The Reserve Bank of Australia kept interest rates unchanged, a more hawkish stance than expected. When will the Australian dollar's decline end?

2025-11-04 15:39:13

The market has lowered its expectations for further easing, and the Australian dollar traded lower against the US dollar on Tuesday (November 4), falling by about 0.31%. This marks the fifth consecutive trading day of decline for the Australian dollar against the US dollar. With momentum signals neutral, price action will determine the next move.

Reserve Bank of Australia Governor Bullock expressed caution at the press conference following the policy meeting, emphasizing that there was no need to consider policy easing at this meeting.

Block noted that policymakers were not considering interest rate cuts, and that a sustained annual core inflation rate above 3% was not ideal. She added that the meeting focused on the policy outlook for maintaining current interest rates and emphasized the need for caution.

Data released by the Melbourne Institute on Monday showed that the TD-MI inflation gauge rose 0.3% month-on-month in October, a slight slowdown from the 0.4% increase in September, but marking the second consecutive month of increase. The annual inflation gauge rose slightly to 3.1% over the same period.

Building permits data released by the Australian Bureau of Statistics showed a significant month-on-month increase of 12.0%, far exceeding market expectations of 5.5% and reversing the 3.6% decline in August. However, ANZ Bank's job advertisements fell 2.2% month-on-month in October, marking the fourth consecutive month of decline, with the previous figure revised to a 3.5% decrease.

Interest rates may have bottomed out; the Reserve Bank of Australia's outlook is reshaping market pricing.

As widely expected, the Reserve Bank of Australia (RBA) kept the cash rate unchanged at 3.6% at its November policy meeting. However, this decision was far from dovish. While the bank believes that last week's surprisingly high third-quarter inflation data was partly due to temporary factors, its latest forecasts indicate that core inflation will not return to the midpoint of the 2-3% target range until the end of 2027. This suggests that the final rate cut in this rate hike cycle may have already been completed.

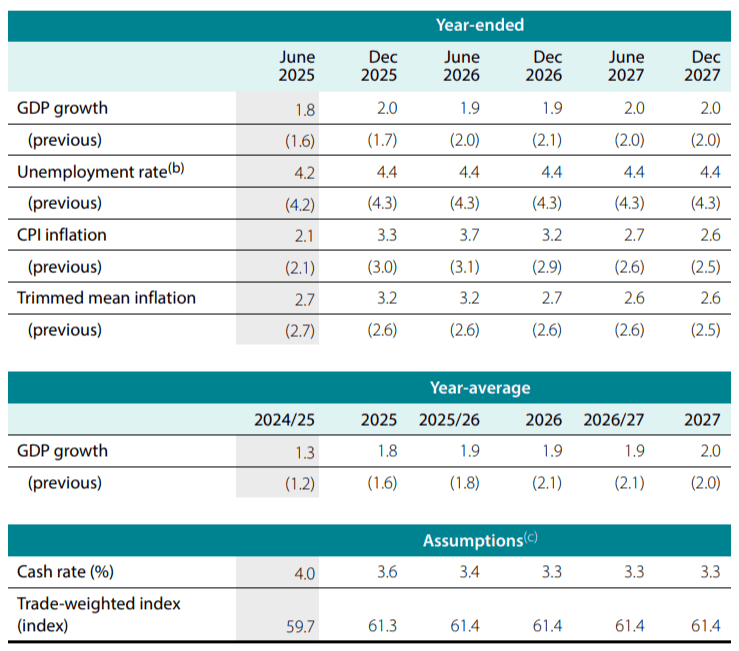

As this meeting coincided with the Reserve Bank of Australia's (RBA) update of its economic forecasts, its statement focused heavily on revisions to the outlook for GDP growth, unemployment, and inflation. The key updated forecasts are shown in the table below: Although fewer rate cuts are assumed compared to the previous outlook, the latest projections still indicate that inflation will remain above target for the next few years, unemployment will rise only slightly, and economic growth will remain robust.

Regarding the third-quarter inflation data released last week, the Reserve Bank of Australia (RBA) acknowledged that it was "significantly higher" than previously forecast, but emphasized that "part of the rise in core inflation... stemmed from temporary factors." The market initially interpreted this as a dovish signal; however, the RBA's dovish stance ended there.

While acknowledging temporary factors driving inflation, its updated core inflation forecast shows that it will not return to the 2.5% policy target until the end of 2027, a significant departure from its outlook three months ago. More importantly, this forecast is based on the premise of two fewer rate cuts than before—a substantial shift in hawkish stance that could have easily predicted inflation would return to the midpoint of the target or even lower.

Even with fewer rate cuts, the Reserve Bank of Australia (RBA) maintains that the unemployment rate will not worsen significantly, anchoring its long-term forecast at 4.4% (0.1 percentage point lower than the current 4.5%). Its growth forecasts also remain firm, with short-term expectations even revised upwards and only slightly adjusted at other times. While it could have warned that "a slightly restrictive policy environment could dampen growth," the RBA has chosen to avoid such statements—clearly contradicting its dovish stance.

