December 3rd Financial Breakfast: Investors took profits, causing gold prices to fall back to the $4200 mark, while oil prices declined due to hopes for peace between Russia and Ukraine.

2025-12-03 07:28:03

Key Focus Today

European Central Bank President Christine Lagarde gave an introductory speech at a hearing of the European Parliament's Committee on Economic and Monetary Affairs (ECON).

stock market

U.S. stocks extended their recent gains on Tuesday in light trading, with all three major indexes closing higher. This marked the sixth gain in the past seven trading days, driven primarily by strength in technology stocks and optimistic expectations of an imminent interest rate cut by the Federal Reserve.

The Dow Jones Industrial Average rose 0.39% to close at 47,474.46; the S&P 500 rose 0.25% to close at 6,829.37; and the Nasdaq Composite rose 0.59% to close at 23,413.67.

The market rally is driven by two main factors. First, market expectations for a Federal Reserve rate cut at its December meeting continue to rise. According to the CME FedWatch tool, traders now expect an 89.2% probability of a 25 basis point rate cut, significantly higher than the 63% a month ago. The key inflation data to be released on Friday—the Personal Consumption Expenditures Price Index—may further solidify these expectations.

Secondly, strong leading stocks emerged in individual sectors. Boeing, the aircraft manufacturer, predicted increased deliveries of its 737 and 787 aircraft next year, causing its stock price to surge 10.1%, becoming the biggest contributor to the Dow Jones Industrial Average's rise and driving the overall strength of the industrial sector. Meanwhile, major technology stocks such as Apple, Nvidia, and Microsoft generally rose by about 1%, and Intel also jumped significantly, collectively contributing to the leading performance of the technology-heavy Nasdaq index.

Warner Bros. Discovery's stock rose 2.8% after receiving a second round of acquisition offers, including from Netflix; while consumer goods giant Procter & Gamble's stock fell 1.1% after citing the impact of the U.S. government shutdown on its business.

Analysts point out that the market is in a period of uncertainty ahead of the Federal Reserve's interest rate meeting next week, but consumer spending data from "Black Friday" and "Cyber Monday" shows that consumer sentiment remains positive, providing fundamental support for the market. In addition, discussions about the next Federal Reserve Chairman are ongoing, with reports suggesting that White House economic advisor Hassett is a leading candidate, and President Trump has stated that he will announce the final decision early next year.

Gold Market

Gold prices retreated from a six-week high reached the previous day, falling by more than 1% on Tuesday. Market analysts believe the decline was mainly due to profit-taking by investors after the recent strong rally.

At the close, spot gold fell 1.1% to $4,186.89 per ounce; gold futures for February delivery on the New York Mercantile Exchange fell 1.3% to $4,220.80 per ounce.

Market analysts point out that the price pullback has not changed the market's overall bullish outlook for gold. Peter Grant, Vice President of Zaner Metals, stated that the pullback is merely temporary profit-taking, and the market's biggest driver—expectations of a Federal Reserve rate cut—remains strong. He is optimistic that gold prices will reach $5,000 at the start of the new year. Currently, the market anticipates an 89% probability of the Federal Reserve cutting rates by 25 basis points at its meeting next week.

