The dollar dilemma: expectations remain, funds don't leave, so why is the market getting more and more anxious?

2025-11-10 20:19:06

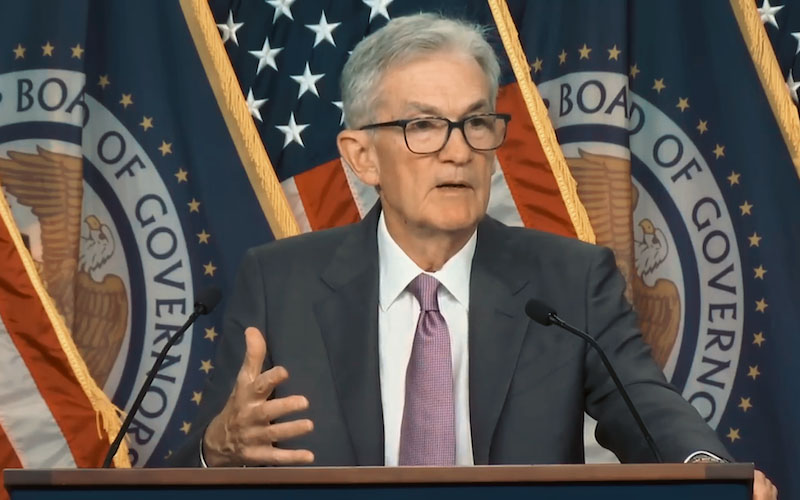

Recent communications from the Federal Reserve have exhibited a mixed pattern of hard and soft stances. Statements from the San Francisco Fed emphasize that current policy remains somewhat restrictive, exerting downward pressure on inflation; tariff-driven price increases are considered primarily confined to the goods side and have not yet significantly spilled over into broader inflation. Simultaneously, the mention of "negative demand shocks" suggests that cooling labor demand is becoming a more significant channel for price declines. This interpretation helps the market moderately lower its expectations for the peak of nominal and real interest rates, theoretically weakening the dollar's interest rate advantage. Conversely, some policymakers still emphasize inflation stickiness and risk symmetry, warning against prematurely declaring an easing cycle. The combined meaning is that the interest rate path is more data-dependent, with Treasury yields fluctuating within a narrow range, thus limiting the extension of the dollar's unilateral trend.

The "voting structure" of policy expectations has been repeatedly discussed by the market. Dovish statements from non-voting officials marginally influence forward guidance, but actual decision-making power remains concentrated in the hands of voting members. If understood within the framework of "a minority favoring rate cuts, a minority advocating for no change, and the rest being data-driven," each inflation and employment data release before the December meeting will marginally affect the pricing of the dollar's risk premium. The current assumption that "the probability of a slight rate cut in December remains high but has decreased" reflects that recent data has not provided strong evidence sufficient to "lock in" a rate cut. In this process, stable inflation expectations and a slowdown in wage growth are key variables supporting the cooling of the dollar interest rate differential theme.

In terms of fiscal and political processes, the progress of the temporary funding bill reduced the tail risk of a short-term government shutdown, allowing risk asset sentiment to recover. For the US dollar, such events typically affect prices through two paths: first, when safe-haven demand declines, both the dollar's liquidity premium and term premium converge; second, if short-term interest rate expectations focus more on economic data itself due to reduced uncertainty, the dollar's elasticity to policy noise decreases. Furthermore, judicial progress surrounding the legality of tariffs, if it renders the previous upward price shock "unsustainable," helps to lower the inflation risk premium and the upper limit of nominal interest rates, indirectly weakening the dollar's interest rate differential support. However, if the ruling brings new policy uncertainty or a rebalancing of trade frictions, it may also temporarily increase the demand for the dollar's "safety margin." These two effects offset each other, strengthening the dollar's range-bound nature.

Short-term funds are focusing on two key triggers: first, whether US small business confidence, labor demand, and wage components can continue to decline, thus validating the "cooling demand—declining inflation" path; and second, whether further communication from Federal Reserve officials reinforces the concept of "symmetric risk management." If "stronger data dependence" becomes a consensus, implied volatility typically declines first, and the directional trend of the US dollar weakens accordingly. The main point of contention at the institutional level is the "starting point and pace of interest rate cuts." The greater the divergence, the harder it is for the US dollar to break out of its unilateral trend.

Technical aspects

The 240-minute chart for the US Dollar Index shows a pullback after testing 100.3599, forming a recent low of 99.3931, and currently trading at 99.6090. The price remains within a downtrend, with 99.8800 acting as significant resistance and the 100.00-100.36 range representing even stronger resistance. The MACD is below the zero line, and while the DIFF and DEA lines have not yet crossed, the green histogram bars are narrowing significantly, indicating weakening downward momentum and a technical correction.

The RSI hovering between 40 and 45 reflects a weak rebound. Support levels to watch are the 99.50 level, followed by the historical retracement zones of 99.39 and 98.55. If the price stabilizes above 99.50 with increased volume, it may retest 99.88. Overall, the price is trending towards range-bound trading with limited volume, and is highly sensitive to unexpected news.

Looking ahead

The dominant variables for the US dollar index remain US real interest rates and global risk appetite. If evidence of slowing inflation and employment rebalancing increases, the market consensus on "declining nominal interest rates – moderate decline in real interest rates" will gradually solidify, weakening the dollar's interest rate differential support. Conversely, if inflation becomes sticky again and long-term nominal interest rates rise, the dollar's dual defensive and yield attributes will still attract allocation demand. The net effect of policy and judicial uncertainties on the dollar depends on the relative strength of their impact on the "inflation risk premium" and the "safe-haven premium." Currently, the two are roughly offsetting, and the dollar is more likely to maintain a data-driven range-bound trading pattern.

The dollar index's fluctuations above 99 reflect the interplay between interest rate path, risk sentiment, and policy uncertainty. The Federal Reserve's communication is becoming increasingly data-dependent, and further evidence is needed to confirm the simultaneous cooling of labor and prices. While fiscal and tariff issues have reduced extreme tail risks, they have not provided directional guidance.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.