The debt crisis is brewing again! Curve steepening transactions may heat up, causing a major shock in the foreign exchange market?

2025-10-09 14:44:43

Investors have been quick to sell long-term bonds issued by governments that increase spending or are perceived as not doing enough to rein in their finances, pushing borrowing costs to multi-decade highs in some countries. However, they have been more forgiving of shorter-term debt.

Ultra-long Japanese government bond yields hit a record high on Monday (October 6) and French long-term bond yields were close to a 16-year peak, while shorter-dated bond yields rose less as political turmoil shook markets.

Budget pressures are unlikely to be resolved in the short term

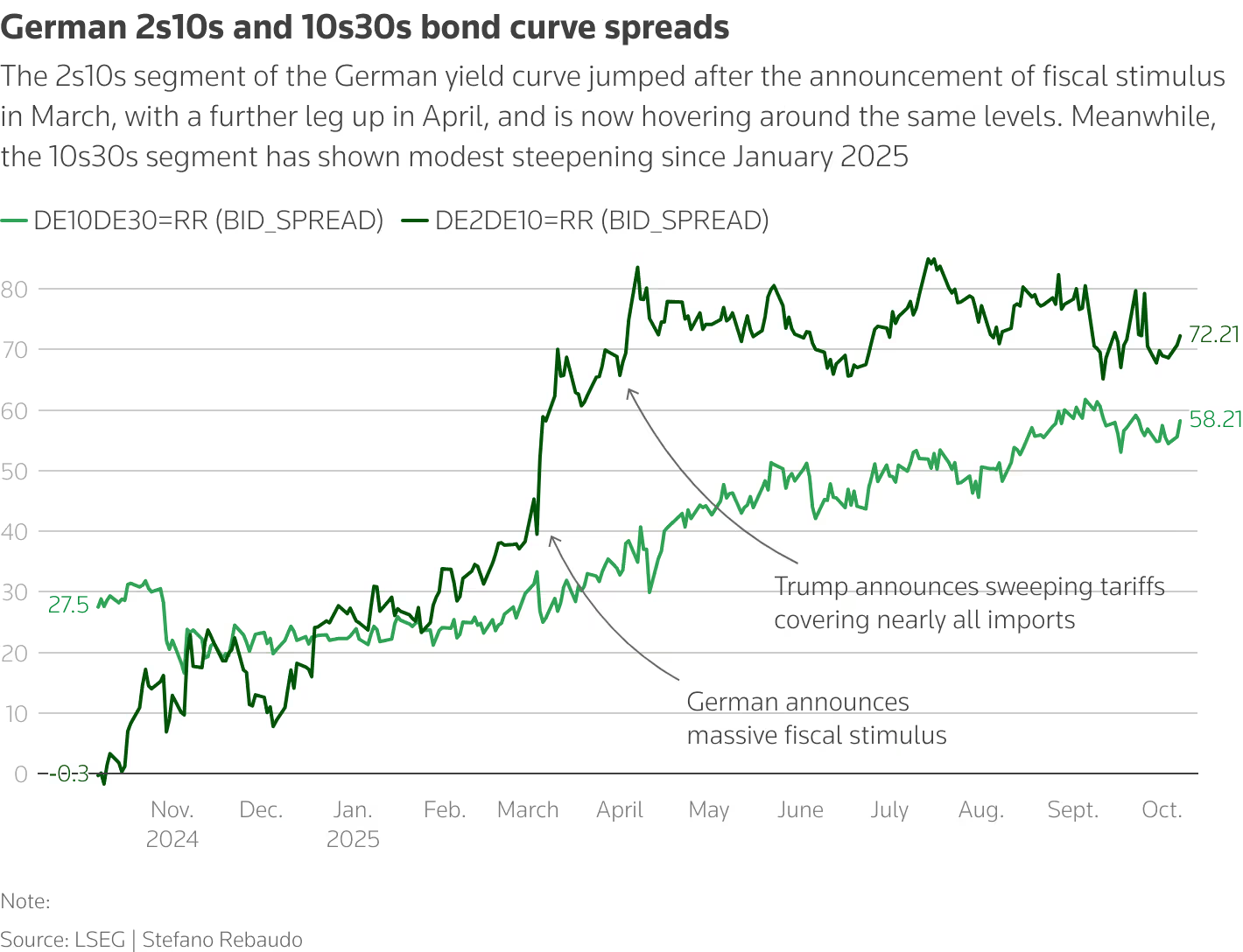

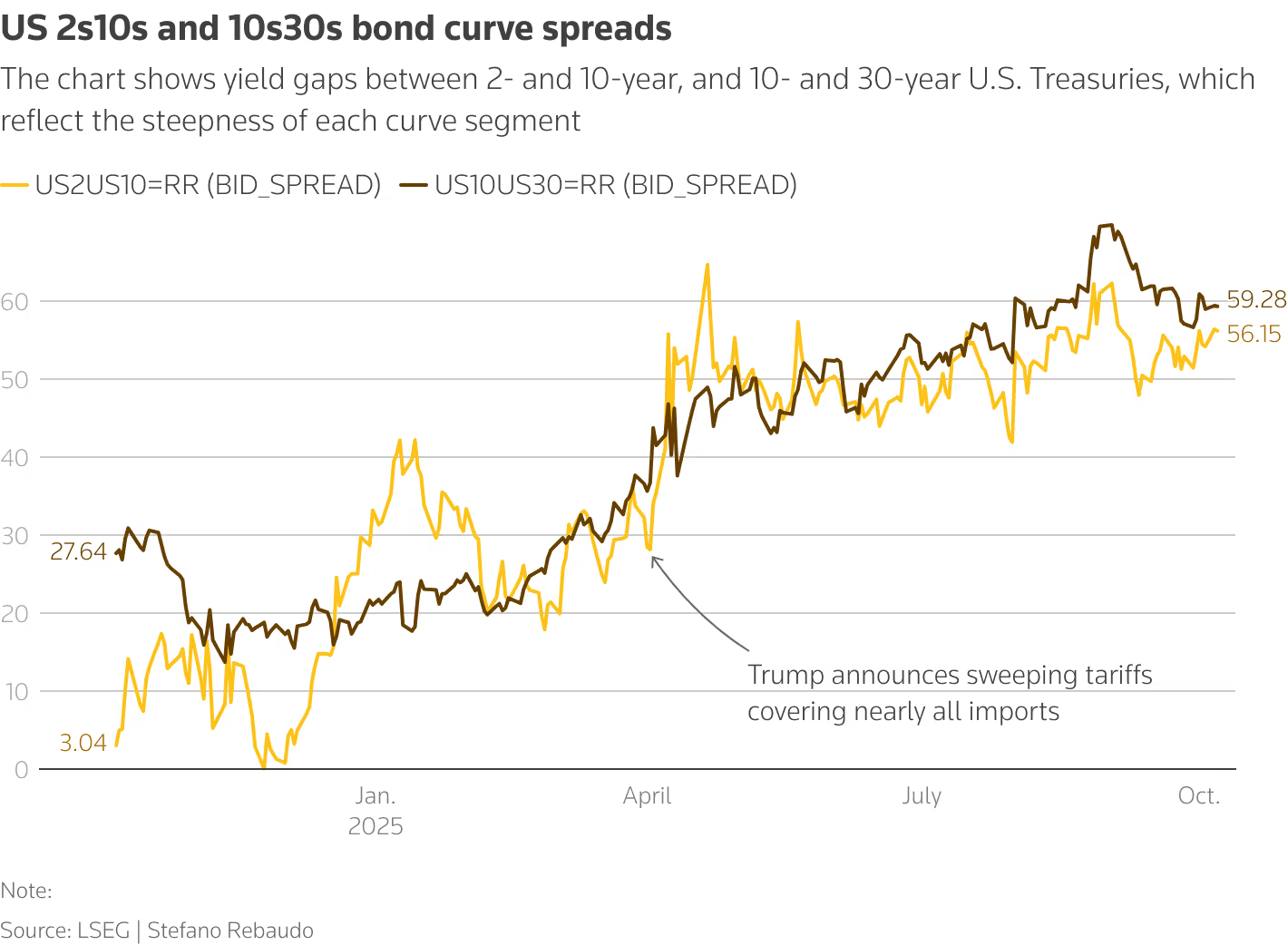

This trend, known as "curve steepening," has been a hot topic in bond markets this year. The spread between 10-year and 30-year German government bonds has widened by 36 basis points, while in the United States it has widened by 37 basis points and in Japan by about 40 basis points. These spreads peaked in early September and have since retreated.

