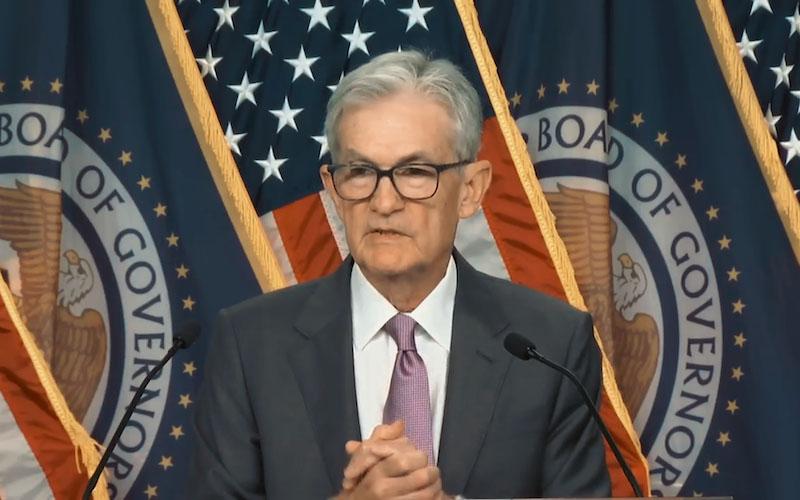

Deciphering Powell's "language art": Trading signals behind "non-isolated actions" and "no endorsement"

2025-09-18 20:44:22

It is worth noting that apart from Powell's additional explanation on monetary policy, questions or gossip about the independence of the Federal Reserve ultimately overshadowed the attention paid to monetary policy and other economic issues.

At the beginning of the press conference, a reporter raised the question: Will the appointment of Stephen Miran, the new member of the Federal Reserve Board - who currently still serves as the chairman of the Trump administration's Council of Economic Advisers - undermine the independence of the Federal Reserve, and whether the Federal Reserve can continue to claim to maintain its independence under this situation.

The Fed chairman responded, "Today, as usual, we welcomed a new member to the Committee. The Committee remains united in its dual mandate and remains firmly committed to its independence. Beyond that, we have no further information to disclose."

But reporters questioned Milan's appointment from multiple perspectives, and Powell was eventually forced to provide further explanation.

When asked about Milan's public assertion that the Fed actually has a triple mandate (maximum employment, stable prices, and moderate long-term interest rates), Powell clarified: " We have always defined our policy objectives as a dual mandate: maximum employment and stable prices. Moderate interest rates are essentially the result of low and stable inflation and maximum employment . We have never for a long time viewed it as a third mandate that required independent policy action."

He added: "There is no possibility, in my opinion, that it could be included in the mission or considered in any other way at this point in time."

Powell also sought to downplay Milan's influence in the discussions at the recently concluded Federal Open Market Committee (FOMC) meeting. " The only way for any voting member to change the direction of policy is to be extremely persuasive, and within our framework, that requires a strong argument based on data and a deep understanding of the economy ," he emphasized. "That's the core of determining policy direction."

In discussing the newly released "dot plot," a key tool reflecting FOMC voting members' expectations for the path of interest rates, Powell seemed to allude to Milan's position. He said, "This week, there was no broad-based support for a 50 basis point cut." Ultimately, only one voting member—widely believed to be Milan—advocated for a 50 basis point cut, while the remaining 11 voted for a 25 basis point cut.

Milan's appointment isn't the only challenge to the Fed's independence that Powell needs to address. When asked about Treasury Secretary Scott Bessent's proposal for an independent review of the Federal Reserve to address its so-called mission expansion, Powell declined to comment directly.

He said, "Regarding reform, the Federal Reserve has just completed a lengthy and highly effective update of its monetary policy framework, and the Board of Governors is currently working on a number of behind-the-scenes initiatives... We are certainly willing to accept constructive criticism and explore ways to better perform our duties."

When asked about his view on the Trump administration's attempt to fire Federal Reserve Governor Lisa Cook on the grounds of "mortgage fraud," Powell responded: "That is a court case and I am not in a position to comment."

