A series of attacks on Russian refineries sparked a diesel panic buying frenzy. Could bullish sentiment return to the top of the oil price curve?

2025-09-25 13:21:03

Data from the U.S. Energy Information Administration on Wednesday showed that crude oil inventories fell by 607,000 barrels in the week ending September 19, compared with a decrease of 9.285 million barrels in the previous week.

"Given the overall drawdowns in crude oil, distillate and gasoline inventories, the report is somewhat supportive," said John Kilduff, partner at Again Capital.

Ongoing geopolitical tensions in the Middle East and the conflict between Russia and Ukraine could provide support for oil prices. In recent weeks, Ukraine has intensified drone attacks on Russian energy infrastructure, targeting refineries and export terminals in an effort to cut Moscow's export revenue. This has led to shortages of certain fuel types in Russia, threatening the possibility of fuel export restrictions if necessary.

Attack on Russian refinery triggers diesel panic buying, funds stockpile

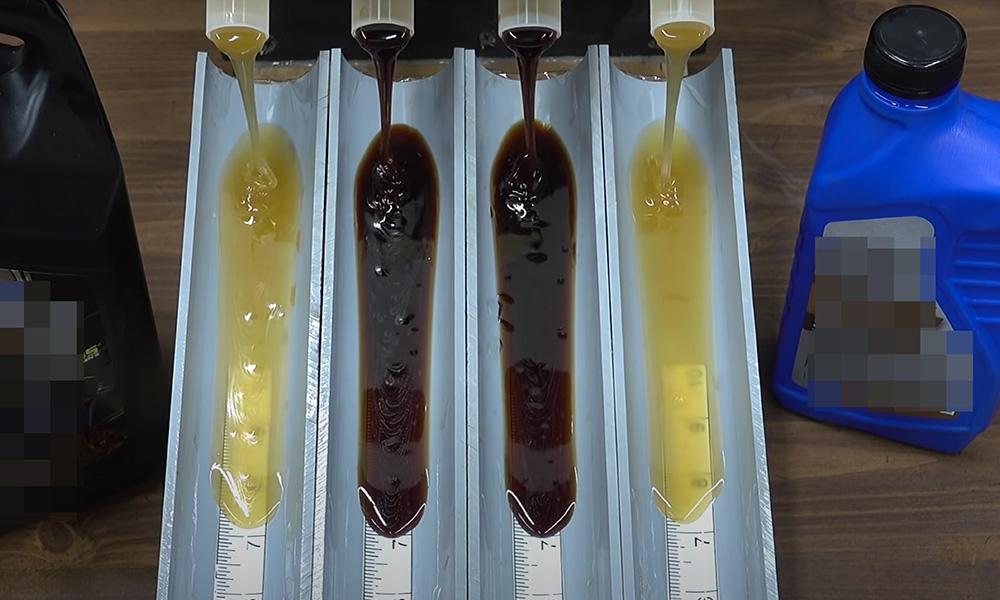

Diesel bulls are pouring back into the market as fresh attacks on Russian refining facilities have tightened recent supplies, spurring a rush into distillate hedging.

Bloomberg data shows that the current net long position of European diesel held by funds has hit the strongest record since early 2022, the trading volume of diesel options on the Intercontinental Exchange has reached a monthly high, and the price of near-month low-sulfur diesel futures has hovered in the low range of US$700 per ton.

The market volatility stems from the recent attack on the Salavat petrochemical complex in Bashkortostan, owned by Gazprom. This is the second time it has been damaged in a week, exacerbating Russia's continued losses in refining capacity.

Since August, supply conditions at several Russian hubs have deteriorated due to repeated Ukrainian drone attacks. Consequently, the market has lowered its export expectations for diesel and other middle distillates. According to the Financial Times, European paper prices have risen accordingly, reflecting tighter immediate supply as autumn refinery maintenance approaches.

However, compensatory supplies are entering the market. Indian refineries have pushed exports of refined products, including diesel, to multi-year highs, filling some of the gap in Rosneft supplies to Europe and the Mediterranean. However, the size and arrival times of these tankers remain volatile due to disruptions to logistics and refinery operations within Russia.

Meanwhile, amid tight domestic supply in Russia, authorities are considering extending the gasoline export ban until October. Officials have hinted at expanding the fuel export restrictions "if necessary." Any additional bans or refinery operational adjustments to address them would impact regional refined product balances and shipping markets, particularly the diesel benchmark price linked to the Amsterdam-Rotterdam-Antwerp region.

Technical Analysis

Technical analysis of the daily chart shows that oil prices are still in a rectangular consolidation pattern.

The 14-day relative strength index (RSI) is above the 50-axis line, indicating that the bullish trend remains valid. In addition, oil prices have broken through the 9-day exponential moving average (EMA, 63.75), indicating that short-term price momentum is strengthening.

On the upside, resistance is seen at the upper track of the rectangular range near $65.70. If this consolidation pattern is effectively broken through, it will strengthen the bullish outlook and push oil prices to the five-month high of around $70.51 set on July 30.

On the downside, the initial support level is at the 9-day exponential moving average (63.75). A break of this level will weaken short-term momentum and may cause oil prices to fall to the lower limit of the rectangular range at $61.60, and then test the three-month low of $61.20 recorded on September 5.

(U.S. crude oil continuous daily chart, source: Yihuitong)

At 13:20 Beijing time, U.S. crude oil continued to trade at $64.62 per barrel.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.