Gold Trading Alert: "Top" Alert! Gold prices have fallen for two consecutive days after the Fed's rate cut. Can they still break through $4,000?

2025-09-19 07:26:51

Despite this, analysts generally believe that this pullback is merely a technical correction, and that gold's long-term bullish trend remains solid. It has risen nearly 39% this year, with its target directly at $4,000. In early Asian trading on Friday (September 19), spot gold fluctuated within a narrow range, currently trading around $3,640.90 per ounce.

The Fed's "dovish" policy has triggered a correction in gold prices, with policy uncertainty becoming the biggest variable.

The Federal Reserve's latest move was undoubtedly the most direct trigger for gold's price fluctuations. On Wednesday, the Fed cut interest rates by 25 basis points for the first time since December 2022, lowering the target range for the federal funds rate to 4.75%-5.00%. The statement also left room for further easing. This should have been a positive signal for gold, as low interest rates often enhance its appeal and reduce the cost of holding non-interest-bearing assets.

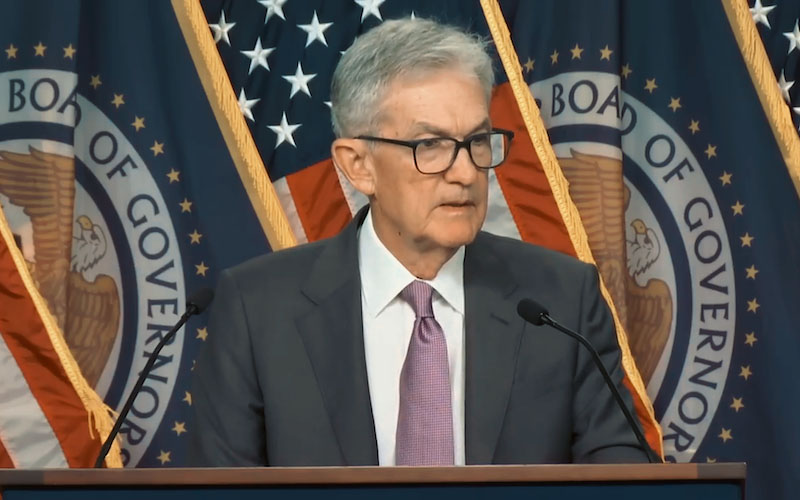

However, Federal Reserve Chairman Powell unexpectedly characterized the rate cut at a press conference as a "risk management measure" aimed at addressing the risk of a weakening labor market. He also emphasized that the Fed was "in no hurry to begin easing" and warned against stubborn inflation. This ambiguous stance instantly cooled market expectations for aggressive rate cuts in the coming months.

Powell's comments were a blow to the market, triggering an immediate reaction. Gold prices briefly hit an all-time high on Wednesday, but then retreated, and profit-taking further amplified the decline on Thursday.

Peter Grant, Vice President and Senior Metals Strategist at Zaner Metals, stated in an interview, "Powell's comments about rate cuts as a risk management measure have caused some confusion, and this uncertainty has prompted profit-taking in the market." He further noted that despite significant short-term volatility, gold's long-term bullish trend remains intact, and each new high strengthens the credibility of its $4,000 target. Grant's view is not unfounded. Gold's performance this year in times of uncertainty has demonstrated its resilience: geopolitical risks, the end of the Federal Reserve's rate hike cycle, and continued accumulation of gold holdings by global central banks have all provided strong support for gold prices.

More notably, the Fed's guidance has led to a deepening divergence in market opinion regarding the future path. Goldman Sachs analysts believe this rate cut will be the first of several, suggesting a cumulative reduction of nearly 50 basis points by year-end. ANZ, on the other hand, characterized Powell's remarks as "far from dovish," suggesting a slower pace of easing. This divergence in interpretation has directly amplified gold price volatility, causing bulls to hesitate at high levels and giving shorts an opportunity to cover their positions.

U.S. bond yields rebounded, and labor data "unexpectedly rose" squeezed gold's space

In tandem with the gold price decline, upward pressure in the U.S. bond market further reinforced this trend. On Thursday, U.S. Treasury yields climbed across the board. The 10-year Treasury yield rose 3.2 basis points to 4.108%, marking its first consecutive day of gains since early September and its largest two-day increase in a month. The 30-year yield rose 5 basis points to 4.724%. This rebound was not accidental, but rather stemmed from a labor market indicator that exceeded expectations: data from the U.S. Department of Labor showed that initial jobless claims fell by 33,000 last week to a seasonally adjusted 231,000, far below economists' expectations of 240,000 and reversing the previous week's sharp rise.

This data was a shot in the arm, boosting investors' confidence in the economy's resilience. Another report showed that the Philadelphia Fed's manufacturing index rebounded to 23.2 in September, significantly higher than the expected 2.5 and the previous reading of -0.3. Although the price indicator declined, the overall signal of a recovery in factory output was strong enough.

