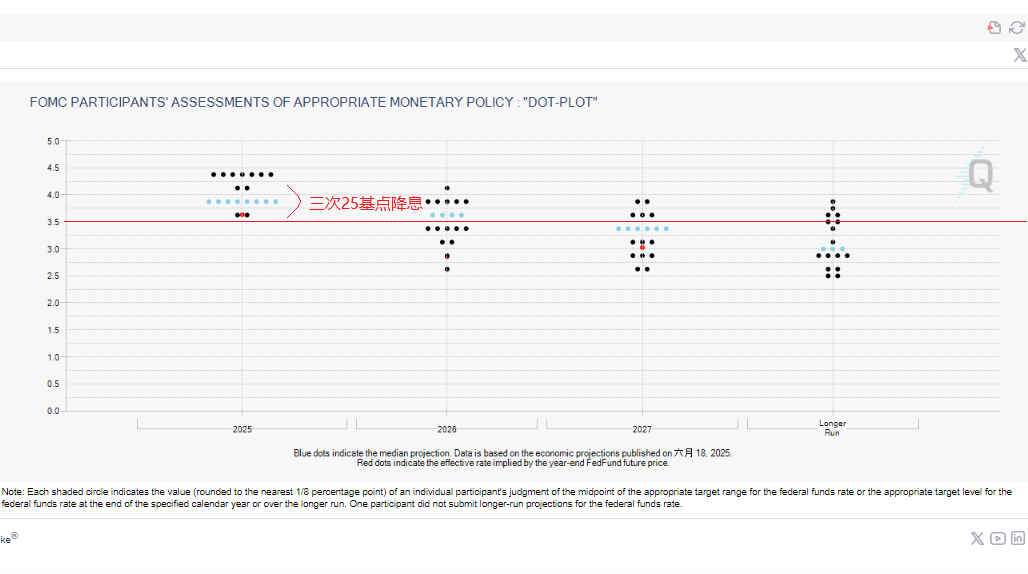

Key clues will come from the Fed's "dot plot"—a quarterly chart that clearly shows each Fed official's forecast for the direction of the central bank's benchmark interest rate. Fed officials have reached a consensus on two rate cuts this year, with some even favoring three. The market expects the first rate cut to take place this Wednesday, with most Fed watchers predicting a 25 basis point cut, marking the first monetary policy easing cycle since December of last year. The US dollar index fell 0.74% yesterday (September 16).

The Federal Reserve will hold two more interest rate meetings this year, in late October and early December. The Fed will maintain its benchmark interest rate in the 4.25%-4.5% range for most of 2025, a move that has already exhausted President Trump's patience.

Ahead of this week's meeting, Trump appointed White House economic adviser Stephen Milan to the Federal Reserve Board. On Monday, a federal court rejected his bid to remove current Fed Governor Lisa Cook. Trump has consistently criticized Fed Chairman Jerome Powell for failing to initiate interest rate cuts sooner, repeatedly calling him "too late."

Former Cleveland Fed President Loretta Mister said she “doesn’t believe” a single or multiple rate cuts will ease the pressure on the Fed.

“The president has made it clear that he wants to secure a majority of seats on the Federal Reserve Board and push interest rates sharply lower,” she said. “He appears to have little regard for the core principle that monetary policy should remain independent and free from short-term political considerations.”

But Mist predicts that the Fed's first interest rate cut this week will not exceed 25 basis points because policymakers need to balance the dual missions of "maintaining price stability" and "achieving full employment."

Mister said that a small rate cut "will make policy less restrictive, but it will still be in a restrictive range - putting downward pressure on the price stability target while providing a necessary buffer for the job market." At the same time, Mister does not believe that this week's rate cut will immediately trigger a rhythm of consecutive rate cuts.

She emphasized: "Policymakers will closely monitor data and make decisions on a meeting-by-meeting basis to strive to maintain a balanced policy. If inflation is to fall, policy must remain somewhat restrictive. If the labor market conditions deteriorate materially, a shift to easing policy is possible, but that point has not yet been reached."

The US dollar index tends to have already reflected the expectation of 2-3 interest rate cuts this year.

Wall Street traders are betting that the Fed will continue cutting rates at its October and December meetings, before pausing until April of the following year. Some forecasts are even more aggressive: Morgan Stanley economists said last week they expect the Fed to continue cutting rates at each meeting until January of the following year, when the target rate will drop to 3.5%.

Luke Tilly, chief economist at Wilmington Trust, said the Fed will likely not make a clear commitment on the path of future rate cuts this week, given the need to strike a balance between weak job growth and inflation. However, he predicts that the Fed will implement one rate cut at each of the next three meetings (a total of three times), dragged down by the weak job market.

In fact, Tilly made it clear that he expects the Fed to initiate six consecutive interest rate cuts - three before the end of this year and three more at the beginning of next year, eventually lowering the policy rate to a range of 2.75% to 3% to approach the so-called "neutral level" (that is, the interest rate level that neither stimulates nor suppresses economic growth).

Follow-up

We need to continue to observe the US economic, employment and inflation data. If the subsequent data only supports 2-3 interest rate cuts this year, the US dollar index may start to rebound. If the data shows unexpected developments, such as a 50 basis point interest rate cut for the first time, the US dollar index may continue to bottom out and price in the possibility of additional interest rate cuts.

Tilly analyzed, "If the Fed is focused on inflation trends over the next year, it will be difficult to see inflationary pressures if job losses occur." He also predicted that job market data will continue to be weak, and GDP growth may even turn negative. "We expect the economy to fall into significant weakness, with a 50% probability of recession and a 50% probability of job losses."

Esther George, former president of the Kansas City Fed, believes the core question lies in how the Fed assesses the degree of restrictiveness of its current policies and what its ultimate policy objectives are. Are Fed policymakers already leaning toward a rate-cutting approach and ready to act? Or will they remain cautious, stating that future policy adjustments will depend entirely on inflation data?

The latest inflation data has led George to conclude that the inflation rate is stagnating at around 3%. She noted that although tariffs have not caused a sharp rise in prices as most people expected, the potential upward momentum of inflation is still worth paying attention to.

Measured by the Consumer Price Index (CPI), "core" prices, which exclude volatile food and energy prices, rose 3.1% year-on-year in August, the same as in July. At the same time, she said, employment market data showed that the labor market may be weaker than previously expected: the United States added only 22,000 jobs in August, far below the 75,000 expected by economists, and the unemployment rate rose from 4.2% to 4.3%.

George said that "if you observe the interest rate meeting this week, you may find that some participants are more inclined to prioritize fulfilling the mission related to the labor market rather than the inflation stability target."

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.