Euro leads, pound sterling lags! Is the prelude to a non-US currency explosion already here?

2025-09-17 20:23:51

After the data was released on Tuesday, market expectations for the European Central Bank to further cut interest rates after this week's interest rate meeting have cooled significantly. It should be noted that the European Central Bank had clearly maintained interest rates unchanged at its interest rate meeting last week, stating that current economic risks are "becoming balanced" and the overall outlook is "in a benign state."

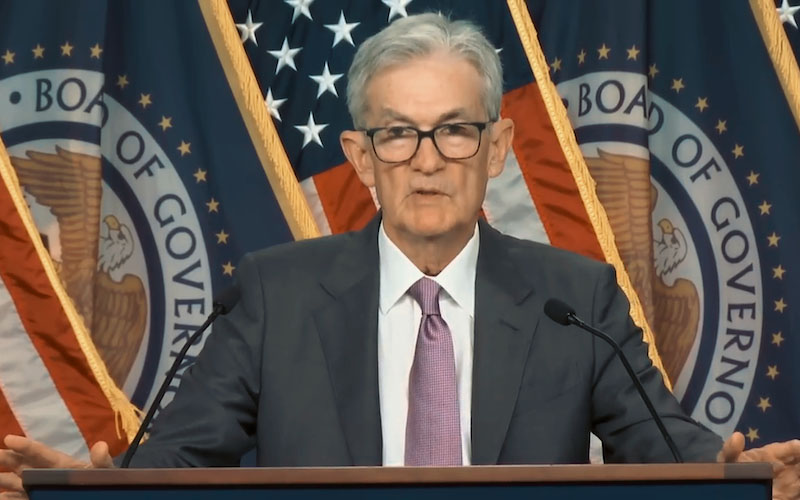

At the same time, traders were positioning themselves for the Federal Reserve's likely dovish rate cut early Thursday morning Beijing time, directly weakening the US dollar. As a result of these factors, the euro/dollar pair had greater upward momentum than the pound/dollar pair, while the pound's continued lag further fueled the euro's continued rise against the pound.

The euro showed strength on Tuesday, driven primarily by the better-than-expected ZEW economic sentiment reports for Germany and the eurozone as a whole. Combined with the European Central Bank's meeting last week, where it held interest rates steady and explicitly stated that economic risks were "balanced" and the outlook was "benign," market expectations for further rate cuts have significantly diminished, further reinforcing the consensus that the current easing cycle may be over.

At the same time, traders positioned themselves for a dovish rate cut by the Federal Reserve later in the day, putting pressure on the US dollar to weaken. Against this backdrop, the euro outperformed the pound against the dollar.

EUR/USD Technical Analysis

It has been mentioned many times before that the EUR/USD daily chart has formed a bullish flag pattern.

It's important to note that the EUR/USD pair's 2-day Relative Strength Index (RSI) has entered overbought territory, suggesting a potential short-term overextension risk. However, the pair's 14-day RSI confirms the upward trend and hasn't yet reached overbought levels. Against this backdrop, a pullback could present an opportunity for bulls to enter the market. Considering the overall pattern integrity, the EUR/USD pair is poised to reach the bullish flag target (around 1.20).

EUR/GBP Commitments of Traders (COT) in-depth analysis

While the weekly Commitment of Trade (COT) report includes dedicated data for EUR/GBP futures, the market liquidity for this instrument is relatively low, limiting its usefulness. To more accurately capture market sentiment, a more liquid alternative indicator can be constructed by subtracting GBP/USD futures positions from EUR/USD futures positions.

This method can effectively reflect the comparison of the long and short exposure of the euro and the pound relative to the US dollar, providing a more reliable sentiment reference for trading decisions.

The EUR/GBP alternative positioning chart shows a continued upward trend in net long exposure, driven by both active increases in long positions and passive reductions in short positions. This trend is highly consistent among large speculative institutions and asset managers, reflecting a consensus on bullish sentiment towards the euro relative to the pound.

While some believe that asset managers' net long exposure is nearing extreme levels of sentiment, in the short term, there is still room for further increases in long bets. Furthermore, given that the current EUR/GBP price remains well below its 2023 high, the probability of the pair breaking through its 2025 high in the coming weeks is gradually increasing.

(The green curve at the top of the chart represents the net long position of the euro against the pound)

EUR/GBP Technical Analysis

The daily chart shows that EUR/GBP is in a clear uptrend, with momentum turning completely bullish after successfully holding above the 50-day exponential moving average.

The price action has formed a series of converging highs and lows. While not a textbook symmetrical triangle, it shares similar structural characteristics. Even so, the current momentum is fully in sync with the dominant uptrend.

Combined with the latest position report showing that "traders' bullish sentiment on EUR/USD is significantly stronger than on GBP/USD", if the price pulls back within yesterday's fluctuation range, it may become a good opportunity for euro bulls to intervene, with the target directly targeting the 2023 high and the high of the year (about 0.8751).

Traders should also keep an eye on the key 0.8660 level, the 2024 opening price, which could act as important support in the short term. As long as EUR/GBP remains above the recent swing low of 0.8631, the bullish bias remains intact.

The core question now is: Is this surge a temporary rebound before a sharp decline, or is it a trend-setting signal that will break through the 2025 high? Judging by futures open interest data, the latter is more likely.

(EUR/GBP daily chart)

At 20:16 Beijing time, the euro is trading at 1.1835/34 against the US dollar and 0.8671/72 against the British pound.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.