Subadra Rajappa, head of U.S. interest rate strategy at Societe Generale, analyzed: "The two-year Treasury yield has very efficiently digested a fairly aggressive policy path, such as six rate cuts before the end of next year; the 10-year Treasury yield is at the lower end of the 4% range. In this environment, the economy and data have unexpectedly improved a bit, and in this case, a rebound from lows should be expected." Her words reveal the logic of the bond market: although the expectation of a Fed rate cut has been basically digested - the market believes that there is a 94.1% probability of at least a 25 basis point rate cut at the October meeting - the strong employment data has steepened the yield curve, and the two-year/10-year yield gap has widened to positive 53.4 basis points, which directly raised the opportunity cost of holding gold.

Inflation expectations also showed subtle shifts. The break-even yield on five-year Treasury Inflation-Protected Securities (TIPS) was 2.46%, while the 10-year was 2.383%, indicating that the market expects average annual inflation to be around 2.4% over the next decade. While below the Fed's 2% target, this data suggests inflationary pressures have not subsided, confirming the Fed's cautious stance. The upward trend in the bond market not only squeezed gold's safe-haven premium but also amplified downward pressure on gold prices through yield linkage.

The strong rebound of the US dollar has intensified the pressure on gold prices, and the global foreign exchange market is volatile and has hidden concerns.

Gold prices are denominated in US dollars, and its fate is often closely tied to the US dollar index. On Thursday, the US dollar index continued its rebound from Wednesday, rising another 0.4% to 97.347. A day earlier, after the Federal Reserve's decision, the dollar index briefly fell to 96.22, a low not seen since February 2022, but Powell's non-dovish tone quickly reversed the decline.

Eric Theoret, a foreign exchange strategist at Scotiabank, pointed out: "Powell's remarks failed to achieve the clear dovish stance that the market had expected. Thursday's optimistic economic data combined with the heavy selling pressure on the US dollar at the beginning of the week were enough to push the US dollar to rebound." He added that the market balance was originally completely tilted to one side, and great momentum would be needed to push the US dollar further down from its current level.

The rebound of the US dollar has made gold priced in US dollars more expensive for holders of other currencies. On Thursday, the US dollar index rose 0.4% overall, directly contributing to the 0.4% drop in gold prices.

Investors are closely watching the Bank of Japan's decision. If the Bank of Japan unexpectedly turns hawkish, it will further push up the US dollar, indirectly negatively impacting gold prices. However, in the long run, the dollar's strong rebound may only be temporary. The lower end of the 4% range of US Treasury yields and the Federal Reserve's easing door still provide room for the dollar to fall.

Swiss gold exports to China surge 254%, signaling a long-term bull market as supply and demand imbalances

Another factor behind gold price fluctuations is the structural shift in global gold supply and demand. Recent data shows that Swiss gold exports to China surged 254% in August compared to July, exceeding market expectations and highlighting robust demand from China, the world's largest gold consumer. As a global gold refining and trading hub, Switzerland's export data often signals genuine demand in the downstream market: Chinese investors have increased their gold allocations amid uncertainty surrounding the Federal Reserve and heightened geopolitical risks.

This data not only confirms gold's safe-haven properties but also reveals a deeper imbalance in supply and demand. Global central banks have continued to increase their gold reserves this year, with emerging markets such as Russia, India, and China being particularly active. However, bottlenecks on the mining supply side—including labor strikes and environmental regulations in South Africa and Australia—have further pushed up prices. Combined with the Federal Reserve's low interest rate environment, gold's annual appreciation has reached 39%, far exceeding other commodities. This confirms Peter Grant's assessment: the pullback is merely a technical correction, and the long-term bull market is unlikely to be reversed.

The bullish momentum in the gold market is not unfounded. Although the World Business Council (CERC) Leading Index fell 0.5% in August, citing "higher tariffs" as a factor in the economic slowdown, headwinds from trade policy have actually strengthened gold's diversification appeal. Until the Federal Reserve's policy path becomes clearer, gold's volatility is likely to continue, but strong demand support ensures its potential for a rapid rebound from any correction.

Summarize

In summary, while the gold price's rollercoaster ride stems from the Fed's disappointing dovish expectations, upward pressure from the bond-exchange rate synergy, and short-term profit-taking, these factors are unlikely to shake the fundamentals of gold's structural bull market. From the technical correction after reaching a record high, to the supply and demand signals from Swiss export data, and to continued buying from global central banks, gold still has a chance to reach the $4,000 target. Investors should view this pullback as an opportunity to position themselves and seize long-term opportunities amid uncertainty. In the short term, caution is warranted regarding the possibility of gold prices testing support in the 3,600-3,610 area.

(Spot gold daily chart, source: Yihuitong)

At 07:25 Beijing time, spot gold was trading at $3639.33 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.