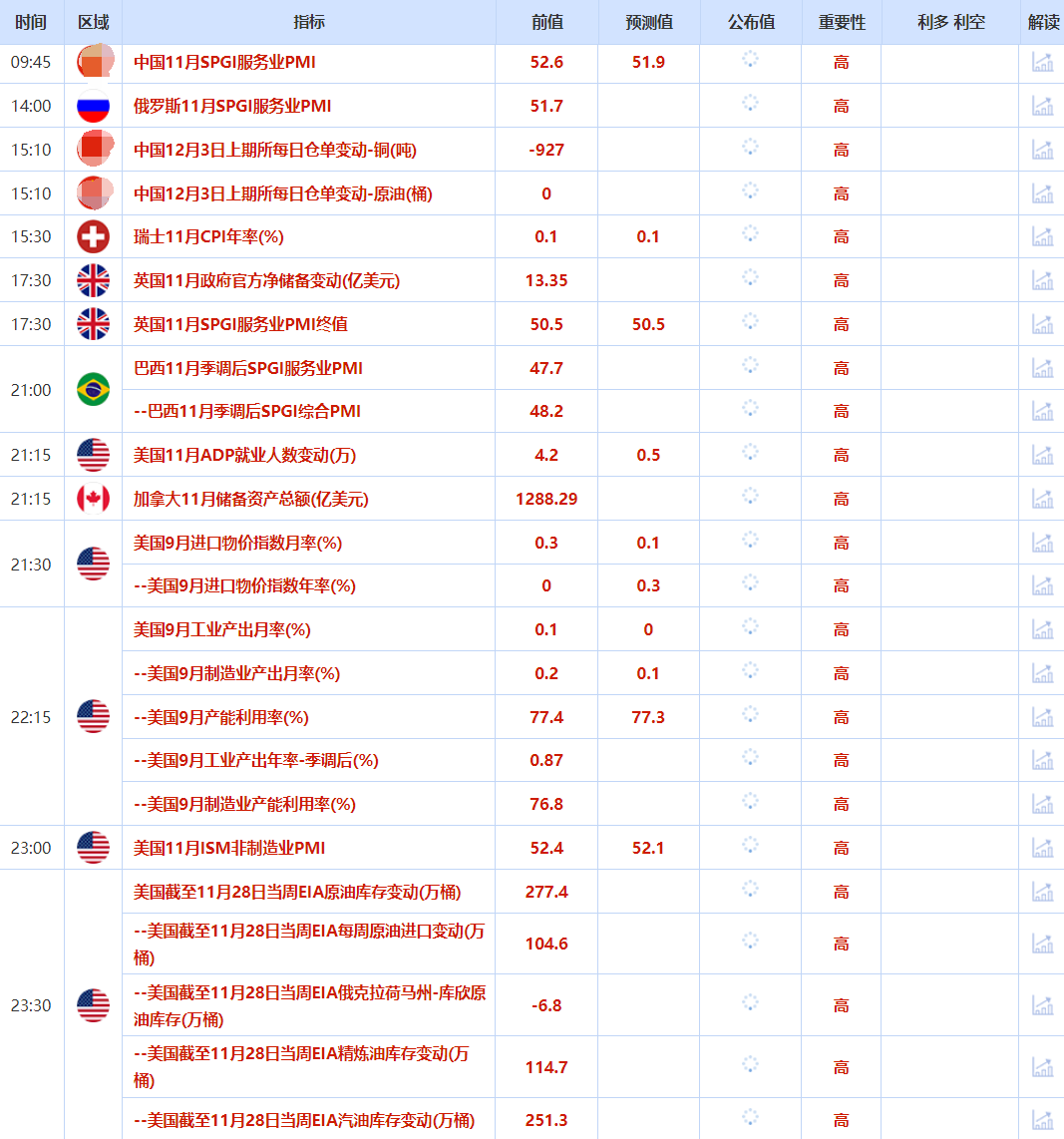

Investors are closely watching key U.S. economic data releases, including Wednesday’s ADP employment report and Friday’s delayed September personal consumption expenditures index, the latter being the Federal Reserve’s most closely watched inflation indicator and potentially providing clearer guidance on the path of interest rate cuts.

From a long-term supporting perspective, global central bank demand for gold remains strong. Data from the World Gold Council shows that central banks made net purchases of 53 tons of gold in October, a 36% increase month-on-month, marking the largest monthly net demand since the beginning of 2025.

Silver prices retreated slightly after hitting a record high, but remained above $57.90 per ounce, with a year-to-date gain exceeding 100%. Platinum fell 2%, while palladium bucked the trend, rising 2.3%.

oil market

International oil prices fell more than 1% on Tuesday as markets weighed between wavering hopes for peace between Russia and Ukraine and persistent concerns about oversupply.

Brent crude futures fell 1.14% to settle at $62.45 a barrel; WTI crude futures fell 1.15% to settle at $58.64 a barrel.

Investors are closely watching the progress of the Russia-Ukraine peace talks. On Tuesday, Russian President Vladimir Putin met with a special envoy of US President Donald Trump at the Kremlin. The market anticipates that a breakthrough in the talks could lead to the lifting of some restrictions on Russian energy supplies. However, the prospects for the talks remain highly uncertain. On the eve of the meeting, Putin issued warnings and threatened to cut off Ukraine's maritime access routes. Analysts point out that hopes for peace may soon be dashed, at which point the market will face the risk of greater disruption due to continued attacks on energy infrastructure.

Recent concerns about oversupply also weighed on prices. These concerns were partly offset by the weekend's attacks on Russian infrastructure and tensions between the US and Venezuela. Trump's announcement over the weekend to close airspace around Venezuela has introduced new uncertainty into the major oil producer's export prospects.

In addition, Putin plans to begin a two-day visit to India on Thursday, aimed at restoring energy and defense relations damaged by US pressure and attempting to sell more Russian oil. The Kremlin has stated that the recent decline in Indian oil imports from Russia is likely temporary.

Foreign exchange market

The dollar rebounded against the yen on Tuesday, recovering some of the losses from the previous session; the euro remained stable after the release of eurozone inflation data.

