GBP/USD Forex Signal: Double Top Pattern Forms Ahead of Bank of England Interest Rate Decision

2025-11-06 19:11:44

The pound fell to its lowest level since April against the dollar after UK Chancellor Rachel Reeves hinted that his upcoming budget would include tax increases. The decline was also driven by traders awaiting the Bank of England's upcoming interest rate decision.

UK tax increase and Bank of England interest rate decision

The pound fell sharply against the dollar after Rachel Reeves delivered a budget speech to Parliament, in which the Chancellor hinted at tax increases for the wealthy.

This tax increase comes at a time when some wealthy individuals have chosen to emigrate to other countries to avoid taxes. More importantly, the tax increase is being implemented at a time when British residents are suffering from high inflation – the UK inflation rate surged to 3.8% in September.

The current stagflation situation in the UK may persist for some time. Stagflation refers to a state in which a country's economic growth stagnates in an environment of high inflation.

Against this backdrop, the Bank of England will announce its interest rate decision later today. Economists expect a majority of central bank officials to vote to maintain the current interest rate level. Cutting interest rates during periods of high inflation would further push up prices.

The day before the Bank of England's decision was announced, the United States released strong economic data. Data from ADP showed that the private sector added 42,000 jobs in October after losing 32,000 jobs in September.

Further data showed that U.S. service sector output improved. The Institute for Supply Management (ISM) non-manufacturing Purchasing Managers' Index (PMI) rose to 52.4 in October from 50 in the previous month, while the S&P Global index rose to 54. A PMI reading of 50 or above indicates that the sector is in expansion.

Technical Analysis

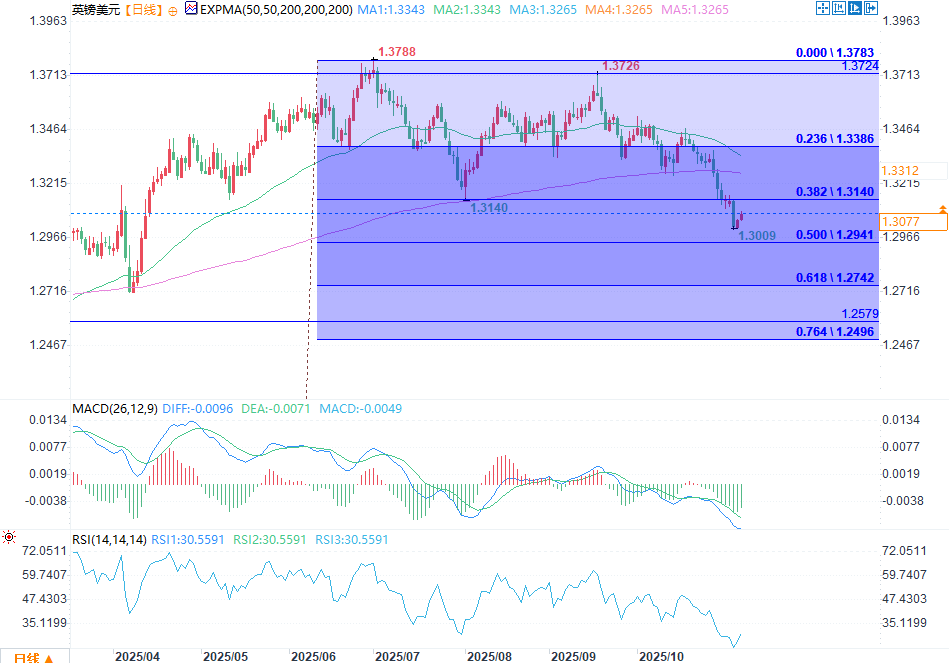

(GBP/USD daily chart source: FX678)

The daily chart shows that the GBP/USD exchange rate has fallen sharply in the past few months, from a high of 1.3726 in September to a low of 1.3009 this week.

The exchange rate has fallen below the important support level of 1.3140, which is both the low of August 1st and the neckline of the double top pattern at 1.3724. The double top pattern is one of the most typical bearish patterns in technical analysis.

The pound/dollar has fallen below the 38.2% Fibonacci retracement level of 1.3140, and has also broken below the 50-day and 200-day exponential moving averages.

Therefore, the most likely scenario for GBP/USD is a bearish move, with the next key target being the 50% retracement level at 1.2940. Another possibility is a rebound in the exchange rate and a retest of the key resistance level at 1.3141.

Bearish view : Sell GBP/USD pair, with a profit target of 1.2900 and a stop-loss at 1.3140. Timeframe: 1-2 days.

Bullish view : Buy the GBP/USD currency pair, with a profit target of 1.3140 and a stop-loss at 1.2900.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.