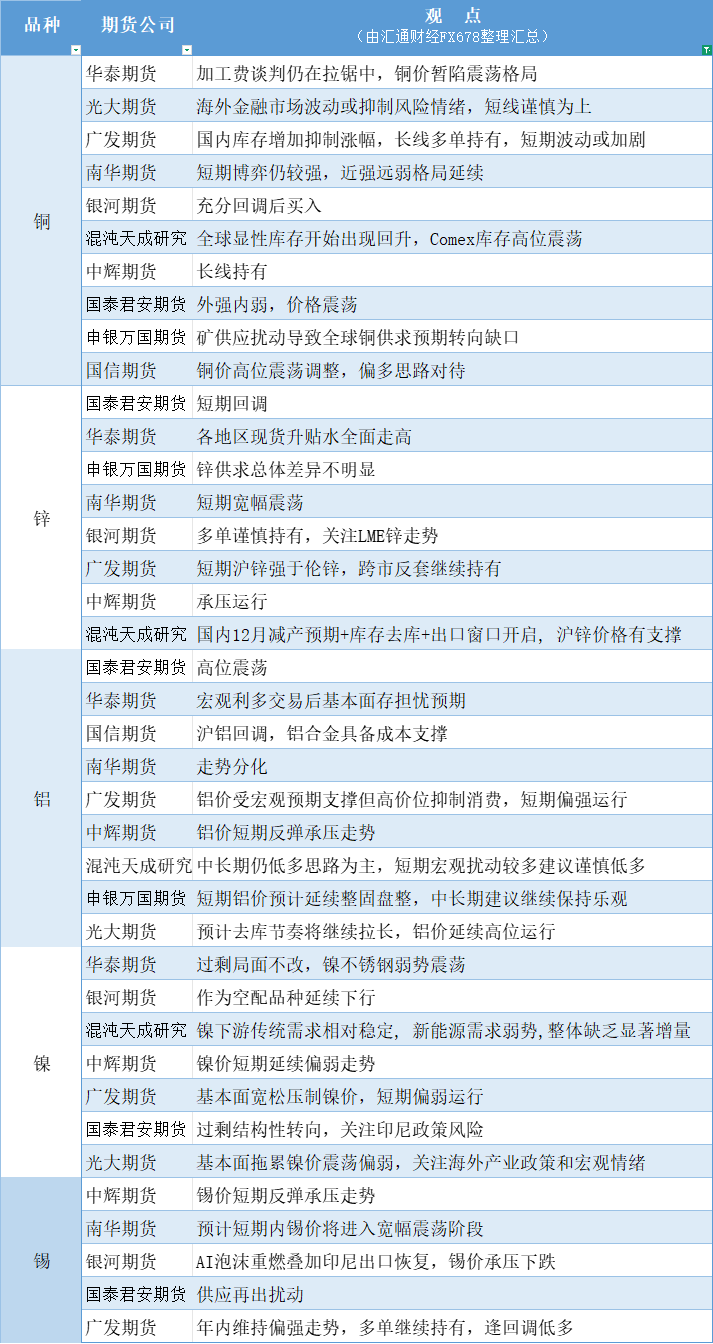

A summary chart of futures company viewpoints: Non-ferrous metals (copper, zinc, aluminum, nickel, tin, etc.) on December 16th

2025-12-16 12:45:46

Copper: Increased domestic inventory limits price gains; long-term positions should be held, but short-term volatility may intensify. Processing fee negotiations remain in a tug-of-war, and copper prices are currently in a consolidation phase. Zinc: Domestic production cuts expected in December, inventory reduction, and the opening of the export window provide support for SHFE zinc prices. In the short term, SHFE zinc is stronger than LME zinc, and cross-market arbitrage should be maintained. Aluminum: Aluminum prices are supported by macroeconomic expectations, but high prices suppress consumption, and prices are expected to remain slightly strong in the short term. Nickel: Downstream traditional demand for nickel is relatively stable, while demand from new energy sources is weak, resulting in a lack of significant incremental growth. Tin: Tin is expected to maintain a slightly strong trend throughout the year; long positions should be held, and buying on dips is recommended. Tin prices are facing downward pressure on short-term rebounds.

This chart was specially created and compiled by FX678 and is copyrighted.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.