One chart: Baltic Dry Index rises, Capesize bulk carrier freight rates strengthen.

2025-11-04 22:36:56

The Baltic Exchange's main shipping index, which measures freight rates for dry bulk vessels, rose on Tuesday, supported by higher freight rates for Capesize vessels.

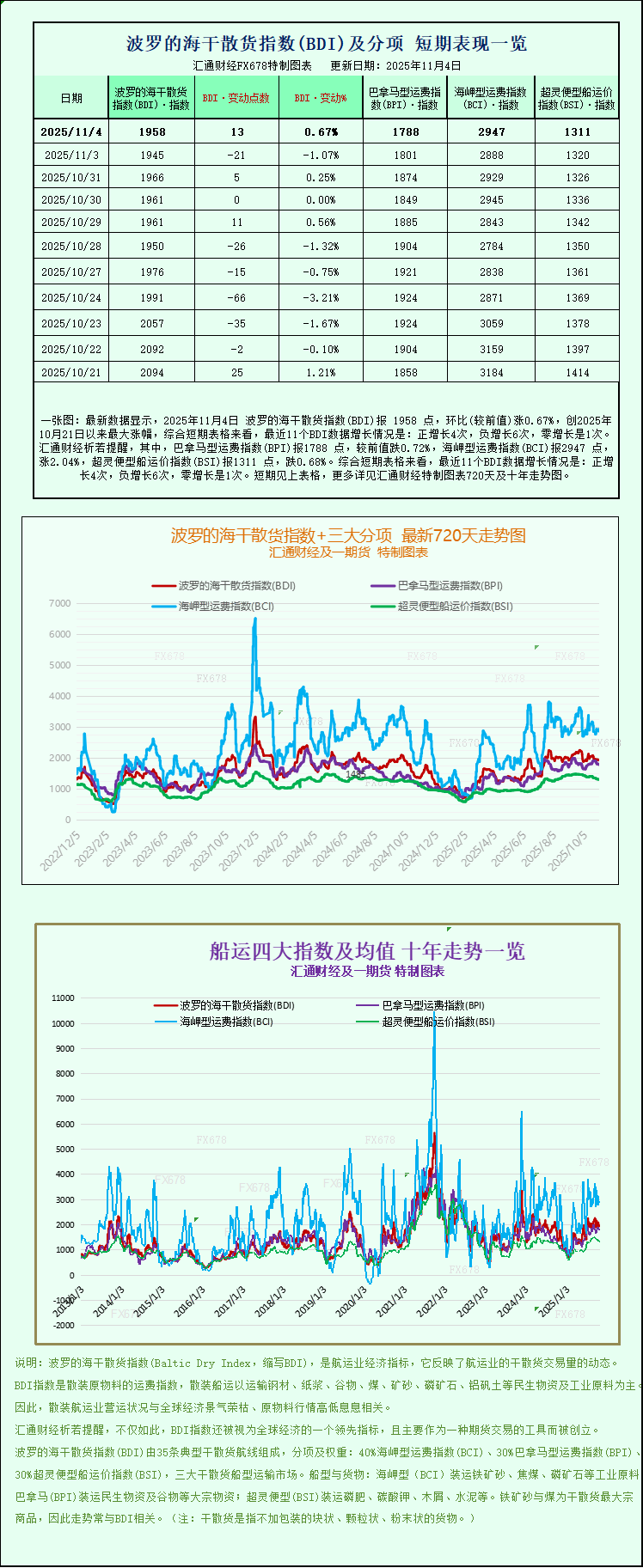

The main index tracking freight rates for Capesize, Panamax, and Supramax vessels rose 13 points, or 0.7%, to 1,958.

The Capesize index rose 59 points, or 2%, to 2,947.

The average daily revenue of Capesize vessels (which typically transport 150,000 tons of cargo, such as iron ore and coal) increased by $489 to $24,444.

Iron ore futures prices fell on Tuesday, marking their third consecutive day of decline.

The Panamax index fell 13 points, or 0.7%, to 1,788, marking its seventh consecutive day of decline.

The average daily earnings of Panamax vessels (typically carrying 60,000-70,000 tons of coal or grain) fell by $117 to $16,090.

Among smaller vessels, the Very Large Vessel Index fell 9 points, or 0.7%, to 1,311.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.