Gold Trading Alert: Gold Prices Plunge Nearly $50 as Trade Outlook Improves! Safe-haven Halo Fades, Is This a Pullback or a New Beginning?

2025-10-27 07:25:14

The easing of Sino-US trade tensions: safe-haven demand plummeted, with gold prices bearing the brunt

Last weekend, China and the United States reached preliminary consensus on several key trade issues during trade consultations in Kuala Lumpur, Malaysia, igniting market optimism. Li Chenggang, China's International Trade Representative and Vice Minister of Commerce, stated after the consultations that both sides will fulfill their respective domestic approval procedures and further strengthen communication to safeguard the hard-earned Sino-US economic and trade cooperation. This progress signals a temporary end to the volatility and turbulence in Sino-US trade relations over the past month. The battle between the US's tough stance and China's resolute efforts to safeguard its interests has yielded initial results based on mutual respect and equal dialogue. Meanwhile, senior US officials revealed that President Trump hopes to focus on trade relations during his meeting with the Chinese President this week, with the possibility of other topics being discussed. This series of positive signals quickly weakened gold's safe-haven appeal, causing prices to plummet at the opening of trading on Monday.

Looking back at the year-to-date, gold prices have risen 55%, largely due to the stimulus of trade tensions. Now that the situation has turned optimistic, investors' impulse to take profits has further increased. Gold prices have fallen by more than 6% from last Monday's record high of $4,381.21, demonstrating the market's sensitivity to trade settlements. However, this easing has not been smooth sailing. The November 1st deadline for the US to impose additional tariffs on Chinese imports is approaching, which may still bring uncertainty. If there are setbacks in the negotiations, gold's safe-haven luster may re-emerge.

Expectations of a Fed rate cut are rising: opportunity costs are lower, providing a buffer for gold prices

While trade optimism has weighed on gold prices, the near-certainty of a Federal Reserve rate cut this week has provided significant support for gold prices. The US Consumer Price Index (CPI) for September showed a year-on-year increase of 3.0%, slightly below economists' expectations of 3.1%. The core CPI rose 0.2% month-on-month, primarily due to slowing rental inflation. This weaker-than-expected inflation reading reinforced market bets on an easing policy by the Federal Reserve. Traders are pricing in a near-100% probability of a policy rate cut to 3.75%-4.00% at this week's meeting, a 95% chance of a further rate cut in December, and even a 55% chance of another rate cut in January.

Interest rate cuts directly reduce the opportunity cost of holding non-interest-bearing assets like gold, narrowing gold's losses to just 0.2% at $4,112.82 in late trading last Friday. Despite a cumulative drop of over 3% last week, ending a nine-week winning streak, independent metals trader Tai Wong noted that gold may have further to fall before consolidating, but emphasized that lower-than-expected inflation is not enough to completely curb the decline.

It is worth noting that the US government shutdown has lasted for 24 days, and the White House has warned that this may result in a permanent blank in October's CPI data, further amplifying economic uncertainty and potentially providing bargain-hunting support for gold. Against this backdrop, the Federal Reserve's precautionary interest rate cuts may help gold prices stabilize after a short-term correction, and may even pave the way for further easing policies next year.

Mild U.S. inflation data solidifies easing expectations, with subtle changes in the yield curve

Mild inflation data in the US not only bolstered expectations of a rate cut but also influenced bond market trends. The September CPI, released last Friday, rose 0.3% month-over-month and 3.0% year-over-year. Surging gasoline prices were partially offset by falling rents, further solidifying market confidence in the Fed's actions. US Treasury yields were largely flat to slightly higher, with the 10-year yield ultimately rising 1.2 basis points to 4%, but overall fell about 1 basis point last week, marking the fourth consecutive week of decline. The two-year Treasury yield rose slightly to 3.484%, while the 30-year rose to 4.587%. The yield curve steepened, with the gap between the two-year and 10-year bonds widening to 52.2 basis points. This reflects stronger investor expectations for lower short-term interest rates, while signs of long-term inflationary pressures persist but do not undermine the accommodative tone.

