Manufacturing data is weak! The US dollar index is stuck in the quagmire, waiting for the Fed's decision to break the deadlock.

2025-09-17 15:13:18

One step forward, two steps back

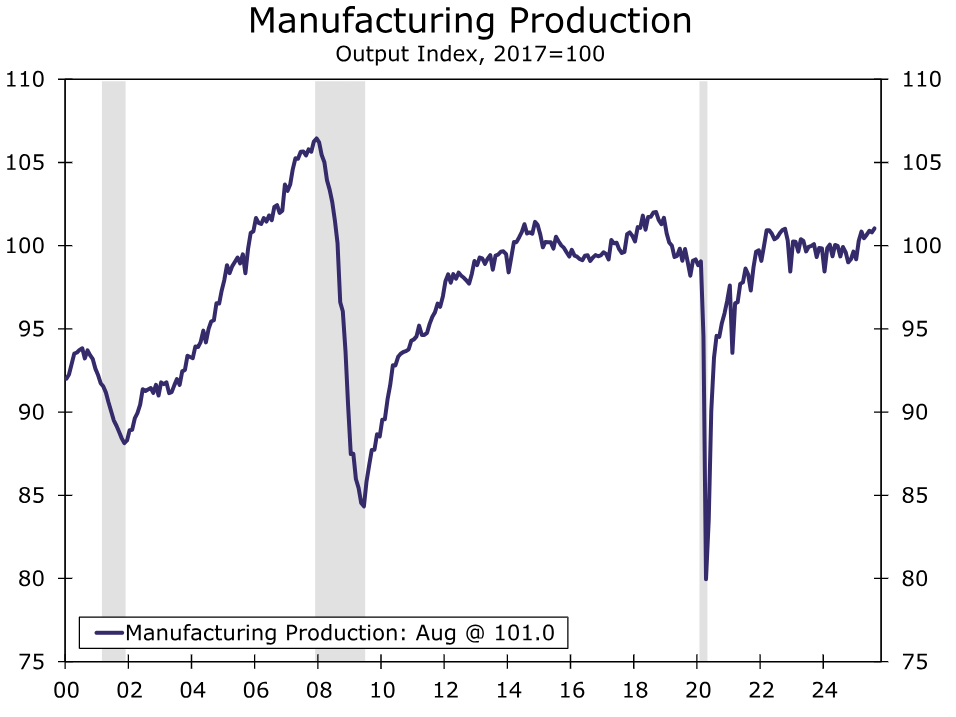

Despite widespread expectations that industrial output would decline for the second consecutive month, it still grew by 0.1% in August. While this data alone seems encouraging, when viewed against the backdrop of a sharp downward revision to July's 0.1% decline to a more disturbing 0.4%, this latest report suggests that total output fell short of market expectations for July.

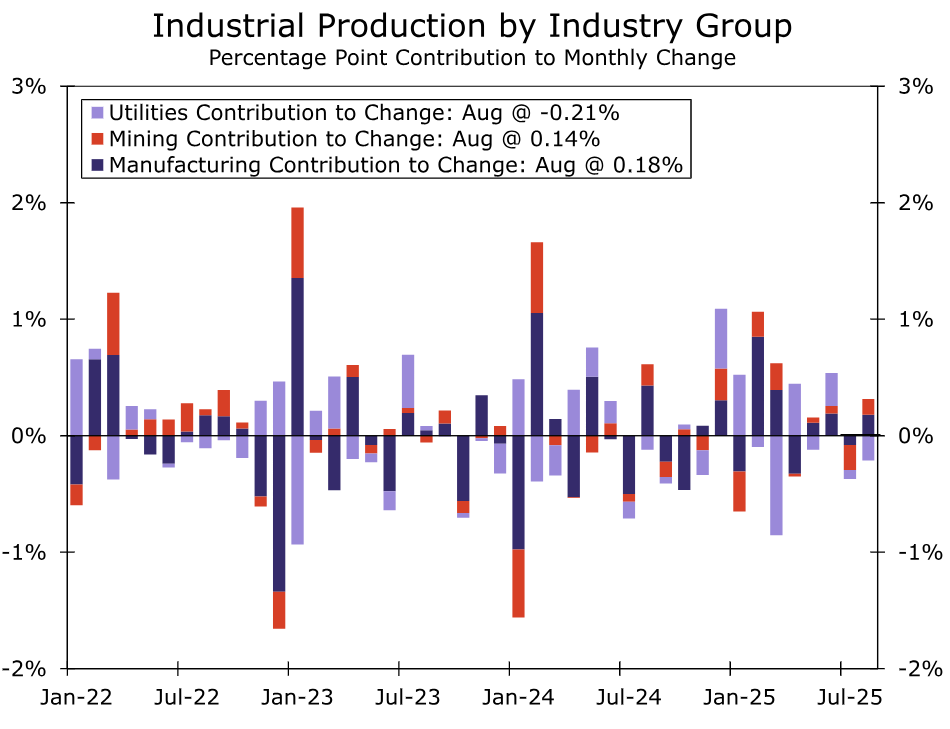

Utilities output was the main source of weakness, falling 2.0% last month after dipping 0.7% in July. While mining production rose 0.9%, the gain was not enough to offset July’s decline.

