Gold and silver prices continued to rise, with strong bullish momentum.

2025-12-12 22:32:00

Global stock markets mostly weakened overnight. U.S. stock indices are expected to open lower when trading begins in New York.

Global stock markets rise after Fed rate cut

Within a week, the Federal Reserve made it clear that its rate-cutting cycle would continue, clearing the way for a year-end "Santa Claus rally," after which global stock indices hit record highs or approached them. The Stoxx Europe 600 index rose as much as 0.5%, hitting a record high; an Asian stock index was less than 2% away from its all-time high; and the S&P 500 futures fell slightly after setting a new closing milestone later this week. Karen Georges, a fund manager at Ecofi Investments in Paris, said, "Everyone is convincing themselves there will be a Christmas rally, so it looks like it's highly likely. Frankly, there haven't been any significant negative catalysts by the end of the year. Investors are keen to buy lagging stocks this year, and now is a good time to diversify portfolios."

The US dollar index is set to decline for the third consecutive week.

The dollar index hit a six-week low on Thursday and is on track for its third consecutive week of decline. The dollar's weakness comes against the backdrop of the Federal Reserve cutting interest rates as expected, and its policy outlook being more dovish than the market anticipated. Fed Chairman Powell stated that further rate hikes are unlikely, and the Fed's forecasts indicate only one rate cut next year. In contrast, the policy stances of other major economies such as Australia, Canada, and Europe have been repriced as hawkish, further pressuring the dollar. The dollar is expected to weaken against most major currencies this week, with the most significant decline anticipated against the euro.

Peace talks between Russia and Ukraine have stalled; Trump says the US will help ensure Ukraine's security.

President Trump stated that the United States is willing to provide aid to Ukraine as part of a security agreement to end the Russia-Ukraine war. Trump expressed dissatisfaction with the progress of negotiations and disappointment that Ukrainian President Volodymyr Zelenskyy had not readily signed the U.S.-led peace plan. According to Bloomberg, Trump's spokesperson said he was "extremely disappointed with both sides of this war" and that he wanted to "resolve" the conflict through action, not talk. White House Press Secretary Carolyn Levitt told reporters on Thursday, "He doesn't want to hear any more talk; he needs action."

Key external market developments today

The dollar index rebounded slightly today after hitting a six-week low on Thursday; crude oil prices fell slightly to around $57.50 a barrel; and the benchmark 10-year U.S. Treasury yield is currently at 4.17%.

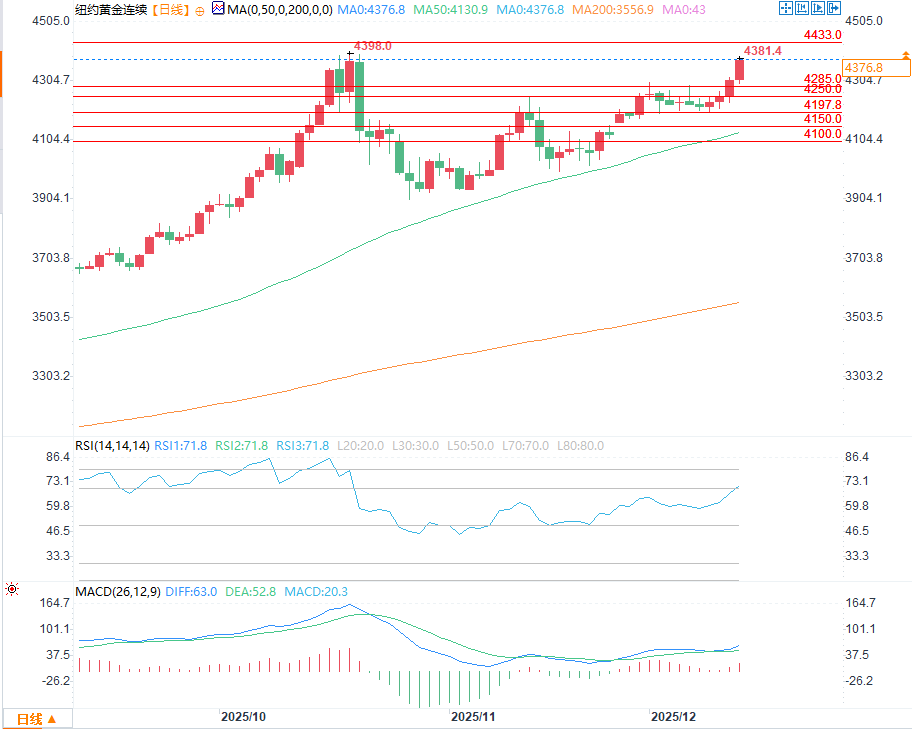

(COMEX Gold Daily Chart Source: FX678)

From a technical perspective, the next upside target for February gold futures bulls is a break above the strong resistance level of $4433.00/oz (the all-time high) at the close; the near-term downside target for bears is to push futures prices below the strong technical support level of $4200.00/oz. The first resistance level is at $4400.00/oz, followed by $4433.00/oz; the first support level is at $4300.00/oz, followed by the overnight low of $4295.50/oz.

For March silver futures, the next upside target for bulls is a close above the strong technical resistance level of $70.00/oz; for bears, the next downside target is a close below the strong support level of $57.00/oz. The first resistance level is at $65.00/oz, followed by $66.00/oz; the next support level is the overnight low of $63.125/oz, followed by $62.00/oz.

Note: The gold market operates primarily through two pricing mechanisms. The first is the spot market, where prices are quoted for immediate purchase and delivery; the second is the futures market, which determines the price for delivery on a future date. Due to year-end position adjustments and market liquidity, the most actively traded gold futures contract on the Chicago Mercantile Exchange (CME) is currently the December contract.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.