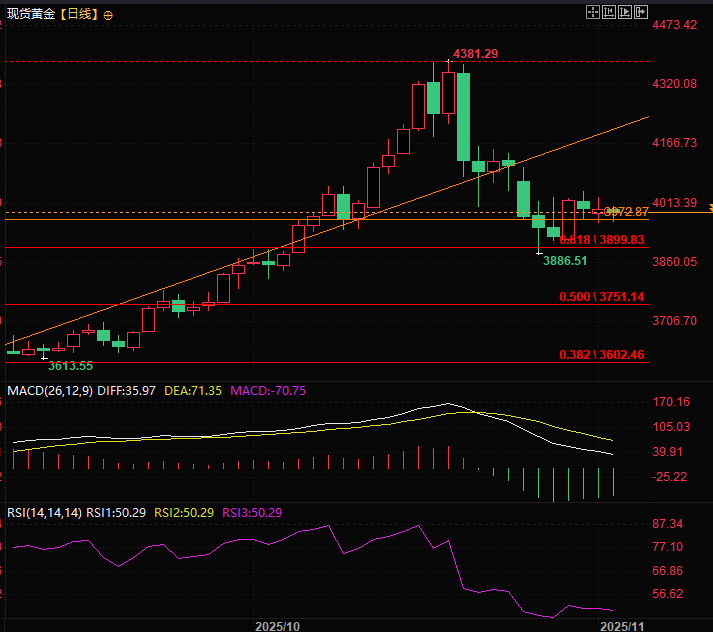

Key support has been tested; gold's rebound may conceal a hidden danger.

2025-11-04 18:55:22

Recent US military threats against Venezuela and Nigeria have boosted market risk appetite and increased demand for safe-haven assets, attracting some bargain hunters to gold. Meanwhile, the prolonged US government shutdown has further provided support for gold prices.

However, the Fed's hawkish stance is favorable to dollar bulls and may put significant downward pressure on gold, which has no yield-generating properties. Meanwhile, the dollar's slight pullback from its high since early August after breaking through 100 provides some support for gold.

However, it should be noted that the Fed's hawkish stance may limit a significant pullback in the dollar, putting downward pressure on gold, which has no yield-generating properties. In addition, gold has been trading in a range recently, choosing a direction, so any new information will have a direct impact on gold prices.

This article provides commentary and analysis on recent gold price movements based on available information.

The Fed's hawkish rate cuts have caused gold prices to bottom out twice.

Last week, Federal Reserve Chairman Jerome Powell's remarks weakened market expectations for another rate cut in December and pushed the dollar to its highest level since early August during Asian trading hours on Tuesday.

In fact, Powell made it clear that a further reduction in policy rates at the December meeting was not a given.

Traders reacted quickly, with the market currently pricing in a 65% probability of an interest rate cut at the Federal Open Market Committee (FOMC) policy meeting on December 9-10. This expectation continues to drive funds into the US dollar, while triggering a new round of selling pressure on gold, which has no yield.

This round of selling is shown in circle 1 on the chart. This drop did not create a new low and is seen as a second bottoming out of the market.

Meanwhile, after the meeting between the high-level leaders of China and the United States concluded, the negative factors for gold prices were fully priced in, and the price began to rebound rapidly, rising from the low point in circle 1 to near the high point in circle 2.

Escalating US-Venezuela conflict prompts gold to flee.

After rebounding to around circle 2, gold briefly recovered due to the escalating conflict between the US and Venezuela, but the recovery was small and slow. Combined with the fact that gold prices had already rebounded by 100 points, funds chose to flee.

This also shows that the bullish momentum in gold is relatively weak, and the market will capture any moment when it weakens technically.

Rate adjustments and market downturn response

The abrupt end of China's gold tax exemption policy last Saturday, which suddenly terminated the long-term tax exemption policy for some retailers, has directly dampened the buying frenzy in China, the world's largest gold consumer market, and may significantly weaken physical demand.

The market interpreted this as a short-term negative factor, leading to a sharp drop at the opening of Circle 3, which also served as a confirmation of the pullback to the key price level of 3963.

(Spot gold intraday chart)

The US shutdown continues, causing gold to trade within a range.

As of Tuesday evening, the US government shutdown, hampered by the congressional deadlock, was nearing the record for the longest shutdown in US history. The Senate planned its 14th vote on the House-passed appropriations bill later Tuesday, while Democrats explicitly rejected the Republican-proposed reopening plan.

Republican Senator John Kennedy stated that despite the president's call to remove the 60-vote threshold, lawmakers will not abolish the lengthy debate process to push for the government's reopening without Democratic support. Senate Majority Leader John Thune, however, expressed optimism that the government shutdown could end this week.

Summarize:

Continued geopolitical uncertainty surrounding the US-Venezuela and Nigerian relations may provide some support for gold's safe-haven appeal. However, gold is currently consolidating within a range and choosing its direction, so caution is advised before positioning for further downside in gold.

As can be seen from the chart above, gold is clearly driven by events, and the market is waiting for new driving clues. However, after the rise in gold prices, some funds began to flee on the back of the positive news, which proves that traders are sensitive to gold prices recently. As a result, gold prices are likely to remain in a range-bound state.

Because the US is still under shutdown, today's JOLTS (Job Openings and Labor Mobility Survey) data will not be released, making tomorrow's ADP data, also known as the US's "mini-nonfarm payrolls" data, extremely crucial.

Meanwhile, since 3963.10 was tested in the early morning session today, any move by the gold price near 3963.10 will be considered a signal that the bears are preparing to break down. Once this happens, the gold price may move towards 3886 and 3751.

(US Dollar Index Daily Chart, Source: FX678)

At 18:37 Beijing time, spot gold is trading at $3995.71.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.