The University of Michigan's consumer confidence index declined in October, but one-year inflation expectations remained stable, further confirming the mild inflation environment.

Jeremy Schwartz, an economist at Nomura Securities, believes the report encourages the Federal Reserve to continue its precautionary path of rate cuts, despite potential pressure. The ongoing US government shutdown could amplify the risk of missing economic data and confine bond market fluctuations to a narrow range, but overall, these factors provide a buffer for gold, preventing a more drastic decline.

Geopolitical risks ease: The situation in Russia and Ukraine turns optimistic, and gold's safe-haven halo dims

In addition to trade factors, improved geopolitical dynamics have also weakened gold's appeal.

Russian President Vladimir Putin's special envoy, Dmitriev, stated that the United States, Ukraine, and Russia are close to reaching a diplomatic solution. Ukrainian President Volodymyr Zelensky acknowledged that the key issue lies in the battle lines, a significant shift from his previous demand for a complete Russian withdrawal. He also mentioned that a meeting between Trump and Putin might take place at a later date. These signals suggest that the Russia-Ukraine conflict, which has lasted for more than three years, may be resolved through diplomatic means.

Meanwhile, Moody's downgraded France's credit outlook from stable to negative, citing the increased risk of political instability, which could undermine the government's ability to address fiscal deficits and debt, although it affirmed its Aa3 credit rating. While this European political uncertainty persists, the overall easing of geopolitical risks has boosted investor risk appetite and further weakened gold's safe-haven demand. However, if a diplomatic solution fails or political divisions in France deepen, these potential risks could still provide short-term support for gold prices, preventing an excessive correction.

European and American stock markets hit record highs: risk assets strengthened, gold faced correction pressure

Last Friday, all three major U.S. stock indices hit record highs. The Dow Jones Industrial Average rose 1.01% to 47,207.12, the S&P 500 rose 0.79% to 6,791.69, and the Nasdaq Composite rose 1.15% to 23,204.87. Each index saw its biggest weekly gains in months. This was driven by lower-than-expected inflation data, upbeat corporate earnings reports, and the Federal Reserve paving the way for interest rate cuts.

European stock markets also performed strongly. Last Friday, the Stoxx 600 rose 0.2%, the FTSE 100 climbed 0.7%, reaching a new closing high, and Germany's DAX edged up 0.13%. This strong performance reflects investors' shift toward optimism about the economic outlook, increasing the appeal of risky assets and further squeezing gold's market share. The combination of positive factors, from the easing of Sino-US trade tensions to diplomatic progress between Russia and Ukraine, poses a risk of a further correction in gold prices in the short term. However, robust central bank buying and a 55% year-to-date gain suggest that gold's structural support remains intact. If the stock market boom encounters headwinds, funds may flow back into safe-haven assets.

Analyst and investor sentiment survey: Bullish enthusiasm cools, gold prices fluctuate in the short term

