Gold prices are experiencing a "perfect storm" of upward momentum! Trump's criminal investigation of Powell raises serious concerns about the Fed's independence.

2026-01-12 10:04:35

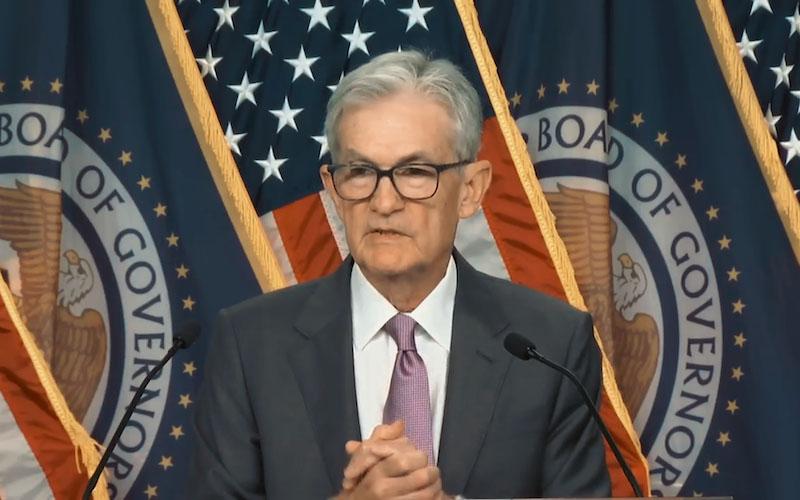

Powell faces criminal investigation, claims to be politically persecuted.

U.S. federal prosecutors have launched a criminal investigation into Federal Reserve Chairman Jerome Powell, a fact Powell confirmed on Sunday evening (January 11).

Powell stated that the investigation was initiated because the Federal Reserve "sets interest rates based on our best judgment of the public interest, rather than following" President Trump's preferences.

In a video statement released from the Federal Reserve account, he said, "This is about whether the Fed can continue to set interest rates based on evidence and economic conditions, or whether monetary policy will be subject to political pressure or coercion."

Powell stated that last Friday, "the Department of Justice served a grand jury subpoena to the Federal Reserve, threatening criminal charges against me for my testimony before the Senate Banking Committee last June (2025)." He explained, "That testimony involved a multi-year, historic renovation project of the Federal Reserve's office buildings."

Powell emphasized: "I deeply respect the rule of law and the principle of accountability in our democratic system. No one—including the Federal Reserve Chairman—is above the law, but this unprecedented action should be viewed in the broader context of the ongoing pressure and threats from this administration."

Powell noted, "But this unprecedented action should be viewed in the broader context of the ongoing pressure and threats from this administration."

“This new threat has nothing to do with my testimony last June or the renovation of the Federal Reserve building. It also has nothing to do with Congress’s oversight function; the Federal Reserve has done everything it can to keep Congress informed of the progress of the renovation project through testimony and other public disclosures. Those are just excuses.”

Pro-Trump prosecutors lead the effort, stemming from long-standing interest rate disagreements.

The investigation is reportedly being overseen by the U.S. Attorney's Office for the District of Columbia, headed by Jeanne Piro, a former New York State Attorney and Fox News host appointed by President Trump.

Since taking office in January 2025, Trump has repeatedly criticized Powell for the Federal Reserve's failure to cut interest rates as quickly and aggressively as he had demanded.

The White House wants to change its president, but Congress is now resisting.

The White House has referred questions regarding the investigation to the Department of Justice. Trump has made no secret of his intention to remove Powell from office after his term ends in May 2026.

It is believed that the main contenders to succeed Powell are former Federal Reserve Governor Kevin Warsh and current National Economic Council Director Kevin Hassett.

North Carolina Republican Senator Tom Tillis, a member of the Senate Banking Committee, vehemently criticized the investigation into Powell and said he would oppose Trump’s nominee for Powell’s successor and any other Federal Reserve governor “until this legal issue is fully resolved.”

