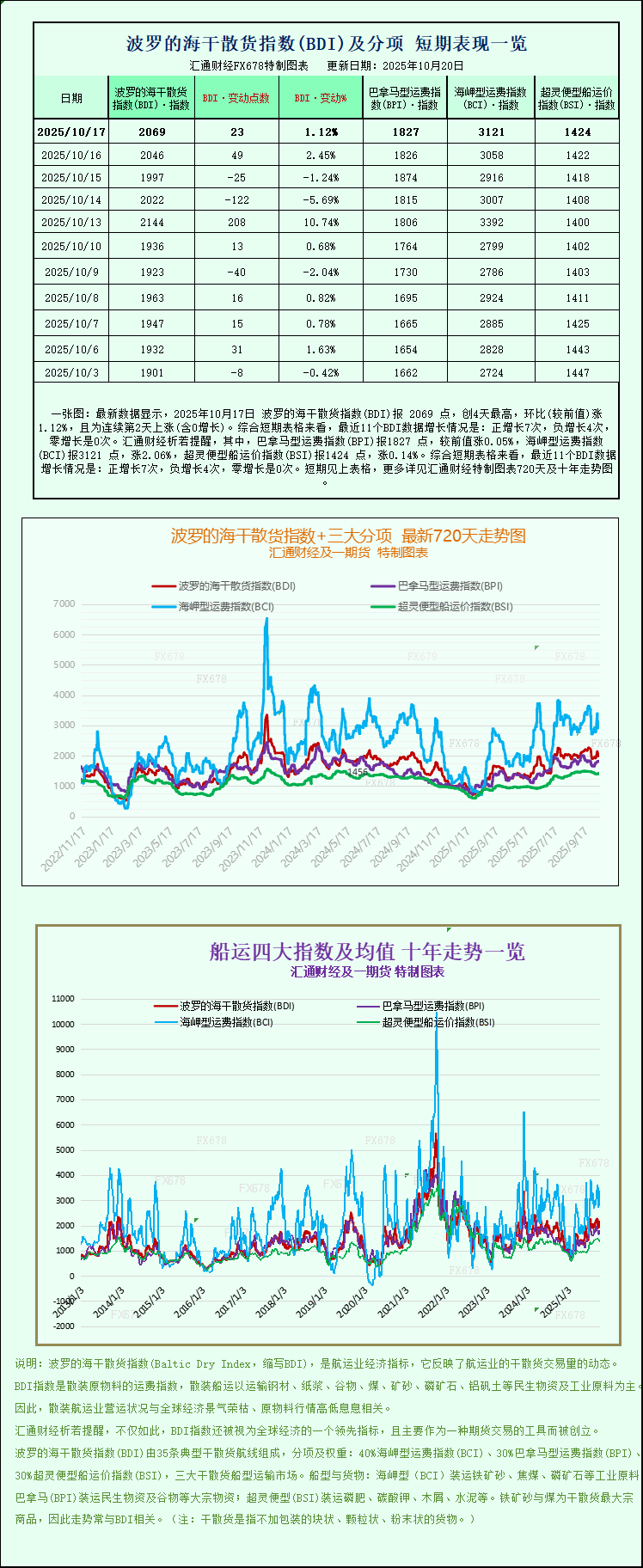

A chart: The Baltic Sea Index rose on a weekly basis, with all shipping sectors rising simultaneously

2025-10-18 01:36:22

The Baltic Exchange's dry bulk shipping index, which monitors rates for ships transporting dry bulk commodities, rose on Friday and was headed for a weekly gain, boosted by broad-based strength across all vessel categories.

The main index measuring rates for Capesize, Panamax and Supramax vessels rose 23 points, or 1.2%, to 2,069. The index gained 6.9% for the week.

The United States and China are imposing new port fees on each other's ships, disrupting trade routes, increasing freight costs and making the high seas a major front in the trade war between the world's two largest economies.

China has “taken new steps that mirror similar actions by the United States and will gradually increase over the coming years, exacerbating uncertainty in global shipping markets,” Intermodal senior analyst Nikos Tagoulis said in a report earlier this week.

The Capesize index rose 63 points, or 2.1%, to 3,121, bringing its weekly gain to 11.5%.

Average daily earnings for capesize vessels, which typically carry 150,000-tonne cargoes such as iron ore and coal, rose $524 to $25,882.

However, iron ore futures are set to fall this week as Sino-U.S. trade tensions stoke concerns about the demand outlook, while markets anticipate higher supplies for the rest of the year.

The Panamax index rose 1 point to 1,827, for a weekly gain of 3.6%, reaching its highest level since September 26.

Average daily earnings for Panamax vessels, which typically carry 60,000-70,000 tonnes of coal or grain, rose $13 to $16,446.

Among smaller vessels, the supramax index rose 2 points to 1,424, its highest level since Oct. 7 and a weekly gain of 1.6%.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.