Countdown to US government shutdown: Can Trump’s “last ditch effort” resolve the crisis?

2025-09-30 01:31:55

Spot gold prices surged to around $3,825 per ounce during trading, while the US dollar index (DXY) came under downward pressure, with short-term risk aversion dominating. This is not only a window to capture gold opportunities, but also a moment to test the resilience of asset allocation.

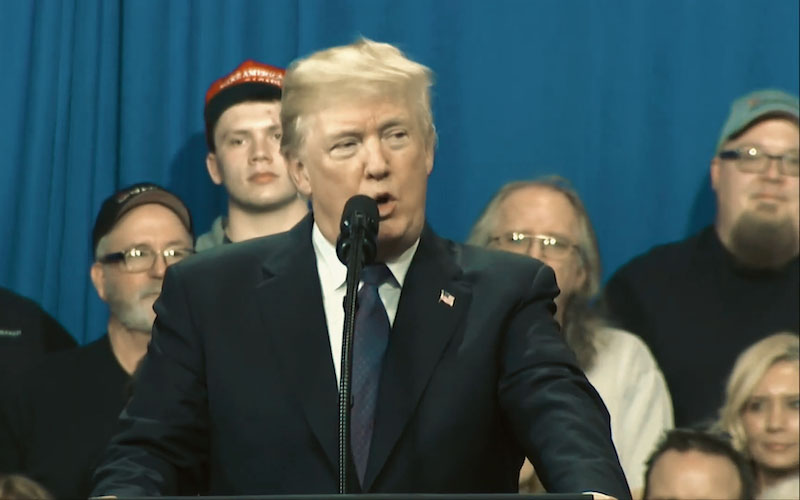

Trump reverses decision: White House summit becomes "life and death race"

With less than 48 hours until the shutdown deadline (early morning of October 1), Trump, demonstrating his dealmaking instincts, reversed his earlier decision to cancel the meeting and agreed to host a Big Four summit at the White House on the afternoon of September 29. Participants included House Speaker Mike Johnson (R-Calif.), Senate Majority Leader John Thune (R-Calif.), Senate Minority Leader Chuck Schumer (D-Calif.), and House Minority Leader Hakeem Jeffries (D-Calif.).

This meeting is a last-ditch effort. Without a Continuing Resolution (CR) for short-term spending, the federal government will partially shut down, with two million workers facing potential furloughs or even layoffs. White House Press Secretary Carolyn Levitt called it a "chance for Democrats to return to common sense." Trump is confident he holds a strong position and that Democrats will shoulder the blame for the shutdown. The Democratic response, however, was muted: Jeffries emphasized that he would not accept a "blank check" and insisted that the CR include an extension of Medicaid subsidies.

U.S. Senate Minority Leader Schumer said in his latest statement, "The Republicans felt the pressure and agreed to negotiate. We are ready to act, and it is time."

History of Closures: Historical "Short-Term Pains" and Market Resilience

The US government shutdown can be compared to an executive shutdown caused by a budget war: the two parties spar over spending bills, the depletion of federal funds, the closure of non-essential departments (such as national parks and some administrative services), and the furloughing of employees. Since the Budget Control Act of 1976, the US has experienced more than 20 government shutdowns, most lasting three to four days and resulting in limited economic losses (a 0.1%-0.2% reduction in GDP per week).

Since 2023, the United States has faced shutdown threats or brief shutdowns several times, but most of them were resolved through temporary bills, avoiding large-scale disruptions.

The recent few times are worth mentioning: From September to November 2023, Congress was deadlocked due to differences in the debt ceiling and spending. On November 15, the new Speaker of the House of Representatives, Mike Johnson, reluctantly passed a temporary CR to postpone the shutdown to January 2024. During this period, the market fluctuations were brief, the US dollar index only fell slightly by 0.2%, and gold futures rose slightly by 0.5%.

In January 2024, the risk of a shutdown loomed again, but on January 19, the two parties reached an agreement and signed the CR to extend funding until March. The economic impact was minimal, and the stock market even rose during the negotiations.

As of 2025, Congress has passed three consecutive rounds of CRs: the first round from October 1 to December 20, 2024, the second round from December 21 to March 14, 2025, and the third round from March 14 to the end of the fiscal year on September 30. Although the last CR contained several unusual provisions, it successfully avoided an actual shutdown.

These events demonstrate that shutdown threats often result in little action—initially, risk aversion pushes gold prices higher and the dollar lower, but once an agreement is reached, the market quickly rebounds. History shows that shutdowns are short-lived: initial risk aversion pushes gold prices higher and the dollar lower, but once they are resolved, they rebound, and the stock and foreign exchange markets dismiss them as mere noise.

The crisis escalates: Trump's "fire threats" and the health care deadlock

This shutdown is unlike any previous ones, characterized by its harsher character: the White House Office of Management and Budget (OMB) has directed agencies to prepare a "permanent layoff list" (RIF), affecting 300,000 federal employees, exceeding previous temporary furloughs. Trump sees the shutdown as an opportunity to "clean up a corrupt government." The core debate is over healthcare: Democrats demand an extension of the Affordable Care Act (ACA) tax credits (which expire at the end of the year and benefit 20 million low- and middle-income individuals) and a reversal of Medicaid cuts, while Republicans insist on post-CR negotiations and the imposition of income limits.

Some attribute the shutdown to Republican intransigence, while others blame it on Democratic obstruction. Political polarization, coupled with the 48-hour countdown, suggests the shutdown could delay employment and PCE data, impacting the Federal Reserve's decision-making.

Financial Market Forecast: Gold Continues to Rise, US Dollar Falls Slightly

The shutdown will have a "shallow and short-lived" impact on financial markets, but risk aversion will push up gold and depress the dollar:

US dollar (DXY): It has fallen 0.5% to a recent low and may depreciate another 0.4%-1% within a week due to political risks triggering safe-haven outflows; but it will rebound after the end. In the long run, the expectation of the Federal Reserve's interest rate cuts (two rounds of 25 basis points) will support the US dollar.

Gold (XAU/USD): has broken through $3,812/oz (up 45% this quarter). If a shutdown occurs, weekly returns could increase by 2%-3%, or reach $3,900. Be wary of a pullback to $3,685.

Foreign exchange market: EUR/USD and GBP/USD may rise by 0.3%-0.8%, and VIX may increase by 10%-15%.

Bank of America believes that the shutdown will reduce GDP by 0.1% per week, and the forecasting website Polymarket predicts that the probability of the shutdown is 55%.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.