USD/CAD strengthened to 1.3750 as investors focused on the US and Canadian central bank interest rate decisions

2025-09-17 13:44:29

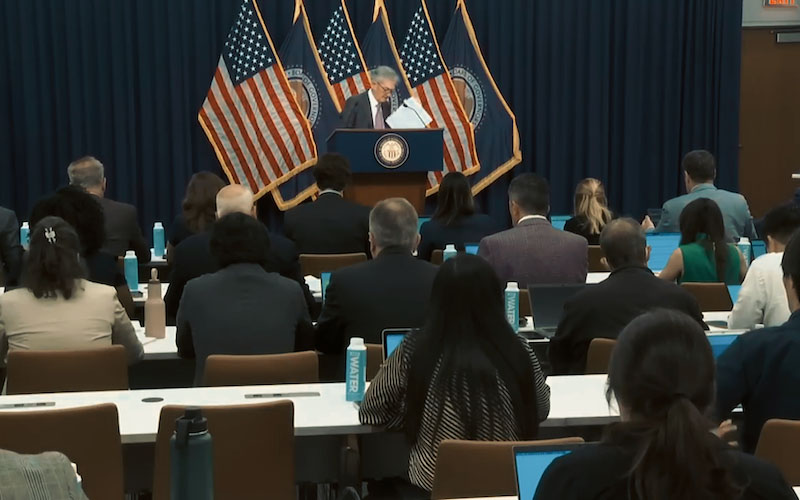

The market generally expects the Federal Reserve to cut interest rates by 25 basis points at its meeting on Wednesday, the first rate cut since December 2024. Some investors still hope for a more aggressive 50 basis point rate cut, but the market as a whole has digested the possibility of 25 basis points.

Morgan Stanley and Deutsche Bank expect the Fed to cut interest rates by 25 basis points at each of its September, October and December meetings.

U.S. retail sales data showed a month-on-month increase of 0.6% in August, 0.2% higher than market expectations; Retail Sales Control Group and retail sales excluding autos increased by 0.7% respectively, indicating that despite high inflation and a slowing labor market, U.S. consumer spending remains resilient.

This strengthens the credibility of expectations of multiple interest rate cuts by the Federal Reserve, while supporting the short-term trend of the US dollar.

In Canada, the CPI rose to 1.9% year-on-year in August, slightly higher than 1.7% in July, below market expectations of 2.0%, and remaining below the Bank of Canada's 2% midpoint target for the fifth consecutive month. However, the core CPI (which strips out volatile items) remained close to 3.0%, indicating that underlying inflationary pressures persist.

The data prompted the BoC to remain cautious, with markets expecting only a modest 25 basis point adjustment on Wednesday.

From a technical perspective, the short-term support level is 1.3720–1.3730. If it falls below, it may fall further to 1.3700. The upper resistance level is 1.3775–1.3800. If it breaks through, it may test the recent high around 1.3830.

The current price is above the 20-day moving average, and the short-term bullish pattern is maintained, but we need to pay attention to fluctuations after the announcement of the Fed and BoC policies; the RSI is slightly bullish, indicating that there is upward momentum, but we still need to observe the immediate impact of policy news on the market.

Overall, USD/CAD is bullish in the short term, but volatility is limited. We should focus on the immediate impact of the US and Canadian central bank policy statements and economic data on the exchange rate.

Editor's opinion:

The USD/CAD trend is influenced by both US dollar policy expectations and Canadian dollar inflation data: expectations of a Fed rate cut support the short-term strength of the US dollar, but expectations of multiple rate cuts may limit further upside; Canada's core inflation remains high, making the BoC cautious and limiting the Canadian dollar's short-term rebound.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.