Summary of RBA Interest Rate Decision

The Reserve Bank of Australia's latest forecasts indicate that core inflation will stubbornly remain above the target range until mid-2026 due to stronger-than-expected consumer demand and house price growth, which appears to limit the room for further interest rate cuts.

In its quarterly monetary policy statement, the Reserve Bank of Australia said that recent data (including strong economic growth, persistent inflation and a still tight labor market) suggest that there is more limited room for production capacity in the economy than previously expected.

The Reserve Bank of Australia stated, "These indicators reflect a mixed financial environment, consistent with the current policy rate being close to the neutral forecast level – in fact, the cash rate is currently below the core forecast range for the neutral rate in some models."

The Reserve Bank of Australia's (RBA) closely watched core inflation gauge, the cut-off mean inflation rate, is projected to accelerate from the current 3% to 3.2% by year-end. This forecast represents a significant upward revision from the previous expectation of "remaining at 2.6% for the next few years."

Core inflation is not expected to fall back to the Reserve Bank of Australia’s target range of 2%-3% until the second half of 2026, and will not drop to 2.6% until the end of 2027.

The Reserve Bank of Australia (RBA) assesses that the labor market has eased slightly, but believes that some degree of tension remains. The RBA expects the job market to not loosen significantly further, and that the unemployment rate, after surging to 4.5% in September, will remain stable at 4.4% over the next two years.

Job growth forecasts have been lowered to 1.1% annual growth by mid-next year, while household consumption is expected to grow at a slightly faster pace of 2.1%.

The annualized growth rate of residential construction has been significantly revised upward to 4.8% by the end of this year, following multiple interest rate cuts that pushed housing prices to record highs.

The Reserve Bank of Australia stated that, given the continued strength of the global economy, its economic growth forecast for next year and beyond remains largely unchanged, taking into account the combined effects of the aforementioned factors. The country's economy is expected to achieve a trend growth rate of approximately 2%.

The Australian dollar was affected by the recent strength of the US dollar.

The dollar index touched a near three-month high of 100.03 on Tuesday before coming under pressure from selling on rallies and fluctuating downwards. It is currently down about 0.09% and trading around 99.77, still at a relatively high level, after rising for four consecutive trading days.

According to the CME FedWatch tool, federal funds futures traders now expect a 65% probability of a rate cut in December, a significant drop from 94% a week ago.

The U.S. Institute for Supply Management manufacturing PMI fell to 48.7 in September from 49.1, below market expectations of 49.5.

Federal Reserve Chairman Jerome Powell said at a press conference following last week’s meeting that another rate cut in December was far from a certainty, and emphasized that policymakers may need to adopt a wait-and-see approach until official data resumes being released.

The Federal Reserve voted 10-2 last week to cut interest rates by 25 basis points, bringing the benchmark rate down to a range of 3.75%-4.0%. The decision was divided – Governor Stephen Milan supported a larger 50-basis-point cut, while Kansas City Fed President Jeffrey Schmid advocated keeping rates unchanged.

The ongoing government shutdown is keeping markets cautious and could exacerbate concerns about the U.S. economy. The shutdown, now in its 35th day, could become the longest in history due to a congressional deadlock over a Republican-backed appropriations bill, with no sign of a resolution in sight in the short term.

According to CBS News, US President Trump plans to block the export of Nvidia's most advanced semiconductor technology. This statement could reignite trade tensions—following signs of easing following the APEC summit in South Korea.

Australia's third-quarter trimmed average CPI rose 1.0% quarter-on-quarter and 3.0% year-on-year, exceeding market expectations of 0.8% and 2.7% respectively. The August monthly CPI jumped to 3.5% year-on-year, not only higher than the previous 3.0% but also exceeding the market expectation of 3.1%.

Australia's third-quarter inflation and August CPI data both exceeded expectations, reducing market expectations for a near-term interest rate cut by the Reserve Bank of Australia.

The Australian dollar is under pressure, and price momentum is showing signs of weakness.

Daily chart technical analysis shows that the Australian dollar is currently consolidating sideways within a rectangular pattern against the US dollar. The recent break below the 9-day exponential moving average (EMA, 0.6535) suggests weakening short-term price momentum.

On the downside, key support lies at the psychological level of 0.6500. A decisive break below this level could see the price test the lower boundary of the rectangular trading range around 0.6460, and then the five-month low of 0.6414.

On the upside, near-term resistance lies at the 9-day exponential moving average of 0.6535. A break above this resistance would strengthen short-term bullish momentum, pushing the AUD/USD pair to test the key level of 0.6600, followed by a move towards the upper boundary of the rectangular consolidation range around 0.6630. A decisive break above the rectangular consolidation pattern would release a bullish signal, laying the foundation for the pair to test the 13-month high of 0.6706 reached on September 17.

(AUD/USD daily chart, source: FX678)

At 15:38 Beijing time, the Australian dollar was trading at 0.6514/15 against the US dollar.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.