The dollar rose 0.3% against the yen to 155.91. The yen had fallen to a two-week low on Monday after hawkish comments from Bank of Japan Governor Kazuo Ueda fueled strong market expectations of a December rate hike. While the market still prices in a high probability of a December rate hike by the Bank of Japan at around 80%, the dollar's movements have become more rational. Analysts believe that Monday's surge in the yen was largely driven by the overall weakness of the dollar, while the market subsequently refocused on the still-robust US economic outlook, pushing the dollar higher.

Market expectations for a Federal Reserve rate cut remain solid. According to the CME FedWatch tool, the market anticipates an 87% probability of a 25-basis-point rate cut at the Fed's December meeting. Pepperstone strategists point out that the dollar, as the "cleanest dirty shirt," continues to show demand in the absence of other dominant factors.

The euro edged up 0.04% against the dollar to $1.1615. Supporting this move was data showing that the eurozone's inflation rate rose slightly to 2.2% in November from 2.1% in October, after European Central Bank policymakers subsequently stated that inflation had effectively reached their 2% target. This slight rebound was seen as manageable, and the market anticipates that the ECB will maintain stable interest rates.

The pound fell slightly by 0.1% against the dollar to $1.3202 after the Bank of England lowered bank capital requirements for the first time in a decade, aiming to stimulate credit and economic growth.

International News

Trump plans to expand the travel ban to approximately 30 countries.

Following the shooting of two National Guard soldiers in Washington, D.C. last week, the U.S. government is expected to expand its travel ban to approximately 30 countries in a more aggressive move to curb immigration. A Department of Homeland Security official revealed that the list of additional countries is expected to be released soon. The U.S. currently has a complete ban on travelers from 12 countries and has imposed partial restrictions on seven others. After the shooting that left one National Guard member dead and another critically injured, President Donald Trump threatened a series of measures to restrict immigration to the United States. Federal authorities have identified the suspect as 29-year-old Afghan citizen Rahmanullah Lakanwar. He previously served for the U.S. military and the CIA in Afghanistan before arriving in the U.S. in 2021. Trump also attempted to ban travelers from certain countries during his first term. This measure underwent multiple amendments and lengthy legal proceedings before being ruled by the U.S. Supreme Court as "entirely within the presidential domain." He reimposed the travel ban earlier this year.

Zelensky: The Ukrainian and American delegations refined the "peace plan"

The United States and Ukraine held high-level talks in Florida on November 30. Ukrainian President Volodymyr Zelenskyy stated on December 2 via social media that the Ukrainian delegation had submitted a detailed report on all talks held in the US. During the talks, the Ukrainian and US delegations further refined the peace plan based on the version developed after the Geneva talks. Zelenskyy stated that the Ukrainian diplomatic team is currently actively communicating and consulting with all parties to ensure the effective participation of European countries and other willing allies in the decision-making process. Ukraine will maintain continuous contact with the United States to determine the schedule for subsequent talks. (CCTV)

Russia does not accept Europe's revision of the Russia-Ukraine peace plan.

Russian President Vladimir Putin stated in a media interview on December 2nd that Russia cannot accept any modifications Europe attempts to make to the US-proposed Russia-Ukraine peace plan. Putin pointed out that Europe's attempts to alter the plan are aimed at obstructing the peace process and shifting blame for its collapse onto Russia. Putin reiterated that Russia has repeatedly stated it has no intention of going to war with Europe. However, if Europe were to suddenly launch a war, Russia is "now" prepared to respond. On November 20th, US media revealed a 28-point peace plan drafted by the White House, which Ukraine and Europe consider biased towards Russia. On November 23rd, representatives from the US, Ukraine, and Europe held talks in Geneva, Switzerland, and significantly revised the plan. (CCTV International News)

Russian presidential aide: No compromise on the Ukraine issue has been reached at the Russia-US summit regarding territorial disputes.

On December 3, local time, Russian Presidential Aide Ushakov stated that the meeting between Russian President Vladimir Putin and US Presidential Envoy Vitkov was constructive, highly beneficial, and substantive. The meeting discussed the territorial issue, but Russia and the US agreed not to disclose the details of the talks. Ushakov stated that the two sides explored several versions of solutions to the Ukraine crisis. The five-hour meeting allowed all parties to discuss the issue of resolving the Ukraine situation in depth and detail. Ushakov stated that there is currently no compromise on the Ukraine issue; Russia can accept some of the proposals put forward by the US, while others are not suitable. Ushakov said that Russia and the US will maintain contact at the presidential aide level. The possibility of a meeting between Putin and Trump will depend on the progress made in the reconciliation process for the Ukraine crisis. (CCTV)

UN report: Financial volatility could jeopardize global trade and push the global economy "to the brink of crisis".

