With the threat of increased production looming, the $60 mark for US crude oil is in jeopardy! The fate of oil prices rests on OPEC+.

2025-10-30 13:33:55

Currently, selling pressure has intensified significantly ahead of the OPEC+ meeting this weekend due to market concerns that the latter may announce a production increase, which could put further downward pressure on oil prices in the short term. As long as concerns about oversupply persist, bearish sentiment is expected to continue to dominate the market in the coming trading days.

Data released by the U.S. Energy Information Administration (EIA) on Wednesday showed that U.S. crude oil, gasoline, and distillate fuel inventories all fell more than expected last week. The data showed that crude oil inventories decreased by nearly 7 million barrels, far exceeding the predicted drop of 211,000 barrels.

OPEC+ Meeting Preview: Production Choices Under the Shadow of Sanctions

This weekend, OPEC+, the world's major oil-producing nations and its allies, will meet. This meeting comes just days after the US imposed sanctions on two major Russian oil companies (key OPEC+ allies). These sanctions initially triggered short-term expectations of supply reductions, contributing to a significant rebound in oil prices in recent weeks.

However, with the next round of meetings approaching, the market expects OPEC+ to take into account the disruption to Russian production, and the final announced production increase may exceed expectations.

OPEC+ has maintained a gradual production increase strategy throughout 2025. To date, the alliance has increased production by approximately 2.7 million barrels per day, gradually recovering the voluntary production cuts of previous years and steadily releasing more supply into the market.

The market expects at least a production increase of 137,000 barrels per day for this week's meeting. If the organization decides to offset the supply gap from Russia caused by US sanctions, the final figure may be revised upwards further.

This move has already raised concerns in the crude oil market, and a more aggressive increase in production starting in December could significantly exacerbate downward pressure on oil prices.

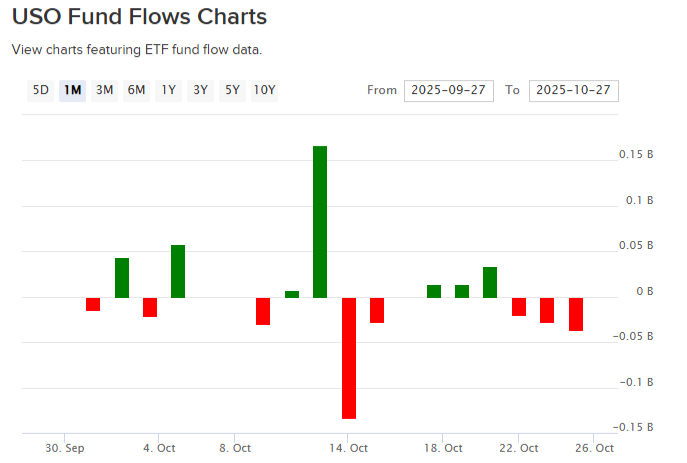

This expectation is already reflected in the weak performance of the USO oil ETF: as of October 24, the fund had experienced net outflows for three consecutive trading days, totaling $36 million, indicating that institutional interest in the crude oil market is waning.

Therefore, this OPEC+ meeting could be a key catalyst for oil price movements. If the final announced production increase exceeds expectations, the current weakness in oil prices may continue, reinforcing the short-term bearish outlook—especially if the new production target for December is confirmed.

The United States approves licenses for Rosneft's German assets as it expands its sanctions network.

The United States has issued a general license allowing Rosneft's German subsidiary to conduct limited business operations. This information was disclosed and confirmed by an announcement on the company's official website.

The authorization applies to Rosneft Deutschland and RN Refining & Marketing, both of which have been under German federal trusteeship since 2022—when Berlin authorities took control to ensure the continuity of refining operations and prevent fuel shortages.

This authorization does not lift sanctions against Rosneft, but it allows necessary maintenance, payment, and service activities to ensure the continued operation of these assets under non-Russian management.

The Schweitt refinery, which supplies approximately 90% of the fuel to the Berlin and Brandenburg regions, is central to this legal arrangement. After the EU embargo on Russian oil took effect, Germany, through the Federal Network Agency, brought Rosneft's 54% stake under state control. Since then, the refinery has maintained operations via the Rostock pipeline and the Gdansk terminal in Poland, supplying non-Russian feedstock.

