Gold prices weakened after a record rally but remained on track for a ninth straight weekly gain

2025-10-18 02:08:45

Concerns about a prolonged trade standoff remain a key driver of gold's recent gains, as trade tensions continue to cloud the outlook for global growth. Gold's rally gained momentum after headlines of stress at regional U.S. banks captured investor attention and sparked risk aversion, while the ongoing U.S. government shutdown further dampened market sentiment.

Furthermore, traders now fully expect the Federal Reserve to cut interest rates by 25 basis points twice in a row at its monetary policy meetings in October and December, adding another layer of support to gold's record rally as lower interest rates enhance the metal's appeal as a non-interest-earning asset.

Gold's market capitalization hits $30 trillion as Fed rate cuts and trade frictions drive inflows

Gold's total market capitalization climbed above $30 trillion for the first time, reflecting a record rally and continued safe-haven demand. The surge in value highlights the scale of global inflows into gold, which now far exceeds major assets such as Bitcoin and major U.S. tech giants.

Fresh turmoil at regional U.S. banks added to market anxiety late Thursday. Zions Bancorp reported about $50 million in loan losses tied to two borrowers accused of providing false information, while Western Union Bank filed a fraud lawsuit against one of its customers over a collateral dispute.

White House senior adviser Kevin Hassett told Fox Business Network that U.S. banks hold ample reserves and the administration remains optimistic about credit conditions. He added that President Trump could escalate actions if the shutdown continues beyond the weekend, while calling the Federal Reserve's projected three rate cuts "a good start."

According to the CME's FedWatch tool, traders see a 96.8% chance of a 25 basis point rate cut at the Oct. 29-30 Federal Open Market Committee meeting, while the Dec. 10-12 meeting shows an 81.3% probability of another 25 basis point cut and an 18.1% probability of a 50 basis point cut.

U.S. President Donald Trump said on Friday his planned 100% tariffs on Chinese imports were "unsustainable," while reiterating that the measures were in response to tightening rare earth export controls.

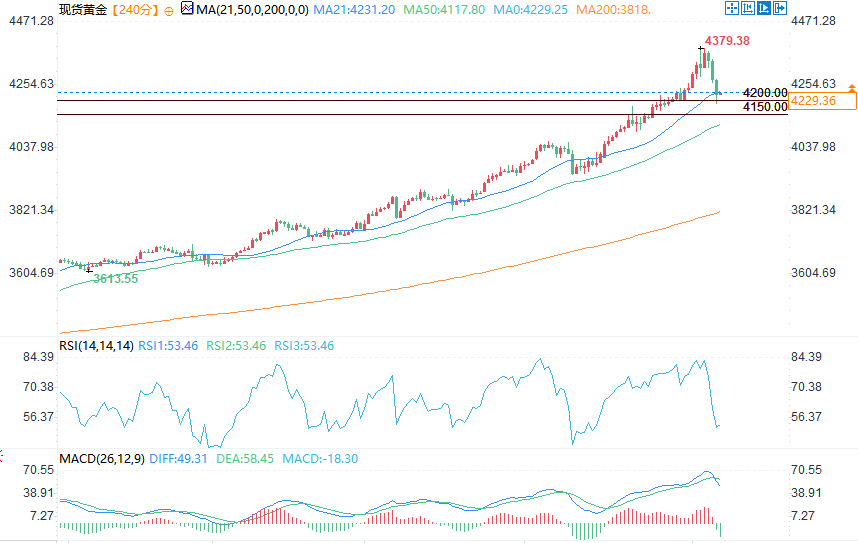

Technical analysis: Gold retreats from record high as traders lock in profits

(Source of spot gold 4-hour chart: Yihuitong)

Gold is retreating from a new record high reached early Friday as traders locked in profits after an overextended rally. Despite the intraday pullback, the broader bullish structure remains intact, suggesting that any dips are likely to attract fresh buying interest.

On the 4-hour chart, immediate support is at $4,230 near the 21-period simple moving average, followed by $4,115 near the 50-period simple moving average. The relative strength index (RSI) has retreated to around 53, retreating from overbought territory, which may cause the price to consolidate before the next upward move.

At 02:05 Beijing time, spot gold was quoted at $4,224.14 per ounce, down 2.26%.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.