AUD/USD Forex Signals: Super Trendline and Head and Shoulders Pattern Indicate a Sharp Drop

2025-11-10 19:35:53

The Australian dollar reacted to the Reserve Bank of Australia's (RBA) interest rate decision last week, with officials keeping rates unchanged at 3.6%. The RBA expressed concern about domestic inflation, which remains stubbornly above its 2% target.

Latest data shows that Australia's overall consumer inflation rate, adjusted inflation rate, and weighted consumer inflation rate all rose in the third quarter. Therefore, interest rate cuts in the coming months could further push up inflation.

The next key catalyst for the Australian dollar/US dollar exchange rate will be the employment data released on Thursday. Economists expect the report to show that the Australian economy added 14,500 jobs in October, compared to 14,900 in September. The unemployment rate is expected to rise to 4.6% from 4.5%.

While labor market data is crucial, its impact on the Reserve Bank of Australia will be relatively limited, as the bank is currently focused on inflation.

Another catalyst affecting this currency pair is developments related to the ongoing government shutdown. There are indications that the shutdown may end soon, which would provide relief to the economy. On the one hand, key macroeconomic data, such as employment figures, will be released after the shutdown concludes.

At the same time, the currency pair will also react to important statements from key Federal Reserve officials such as New York Fed President John Williams and Philadelphia Fed President Anna Paulson. Other Fed officials, including Rafael Bostic and Stephen Milan, will also speak, providing further clues about future policy directions.

Technical Analysis

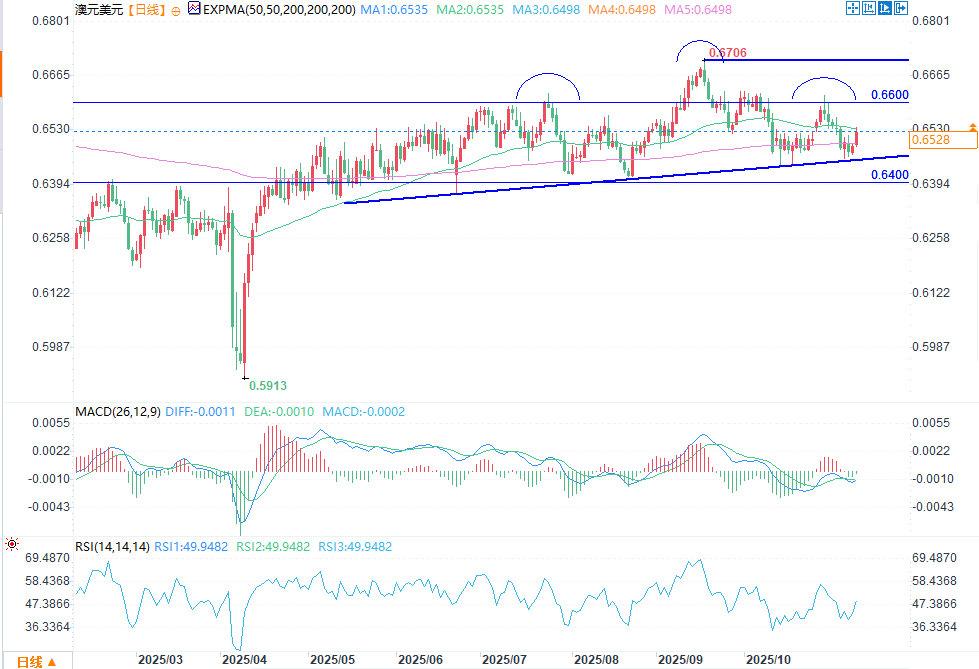

(AUD/USD daily chart source: FX678)

The daily chart shows that the AUD/USD pair has been fluctuating over the past few months. The pair has fallen from a high of 0.6700 to around 0.6528 currently.

The Australian dollar/US dollar pair has fallen below its 50-day exponential moving average (EMA) and remains below the supertrend line indicator, suggesting that bears are currently in control.

The currency pair has also formed a head and shoulders pattern and is currently at the neckline.

The AUD/USD pair may see a strong bearish breakout, with a potential target at the psychological level of 0.6400. A break above the resistance level of 0.6536 would invalidate the bearish view.

The MACD indicator shows that the current momentum of both bulls and bears is extremely weak, and the market is at a critical point of directional choice. The RSI indicator is at the 50 neutral watershed position, indicating that the short-term bullish and bearish forces are balanced. If the RSI falls below 50, the bias will be bearish, and if it rises above 50, the bias will be bullish.

bearish view

Sell the AUD/USD currency pair, setting a profit target of 0.6400. Set a stop-loss at 0.6600. Timeframe: 1-2 days.

Bullish viewpoints

Buy the AUD/USD currency pair, setting a profit target of 0.6600. Set a stop-loss at 0.6400.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.