The charts show that the news is not all bad. The largest industry group, manufacturing, barely achieved a 0.2% increase, and the underlying trend has actually been slightly firmer recently. The index has been above 100 for three consecutive months and has hit a three-year high based on the three-month moving average.

Before focusing on an improvement, it's important to recognize that underlying economic activity remains highly concentrated, driven by just a few sectors. Over the past year, computer and electronics products and chemicals have been among the few bright spots in this sluggish sector. Aerospace and petroleum manufacturing have also performed relatively strongly.

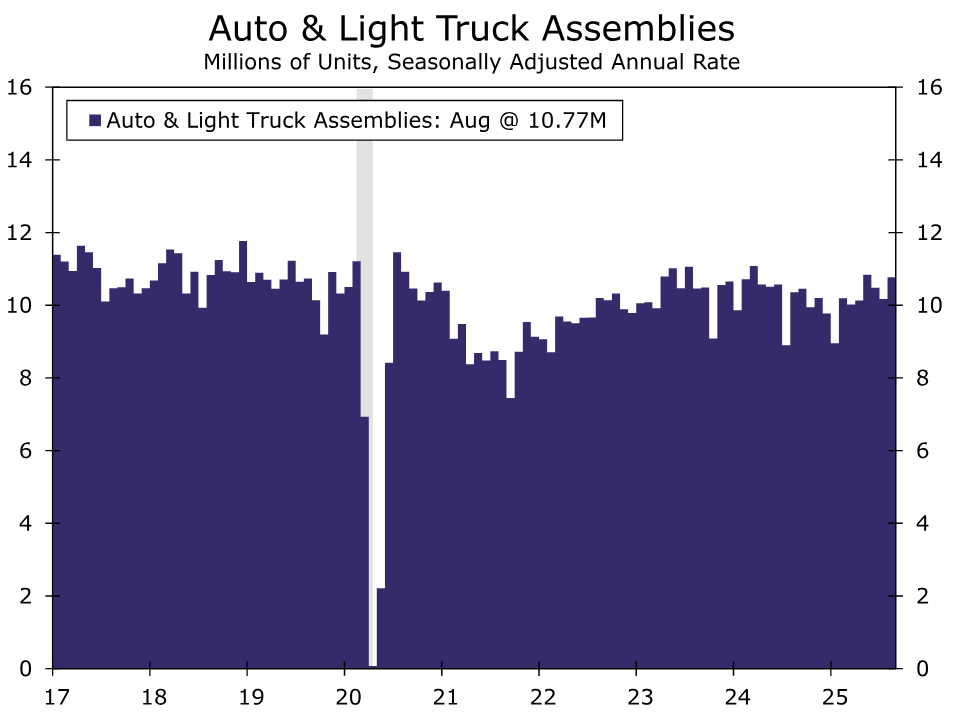

Activity in motor vehicle and parts manufacturing and miscellaneous manufacturing also rebounded a year ago, with auto manufacturing now experiencing growth. Automotive industry activity has exceeded pre-pandemic averages for nine consecutive months but remains slightly below the 2023-2024 average. In terms of total assembly volumes, cars and light trucks are currently moving toward the upper end of the range recorded over the past three years.

Despite a slight pickup in manufacturing activity over the past three months or so, we remain cautious about the sector's trajectory as activity remains constrained by ongoing uncertainty, with the exception of a few specific sectors.

While tariff rates have changed little in recent weeks, the administration appears to be still seeking to fine-tune trade policy between specific trade deals between different countries and tariffs on specific products that are still under discussion. Furthermore, there is still a Supreme Court ruling to be made.

The legality of widespread tariffs, which could be implemented in November, is a key issue. Beyond tariff policy, monetary policy also needs to be considered. Although the market expects the Federal Reserve to resume its easing cycle this week and further cut interest rates this year, borrowing costs are expected to remain relatively high.

Business capital spending intentions have shifted, and purchasing managers' surveys suggest overall manufacturing activity has stalled. A full recovery in manufacturing activity may take time.

Analysis of potential impact on the US dollar

Weak manufacturing data may consolidate market expectations that the Federal Reserve will continue to cut interest rates this year, suppressing the US dollar's interest rate advantage in the short term.

Moreover, the 14-day relative strength index (RSI) is significantly below its midline, indicating a lack of bullish momentum.

The US dollar index fell significantly on Tuesday, falling below the psychologically important 97 mark and approaching its historical low of 96.37 on July 1. During the Asian and European trading hours on Wednesday, the US dollar index continued to fluctuate around the previous trading day's low of 96.54.

(Daily chart of the US dollar index, source: Yihuitong)

At 15:13 Beijing time, the US dollar index was at 96.72.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.