Powell made it clear that the Fed's core focus at this meeting was entirely on the job market, a key reason all voting members unanimously supported the rate cut . He said, "The core of today's policy decision is precisely the risks we observe in the job market. Even though downside risks to the job market existed in July, these risks have now become reality, and the overall risk exposure has significantly increased ."

The Fed chairman also acknowledged that both dimensions of the dual mandate are currently at a critical juncture. "There is no longer a risk-free policy path," he admitted. "It is not immediately clear what policy actions should be taken now."

Another reporter asked whether the rate cut would have been initiated earlier if it had been known that the employment data would have been significantly revised downward. He responded, "We must formulate policies with an eye to the future, not dwell on the past. What I can clearly say is that we understand the current situation and have taken appropriate action today."

In the process of defending the latest employment data, Powell's remarks on possible future interest rate cuts were more specific than in previous meetings, and his statement seemed to support market expectations.

He said, "This time, the interest rate cut was implemented by 25 basis points, but the market is also pricing in the subsequent interest rate path. He (Powell) is by no means endorsing all the market's pricing behavior, but just wants to make it clear that this is not a single isolated policy measure."

As with previous meetings, Powell also faced questions about tariffs. He said, "Our previous expectation was that inflation would pick up this year due to the pass-through of tariffs to commodity prices," but acknowledged that the actual pass-through of tariffs to inflation "has been slower and smaller than expected."

He added that "most of the cost of tariffs is borne not by exporters but by the companies that sit between exporters and consumers," and suggested that tariffs could be a factor in the recent job market weakness. "That's certainly a possibility," he said.

However, the Fed chairman made it clear that he does not believe tariffs are the primary cause of weak employment. "The current performance of the job market has more to do with immigration issues than the impact of tariffs."

Powell also addressed inflation expectations, saying that despite a recent pickup in inflation, indicators still support the Fed's optimistic scenario. He said, "Almost all long-term survey data (with the University of Michigan survey being a slight outlier recently) remain stable at levels consistent with our longer-run 2% inflation objective."

Regarding financial stability, he noted that the Fed has not identified any material risks to worry about. He said that "the overall picture is mixed, but both households and the banking sector are in good shape."

When asked by another reporter whether he had decided whether to stay on at the Fed when his term ends in May, he responded, "There is no new information to disclose to you today on this matter."

Trading reminder:

Despite widespread market expectations that the US has opened the door to rate cuts, with subsequent reductions imminent, Powell emphasized that he "does not endorse all pricing actions." This is because the market could overreact, and Powell's statement is intended to discourage the market from pricing in aggressive rate cuts. By stating that the rate cuts are "not a single, isolated event," he acknowledged policy coherence while leaving room for a possible subsequent policy shift (such as a pause in rate cuts).

At the same time, Powell proposed that the only way for any voting member to push for a policy adjustment is to be extremely persuasive; and within our work framework, to achieve this, we must put forward highly weighty arguments based on data and a deep understanding of the economy. This suggests that there is no need to worry about the independence of the Federal Reserve, and indirectly reduces market concerns about the Federal Reserve's independence and ability to handle inflation. At the same time, Waller and Bowman also supported a 25 basis point rate cut this time, which indirectly confirmed that the Federal Reserve still maintains its independence. This has curbed the market's betting on the Trump deal (the Trump deal is a trading behavior in which the US president intends to achieve a rapid interest rate cut by interfering with the Federal Reserve, and the market over-bets on this result in advance), which has curbed the weakening of the US dollar.

The essence of Powell's statement is a recalibration of policy flexibility and market expectations.

He conveyed the continuity of easing through a series of actions, maintained policy independence by not endorsing pricing, and explained current operations through risk management, ultimately achieving a dynamic balance between employment and inflation. For traders, the core message is: closely monitor non-farm payroll data, PCE data, and other data going forward, rather than relying solely on market inertia (the US President accelerating the Fed's rate cuts). The Fed's policy path will always be anchored by data, not market sentiment.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.