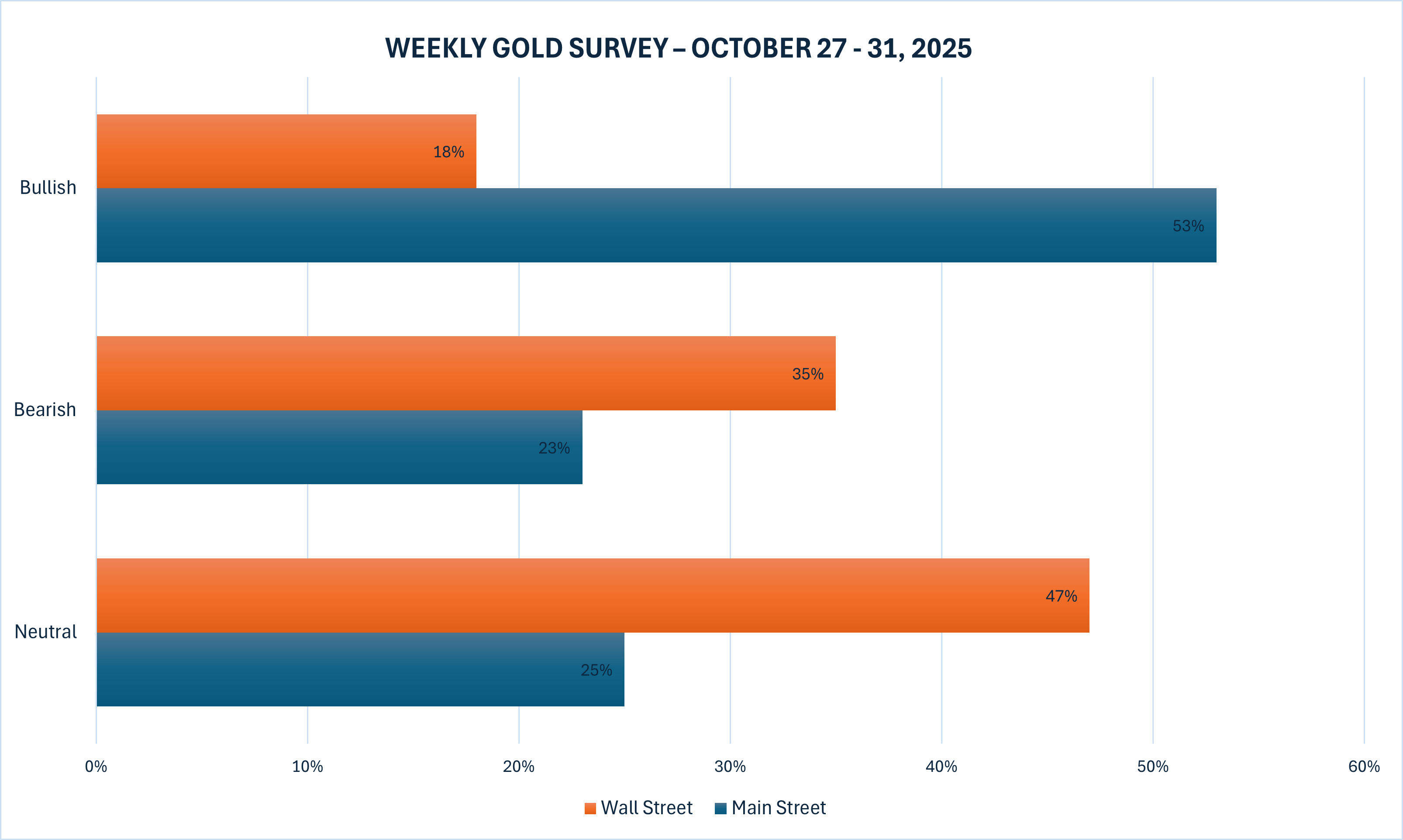

The shift in market sentiment is evident in surveys. Kitco News' gold survey shows that only 18% of Wall Street analysts expect gold prices to rise in the coming week, while 35% predict a decline and 47% believe they will move sideways. Retail investor sentiment has also cooled, with 53% bullish, 23% bearish, and 25% anticipating consolidation. This cooling sentiment stems from last week's selling pressure, but also suggests bargain-hunting buying. Overall, gold prices are likely to fluctuate and adjust in the short term, but in the long term, the lingering Federal Reserve easing cycle and potential risks may support a rebound.

In summary, the recent decline in gold prices from historical highs is primarily due to the dual pressures of the Sino-US trade settlement and the easing of geopolitical risks, which has exacerbated the correction due to a sharp drop in safe-haven demand. However, expectations of a Federal Reserve rate cut, tame inflation, and uncertainty surrounding the government shutdown have provided some cushion, preventing a collapse in gold prices. Looking ahead, with the approaching meeting between Trump and the Chinese President and the Federal Reserve meeting, gold prices may continue to face downside risks in the short term. However, if new uncertainties emerge in the global economy, gold's safe-haven properties will re-emerge. Investors should closely monitor these key events and rationally seize opportunities to buy on dips, seeking the long-term value of gold amidst uncertainty.

(Spot gold daily chart, source: Yihuitong)

At 07:22 Beijing time, spot gold was trading at $4082.68 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.