The First Blood of the AI Revolution: Over One Million Layoffs in the US, the End of the Dollar Index

2025-11-06 21:53:06

October saw a surge in layoffs, bringing the total for the year to a record high in recent years.

Data shows that the total number of layoffs by U.S. companies reached 153,074 in October, a sharp increase of 183% compared to September and a 175% increase compared to the same period last year. This figure breaks the record for the largest number of layoffs in a single month in October since 2003, and also makes 2025 the year with the largest number of layoffs announced by companies since 2009.

Looking at the full-year data, companies have announced a total of 1.1 million layoffs so far, a 65% increase compared to the same period last year, the highest level since the COVID-19 pandemic in 2020.

In particular, the total number of layoffs in October set a new record for the highest number of layoffs in a single month in the fourth quarter since 2008.

Experts analyze: Disruptive technologies are reshaping the landscape, and the negative impact of layoffs will become more apparent in the fourth quarter.

"Similar to the industry upheaval in 2003, a disruptive technology is now reshaping the market landscape," said Andy Challenger, the company's career expert and chief revenue officer.

He further pointed out that the number of new jobs created has fallen to a multi-year low, and against this backdrop, companies choosing to announce layoffs in the fourth quarter will undoubtedly trigger a more negative market reaction.

Data Background: Official data has stalled, and other indicators show divergence.

It is noteworthy that this report was released at a time when the U.S. government had suspended the collection and release of official labor market data due to the shutdown in Washington, D.C., making this report an important reference for observing the dynamics of the labor market.

However, Challenger's monthly layoff data is highly volatile, and weekly unemployment claims data from various states have not yet shown signs of accelerated layoffs. Meanwhile, a report from payroll processing company ADP showed that the U.S. private sector added a net 42,000 jobs in October, reversing two consecutive months of job losses.

Policy Updates: Federal Reserve Concerned About Weak Labor Market, Expectations for Rate Cuts Rise

This layoff report comes as Federal Reserve officials have expressed concern about the weak labor market.

Federal Reserve Governor Milan stated that he still believes labor demand is not as strong as expected.

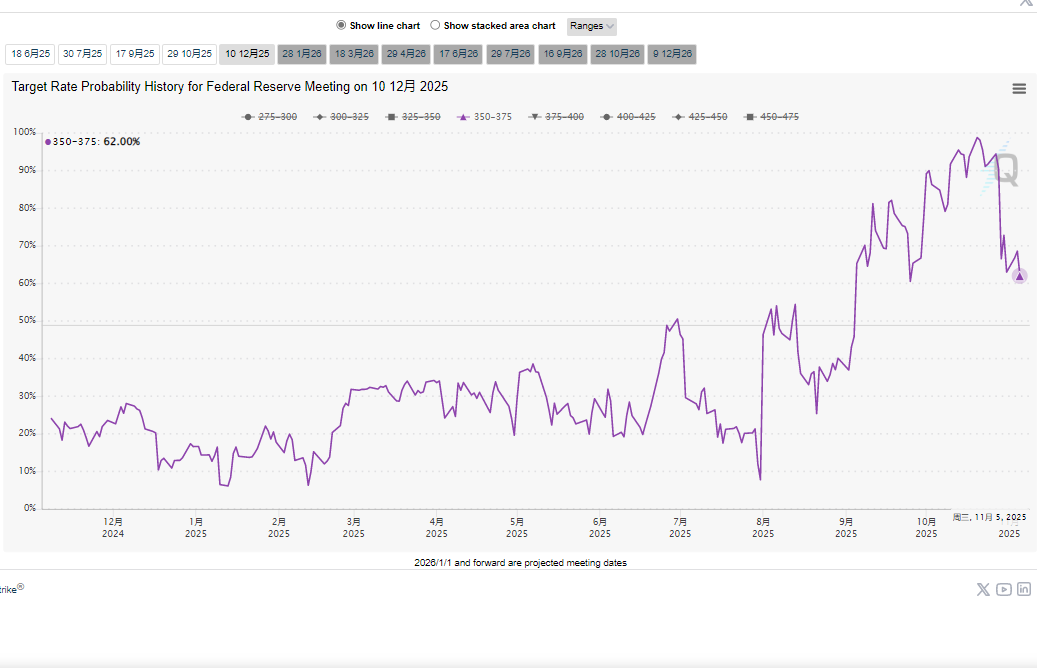

The Federal Reserve has lowered its benchmark interest rate twice since September, and the market generally expects it to approve another 25 basis point rate cut in December. Although the impact of Powell's speech has decreased significantly recently, it still accounts for 62%. Policymakers hope to take forward-looking measures to deal with potential economic risks in advance.

Industry distribution: The technology sector is the hardest hit, with layoffs increasing in multiple fields.

In terms of industry distribution, the technology sector has become the hardest hit by layoffs due to business restructuring caused by the integration of artificial intelligence.

Data shows that the industry announced 33,281 layoffs in October, almost six times the number announced in September.

In addition, the number of layoffs in the consumer goods industry has increased to 3,409; non-profit organizations, which have been severely impacted by the government shutdown, have laid off a total of 27,651 people this year, an increase of 419% compared to the same period in 2024.

Trend Analysis: Multiple factors are driving corporate contraction, which will intensify competition for job seekers in the labor market.

Andy Challenger's analysis states: "Some industries are entering a period of adjustment after the hiring boom during the pandemic, while factors such as the widespread application of artificial intelligence, weak consumer and corporate spending, and rising operating costs are driving companies to tighten their belts and freeze hiring."

He further stated that the increased difficulty for laid-off workers to quickly find new jobs may further exacerbate the overall labor supply in the labor market, meaning that while there are more job seekers, jobs will become even harder to find.

Summarize:

Objective data shows that as layoffs intensify, the US job market is deteriorating, with fewer job openings and more job seekers. These are all signs of a deteriorating US labor market, and the pressure on the job market will lead the market to bet on the Federal Reserve to cut interest rates, thereby suppressing the US dollar index.

However, if the market continues to accept the AI narrative, and US tech companies continue to tell compelling stories and generate impressive financial statements, the US dollar index may be boosted by the US AI narrative, since the underlying logic of the US dollar index represents the comprehensive national strength of the United States.

After breaking through the rising wedge, the US dollar index halted its gains at the 100.45 level and has now fallen below the 5-day moving average and the 100 mark, down 0.41%.

(US Dollar Index Daily Chart, Source: FX678)

At 21:50 Beijing time, the US dollar index is currently at 99.74.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.