The newly issued U.S. license ensures that transactions supporting the continued operation of the Schwet refinery, including service contracts, insurance, and financial settlements, remain compliant within the framework of U.S. sanctions laws. This move essentially demonstrates that despite Washington's tightening restrictions on Russian oil and gas revenues, it is fully committed to maintaining energy stability in Central Europe.

This authorization comes against the backdrop of escalating US sanctions: Rosneft and Lukoil have been added to the sanctions list, marking one of the most extensive enforcement actions since the 2022 sanctions on Russian energy.

The latest plan expands its scope to include traders, insurance companies, and tanker operators involved in Russian oil transportation, effectively tightening compliance boundaries in the global supply chain. US officials stated that this move aims to close loopholes in the "shadow fleet" system and curb revenue Moscow obtains through offshore intermediaries.

The sanctions have triggered changes in trade flows: India’s Reliance Industries has stopped importing Russian oil, and a Russian oil tanker has been forced to return to port under the threat of secondary sanctions.

The license has an expiration date and is currently valid until April 29, 2026.

Russian oil tanker forced to return to port due to US sanctions threat

According to Kepler, an Aframax tanker carrying Russian crude oil abruptly changed course shortly after leaving the Russian coast and then stalled in the Baltic Sea. The crude oil on board originated from a Russian oil company that was sanctioned by the United States a week earlier.

According to data from Kepler and Wotech, the oil tanker "Furya" loaded approximately 730,000 barrels of Urals crude oil in Primorsk on October 20 and set sail for Westkar, India – a key hub for Reliance Industries and Bharat Oil to receive foreign crude oil.

An anonymous Indian energy executive said the arrival time is expected to be mid-November, and revealed that Indian buyers may gradually reduce new orders for Russian crude oil.

Russia's two largest oil exporters together account for about half of Russia's total oil exports, averaging about 2 million barrels per day. US sanctions require companies doing business with these two companies to terminate their cooperation by November 21. Lukoil announced this week that it will sell its overseas operations due to the sanctions.

Industry observers are generally skeptical about the effectiveness of the sanctions. Kepler's analysis suggests that while sanctions against Rosneft and Lukoil may disrupt crude oil flows in the short term, they will not trigger structural changes in the oil market.

Kepler pointed out: "The likelihood of a major disruption to Russian crude oil exports is low because the current measures are not secondary sanctions. It remains legal for non-US entities such as India, Turkey, or China to directly purchase crude oil from Rosneft."

Other experts have pointed out that if the sanctions actually take effect, it could lead to a sharp rise in oil prices, which would be bad news for major Western oil-importing countries.

Richard Neff, a former senior State Department official, told The Wall Street Journal this week: "They are walking a tightrope, and they have clearly been instructed not to destroy the global economy, which means the sanctions will only target third- or fourth-tier targets. As things stand, this is essentially a signaling operation intended to cause limited damage."

Technical Analysis

Continued Downward Trend: Oil prices have been steadily declining along the intact downtrend line on the chart recently. From a broader perspective, the bearish bias remains dominant, and as long as prices remain below the 50-day moving average (62.03), the downward trend is expected to continue in the coming weeks.

RSI (Relative Strength Index): If the RSI remains below the 50 neutral line, it suggests that a bearish bias may dominate in the short term.

MACD: This indicator is still running below the zero line, reflecting a short-term bearish trend in oil prices.

Key price points:

$62 – Strong resistance level: This level coincides with the 50-day moving average (62.03). A successful breakout could reverse the current downtrend and trigger a short-term technical rebound.

$60 – Key Level in the Near Term: This is an important psychological level in the short term. As long as the price fluctuates around this level, the market may maintain a sideways consolidation trend.

$57 – Key Support Level: This level marks the yearly low. A move near or below this level could reignite selling pressure and reinforce the short-term bearish trend.

(US crude oil daily chart, source: FX678)

At 13:33 Beijing time, US crude oil futures were trading at $60.18 per barrel.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.