The German 10/30 year spread is currently around 56 basis points, down from 61.5 basis points in early September but still around double its level at this time last year.

(Figure: German 2/10 and 10/30 bond yield spread trends)

Germany overhauled its fiscal rules earlier this year, increasing spending on infrastructure and defense, and is expected to increase its budget deficit to 70% of gross domestic product from 60%.

France is embroiled in a political crisis with fiscal problems at its core, and a key source of demand for euro zone bonds is also expected to fall as Dutch pension funds will no longer need to hold as many long-term bonds following industry reforms.

In response, national debt agencies in the United States, the eurozone, Japan and other countries are working to protect against volatility and weakness in long-term bonds by selling shorter-dated debt and reducing issuance of longer-dated debt.

“We remain bullish on the curve steepening trade in both German and U.S. Treasuries, although we have reduced our exposure as the curves have largely normalized,” said Konstantin Veit, portfolio manager at PIMCO.

The steepening of the yield curve in the euro area is mainly driven by risk premia (political and fiscal risks) rather than healthy economic growth expectations, which will put significant pressure on the euro.

Risks loom in the US

In the United States, the debate isn’t just about the trajectory of the national debt. There are concerns about inflation and the independence of the Federal Reserve, even if the current consensus is that price pressures caused by tariffs will prove short-lived.

Both of these factors could contribute to a further steepening of the Treasury yield curve. Any perception that the Fed is yielding to Trump’s pressure to cut rates more quickly could push up inflation expectations and yields.

Pinhao and others argue that the U.S. yield curve reflects an assumption that the Federal Reserve's independence remains unchanged and that the budget deficit ultimately approaches the U.S. government's own forecasts, meaning further steepening of yields may be limited.

(Figure: Trend of U.S. Treasury bond yield spreads between 2/10 and 10/30)

Against the backdrop of widespread fiscal problems around the world, the relative resilience of the US economy and its upward yields may still make it the "least worst option", attracting capital inflows and supporting the US dollar.

