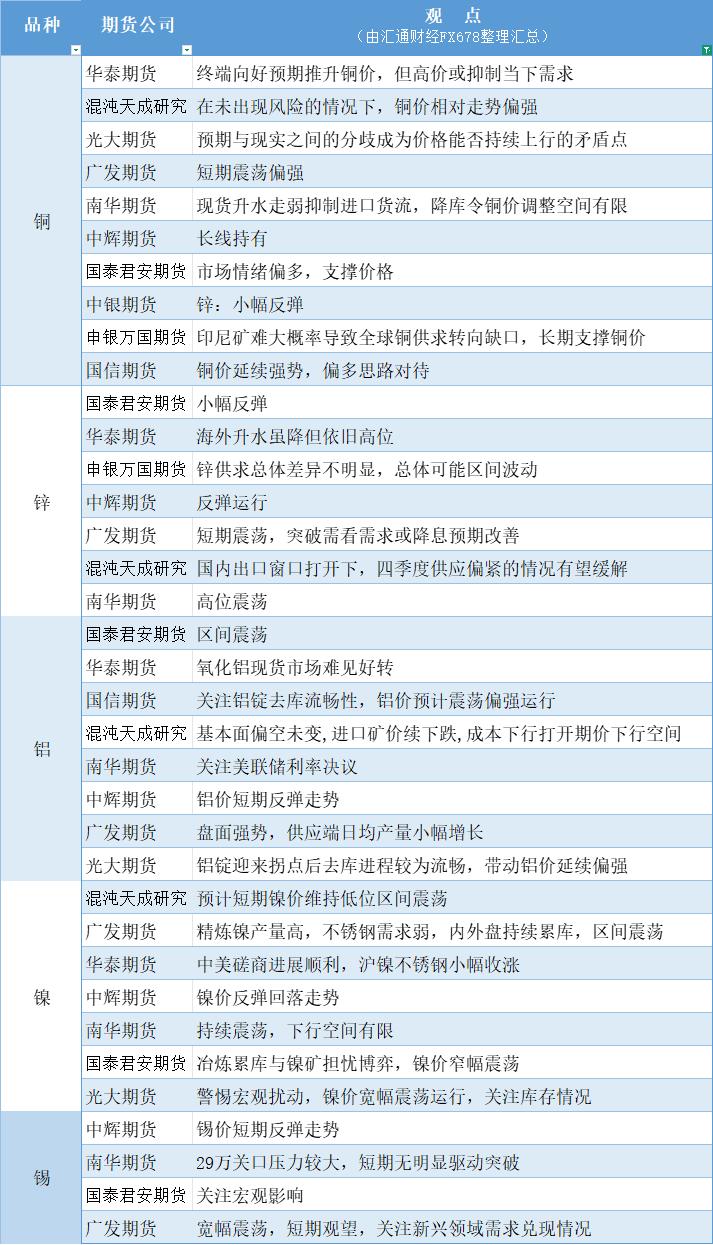

A chart summarizing the views of futures companies: Nonferrous metals (copper, zinc, aluminum, nickel, tin, etc.) on October 28

2025-10-28 13:31:59

Copper: The weakening spot premium suppresses the flow of imports, and the reduction in inventory limits the adjustment space for copper prices, resulting in strong short-term fluctuations; Zinc: With the opening of the domestic export window, the tight supply situation in the fourth quarter is expected to ease, and the overall difference in zinc supply and demand is not obvious, and the overall fluctuation may be within a range; Aluminum: The fundamentals are bearish and unchanged, the price of imported ore continues to fall, and the downward trend in costs opens up room for futures prices to fall, and aluminum prices rebound in the short term; Nickel: Refined nickel output is high, stainless steel demand is weak, and domestic and foreign markets continue to accumulate inventory, with range fluctuations; Tin: Wide range fluctuations, wait and see in the short term, and pay attention to the demand realization in emerging fields.

This chart is specially created and compiled by Huitong Finance, all rights reserved.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.