Gold price reaches 4200, new high trend deduction, grasp the details to seize the opportunity

2025-10-16 17:13:14

The economic risks triggered by the US government shutdown, escalating trade frictions, and geopolitical tensions, along with the release of the US Beige Book, continue to drive demand for the safe-haven precious metal. Furthermore, expectations of a dovish Federal Reserve policy have further reduced the downside potential for this interest-free asset. The following are recent events that are positive for gold.

US government shutdown exacerbates market uncertainty

The partial shutdown of the U.S. federal government continues to unfold, now entering its third week with no clear resolution. On Wednesday, a Republican-sponsored temporary government funding bill failed to reach the required votes in the Senate for its ninth vote, further exacerbating market concerns about policy uncertainty.

Investors are concerned that a prolonged US government shutdown will directly suppress economic momentum. A US Treasury official stated that the shutdown could cost the US economy $15 billion in lost output per week, revising Treasury Secretary Scott Bessant's previous statement and further strengthening the market's pricing of downside risks to the economy.

Trade developments

On October 10, the Ministry of Transport issued an announcement. In response to the USTR's countermeasures to impose additional port service fees on Chinese companies and Chinese-built ships, its charging standards are basically consistent with the US policy. The mutual port fees levied by China and the United States will take effect from October 14, 2025.

On the 15th, Foreign Ministry Spokesperson Lin Jian held a regular press conference. A Kyodo News reporter asked, "US President Trump has reportedly accused China of deliberately halting imports of US soybeans and stated that he would halt imports of edible oil from China in retaliation." What is China's comment?

Lin Jian said that China's position on handling Sino-US economic and trade issues is consistent and clear. There are no winners in trade wars and tariff wars, and it is not in the interests of any party. The two sides should negotiate to resolve relevant issues on the basis of equality, respect and mutual benefit.

The Fed has good reasons to cut interest rates

The Beige Book on economic conditions released by the Federal Reserve early this morning showed that U.S. economic activity has remained basically flat since September and employment has remained stable overall. However, the number of companies reporting layoffs has increased recently, which has exacerbated market concerns about a weakening labor market.

As a result, traders continue to price in two more rate cuts from the Federal Reserve this year. This expectation has directly pushed the US dollar to a one-week low and provided logical support for further short-term gold price increases. Market focus is now shifting to speeches by key members of the Federal Open Market Committee (FOMC), which could further reinforce the case for rate cuts and, in turn, impact spot gold prices.

Meanwhile, Federal Reserve Chairman Jerome Powell sent a clear dovish signal on Tuesday, stating that the U.S. labor market remained in a sluggish state of "low hiring and low firing" in September. This statement directly confirms market expectations that the Fed is likely to cut interest rates by 25 basis points at each of its October and December meetings.

Intensified geopolitical disturbances

Trump revealed that he is considering providing Ukraine with Tomahawk cruise missiles with longer range, further exacerbating geopolitical tensions.

The Gaza peace talks also failed to resolve the demands of various forces. The United States announced the end of the "Gaza War", but the vague agreement may not be able to support peace between Palestine and Israel.

Trend deduction after breaking through $4,200: How will the price of gold develop in the future?

One of the important long-term logics supporting this round of gold predictions is the market's expectation that central banks of various countries will continue to purchase gold. However, from the recent fluctuations in gold, it can be seen that short-term new event stimuli may be the more core driving force behind the recent rapid rise in gold prices.

Currently, new clues such as intelligence, geopolitics, and tariff issues that may prompt the Federal Reserve to cut interest rates, as well as the linkage between spot gold and other precious metals and gold stocks that reflect market risk preferences are more significantly affecting the development of gold prices.

As mentioned in previous articles, the rise of spot gold here is in an accelerating stage and is easily affected by the risk appetite of Asian stock markets, and follows the decline when stocks fall sharply.

Based on the above logic, we found several key points in observing gold, namely, judging market sentiment through the rise of related varieties and the rise rate of gold itself, while paying close attention to whether there is any new stimulus news.

The stimulating news has been listed in the previous paragraphs, but market sentiment may be developing in the opposite direction. For example, when spot gold rose to 0.8% to hit a record high during the Asia-Europe session, spot silver was in the red, and LME copper was also in the green. At the same time, the prices of related precious metals in A-shares did not show any significant performance. Shandong Gold even closed down 4%, which was a rare phenomenon before.

Investors are hesitant to continue betting on a short-term rise in gold, or perhaps they are betting that there will be no new news or clues in the future. Combined with the slowdown in the downward trend of 10-year US Treasury yields, perhaps gold prices have already reflected most of the positive factors, and there may be a risk of a correction.

However, combined with the long-term upward logic discussed earlier, and the fact that recent positive news for gold has room to continue to ferment, even if gold falls, it may still receive relatively good support.