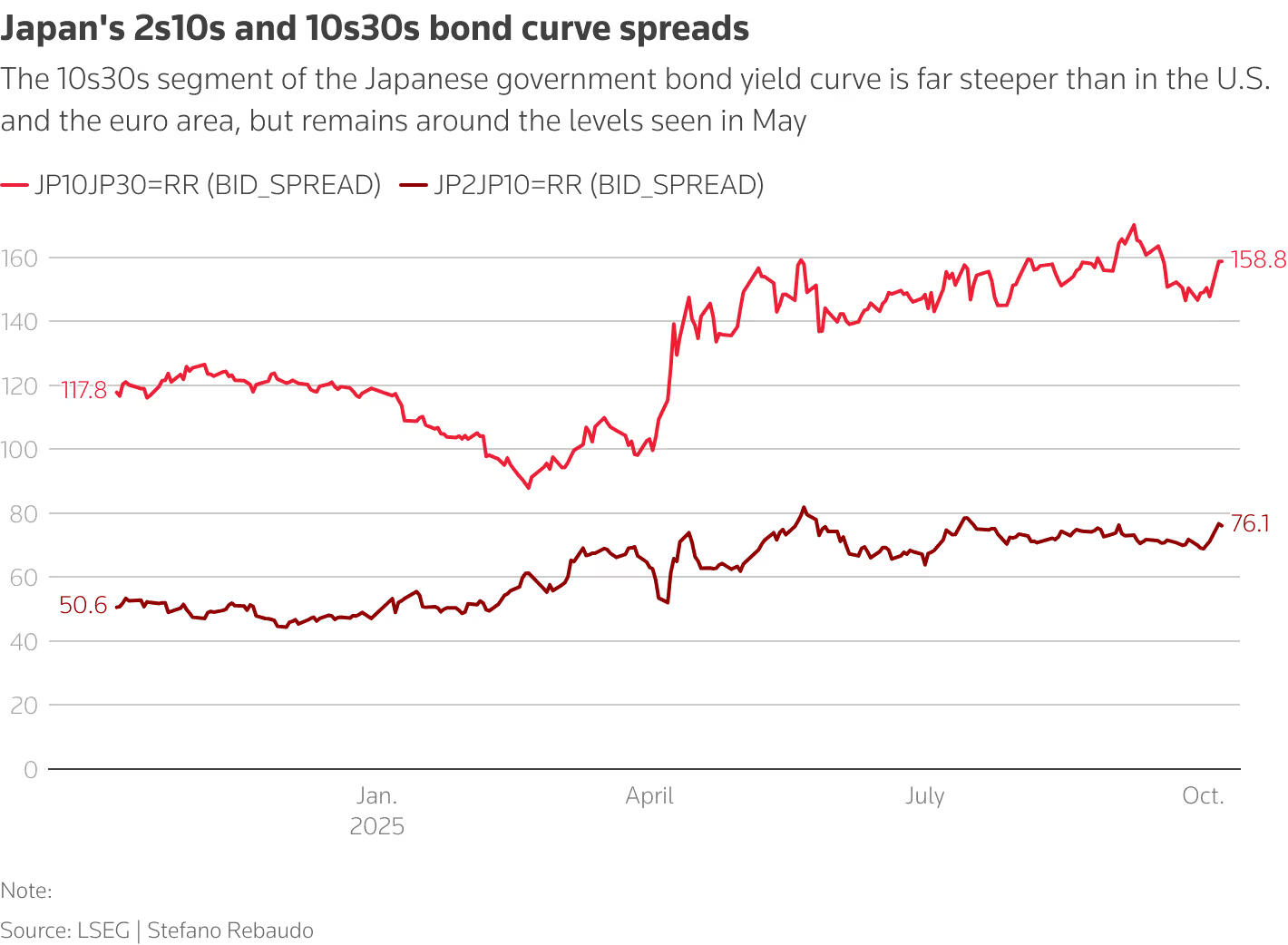

Japan's yield curve steepens more significantly

Even with U.S. government debt reaching around 120% of GDP or Japan's at 230%, investors remain interested in ultra-long bonds.

Japan's 10/30 year spread is around 160 basis points, while Germany's and the United States' are 55 and 57 basis points, respectively.

“The steepening of JGB yields is largely due to the introduction of a new solvency system for the country’s life insurers, which no longer need to hold as many long-term bonds,” said Konstantin of Pinhao.

(Figure: Trends in the yield spread between Japanese government bonds on February 10 and October 30)

The steepening of Japan's yield curve is more driven by structural changes in domestic asset allocation and the normalization of central bank policies, which will have a complex impact on the yen. However, in the initial stage, the market may pay more attention to the narrowing of its global interest rate gap rather than the increase in its absolute level.

The steepening trend in the bond yield curve primarily impacts the foreign exchange market through interest rate differentials and capital flows. If the current situation persists, it is expected to provide modest support for the US dollar and pressure the euro and yen, though the extent of the impact will vary across countries.

At 14:43 Beijing time, the US dollar was trading at 153.10/11 against the Japanese yen.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.