The United Nations Conference on Trade and Development (UNCTAD) released its "Trade and Development Report 2025" on December 2, projecting that global economic growth will slow to 2.6% in 2025, down from 2.9% in 2024. The report focuses on the impact of finance on trade, noting that financial market volatility has an impact on global trade almost as significant as that of real economic activity, affecting the global development outlook. UNCTAD Secretary-General Alan Greenspan stated that the findings indicate the financial environment is increasingly dominating the direction of global trade, adding that "trade is not just a supply chain, but a link between credit lines, payment systems, money markets, and capital flows."

The White House will propose more lenient fuel economy standards.

Sources say the White House will propose a significant reduction in fuel economy standards, overturning rules finalized last year by then-Biden. The National Highway Traffic Safety Administration (NHTSA) is expected to propose a substantial reduction in fuel economy requirements for vehicles manufactured between 2022 and 2031. Trump is expected to announce the plan at a White House event on Wednesday, in which executives from the Detroit Three automakers are also expected to attend. Earlier this year, Trump signed legislation ending fuel economy penalties for automakers.

The Trump administration removed the word "renewable" from the name of the U.S. Energy Laboratory.

The Trump administration renamed a U.S. energy laboratory, removing the word "renewable." This is the latest move by the administration to downplay the importance of solar and wind power sources and instead support fossil fuels. The National Renewable Energy Laboratory (NREL), located in Golden, Colorado, announced on its website Monday evening that it is now called the "National Laboratory of the Rockies." As one of 17 laboratories under the U.S. Department of Energy, the laboratory also focuses on energy efficiency research. It was founded by former U.S. leaders, including two members of Trump's Republican Party.

Trump may announce his nominee for the new Federal Reserve Chairman early next year.

US President Donald Trump said at a cabinet meeting at the White House on December 2 that he is likely to announce his nominee for the next Federal Reserve Chairman in early 2026, to succeed current Chairman Jerome Powell, whose term ends in May 2026. Trump also confirmed that Treasury Secretary Bessant has no intention of taking the position. Previously, Trump stated that he had made a decision on his nominee. According to sources, Kevin Hassett, director of the National Economic Council, is considered the leading candidate for the next Fed chairman by Trump, his advisors, and allies. Under relevant laws, the US president's nominee for Fed chairman must be confirmed by the Senate. Powell was nominated for Fed chairman during Trump's first term and took office in February 2018. He was later nominated for re-election during the Biden administration. Trump has repeatedly criticized Powell publicly for the Fed's monetary policy. After being re-elected in January of this year, Trump repeatedly criticized Powell, accusing the Fed of cutting interest rates too slowly and threatening to dismiss him. The Fed's ability to maintain monetary policy independence has raised widespread concerns. (CCTV)

Domestic News

Chinese scientists have cracked the high-temperature sensing mechanism of rice, contributing to stable rice yields.

Reporters learned from the Center for Excellence in Molecular Plant Sciences, Chinese Academy of Sciences, that the team of Academician Lin Hongxuan, in collaboration with the team of Researcher Lin Youshun from Shanghai Jiao Tong University and the team of Researcher Li Yixue from Guangzhou National Laboratory, has recently cracked the dual "code" of rice's perception and response to high temperatures. This research revealed a sequentially activated, synergistically linked heat signal sensing mechanism in plants. Through genetic modification of this mechanism, they successfully cultivated new rice lines with gradient heat tolerance, contributing to molecular breeding of crops with high-temperature tolerance and providing a new solution to address food yield reductions caused by global warming. The relevant research results will be published in the international academic journal *Cell* on December 3, 2025 (Beijing time). (CCTV)

China has made new breakthroughs in multiple fields, including new energy, engineering, and transportation.

The Inner Mongolia Wuhai semi-solid-state lithium battery energy storage project successfully connected to the grid and began generating electricity. This coincided with the topping out of the south main tower of the Zhangjinggao Yangtze River Bridge, marking a breakthrough for Chinese bridges by increasing span from 1,000 meters to 2,000 meters. Additionally, the low-altitude air transport route from Taicang, Jiangsu to Pudong, Shanghai officially opened. These achievements showcased China's robust technological capabilities once again. This marks a new stage in energy storage. In recent years, semi-solid-state lithium batteries, balancing safety and economy, have become a core direction for technological iteration in the energy storage field. Previously, my country's largest grid-connected semi-solid-state energy storage project was a 100,000 kW/200,000 kWh demonstration project. The Wuhai project's scale has more than doubled, signifying that my country is at the forefront of the world in the large-scale application of semi-solid-state energy storage technology. (CCTV)

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.