Technical Analysis:

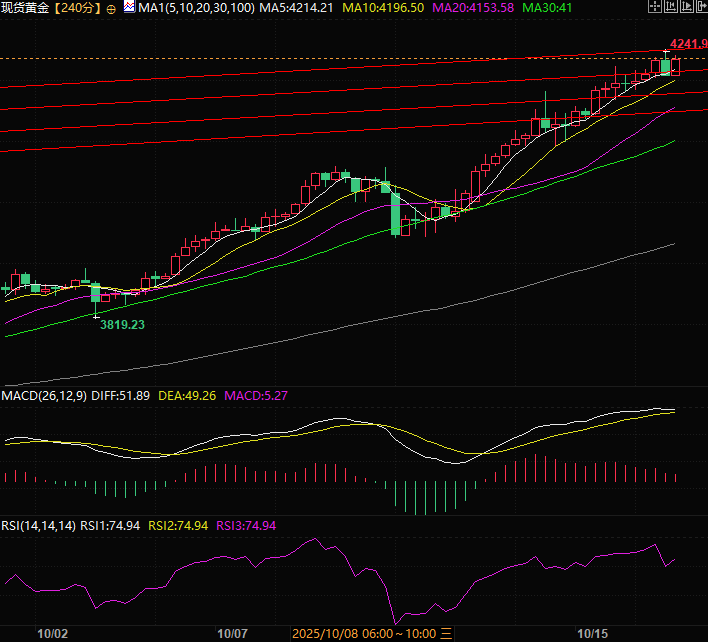

The 4-hour chart of spot gold has been in a rhythm of consolidation, breakthrough and then consolidation. This morning, there was a point that disrupted the rhythm. A rare combination of two positives and one negative appeared. This multi-party cannon combination at a high level indicates that the bullish sentiment is high, that is, the bottom-fishing funds can make profits quickly, which is another evidence of the high sentiment. In other words, if the bottom-fishing funds can always make profits, then the bottom will be further raised. Therefore, as long as the spot gold price falls below the 5-day line or the low of 4200, it means that this pattern is invalid and a reversal is about to be initiated.

(Spot gold 4-hour chart)

Spot gold time-sharing chart, 4217 is repeatedly confirmed by funds and is an important turning point in the short term. If the gold price runs to this point, we need to be vigilant. The rising trend line serves as an auxiliary, and we should focus on the support of 4217.

(Spot gold time-sharing chart)

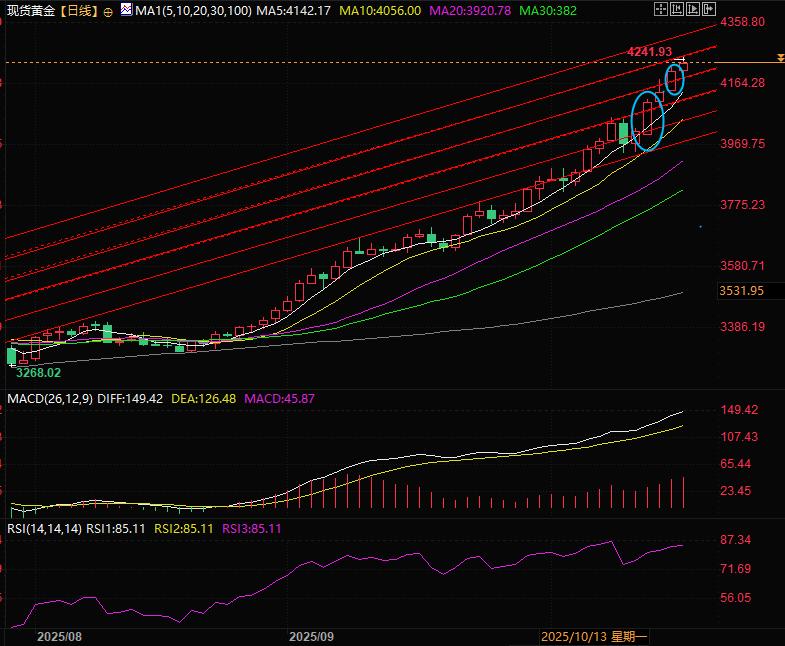

The daily chart of spot gold shows that the growth rate of gold prices has slowed down (the circled part is the growth rate of three days and three intervals compared with the growth rate of three days and two intervals, and the growth rate has slowed down), which means that the upward momentum has weakened. It is currently suppressed by the rising channel and is far away from the 5-day line. There is a possibility that the growth rate will further decline, and the gold price will start to adjust and wait for the 5-day line.

(Spot gold daily chart, source: Yihuitong)

At 16:54 Beijing time, spot gold was trading at 4231.66.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.