"If there were any doubts before that there were advisors within the Trump administration actively pushing to end the independence of the Federal Reserve, those doubts should now be completely dispelled," Tillis said in a statement.

The senator pointed out: "What is now being questioned is the independence and credibility of the Department of Justice."

The Federal Reserve's independence is sounding the alarm.

"President Trump is attempting to bring criminal charges against Powell for his testimony before Congress regarding the renovation of the Federal Reserve headquarters," Brian Jacobson, chief economic strategist at Annicks Wealth Management, wrote in a report to clients last Sunday.

Jacobson wrote: "Powell may protest by staging a sit-in. His term as chairman ends in May, but his term as a governor does not expire until January 2028."

Jacobson points out: "Faced with political pressure on the Fed, he may choose to remain on the board out of a confrontational mindset. This would prevent President Trump from appointing anyone else to the board. Stephen Milan's term ends in January 2026, which may be the only vacancy Trump can fill. While Powell's continued tenure is unconventional, everything is breaking with tradition now."

Long-standing grievances and intervention in the Federal Reserve

Trump nominated Powell to be the Federal Reserve Chairman in 2017, and the appointment was confirmed in 2018. But almost from the very beginning of Powell's tenure, Trump has repeatedly harassed the Fed Chairman over interest rates.

Trump has repeatedly called Federal Reserve officials "idiots" and has even compared Powell to a "golfer with terrible putting skills."

These criticisms intensified during Trump's second term. He urged the Federal Reserve to cut interest rates for months on end, continuing the pressure even after the Fed implemented three consecutive 25-basis-point rate cuts starting in September 2025.

During this period, Trump installed his own nominee, Miguel, on the Federal Reserve Board of Governors and attempted to remove another governor, Lisa Cook, from the board on mortgage fraud charges. Cook denied the charges. The Supreme Court is scheduled to hold a hearing in late January 2026 on a case challenging Cook's removal from office.

The combined impact and correlation between the US dollar and gold

The damage this event inflicts on the dollar's credibility and its boost to gold will far exceed the impact of typical external risk events in both nature and depth.

Impact on the US dollar: Structural downside, facing a devaluation of confidence.

The US dollar will face significant selling pressure in the short term due to the "institutional risk premium." This is no longer simply a negative economic factor, but a challenge to its core credibility, with a more lasting and profound impact. During Monday's Asian trading session, the US dollar index edged lower and is currently trading around 98.95.

(US Dollar Index hourly chart, source: FX678)

Impact on gold: A double benefit, with the safe-haven and monetary attributes resonating.

Gold is poised to emerge as the biggest winner in this "American civil war." It benefits from both the devaluation of the dollar's credibility (its monetary attributes) and soaring market uncertainty (its safe-haven attributes). The upward momentum for gold prices will be very solid.

On Monday during the Asian session, spot gold fluctuated upwards, continuing the gains of the previous two trading days, with an intraday increase of about 1.35%, once touching a record high of $4,600.89 per ounce, before encountering selling pressure at higher levels and falling slightly. It is currently trading around $4,570 per ounce.

This event provided a "perfect storm" of upward momentum for gold (credit hedging + favorable interest rates + safe-haven demand), while simultaneously imposing a heavy burden of "institutional risk" on the US dollar. The market's trading focus has shifted from "economy and interest rates" to "institutions and credit."

(Spot gold hourly chart, source: EasyForex)

Conclusion : Gold prices are highly likely to rise strongly, driven by both the strengthening of gold and the weakening of the US dollar, forming a dual-engine effect. This event provides a "perfect storm" of upward momentum for gold, while simultaneously placing a heavy burden of "institutional risk" on the US dollar. The market's focus has shifted from "economy and interest rates" to "institutions and credit."

The market will next closely watch whether the congressional boycott is effective, whether Powell will "linger," the Supreme Court's ruling in the Cook case, and any evidence that might indicate political interference in the Fed's decisions. Each development in these areas will exacerbate the aforementioned trends.

At 10:00 Beijing time, spot gold is trading at $4,570.97 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.