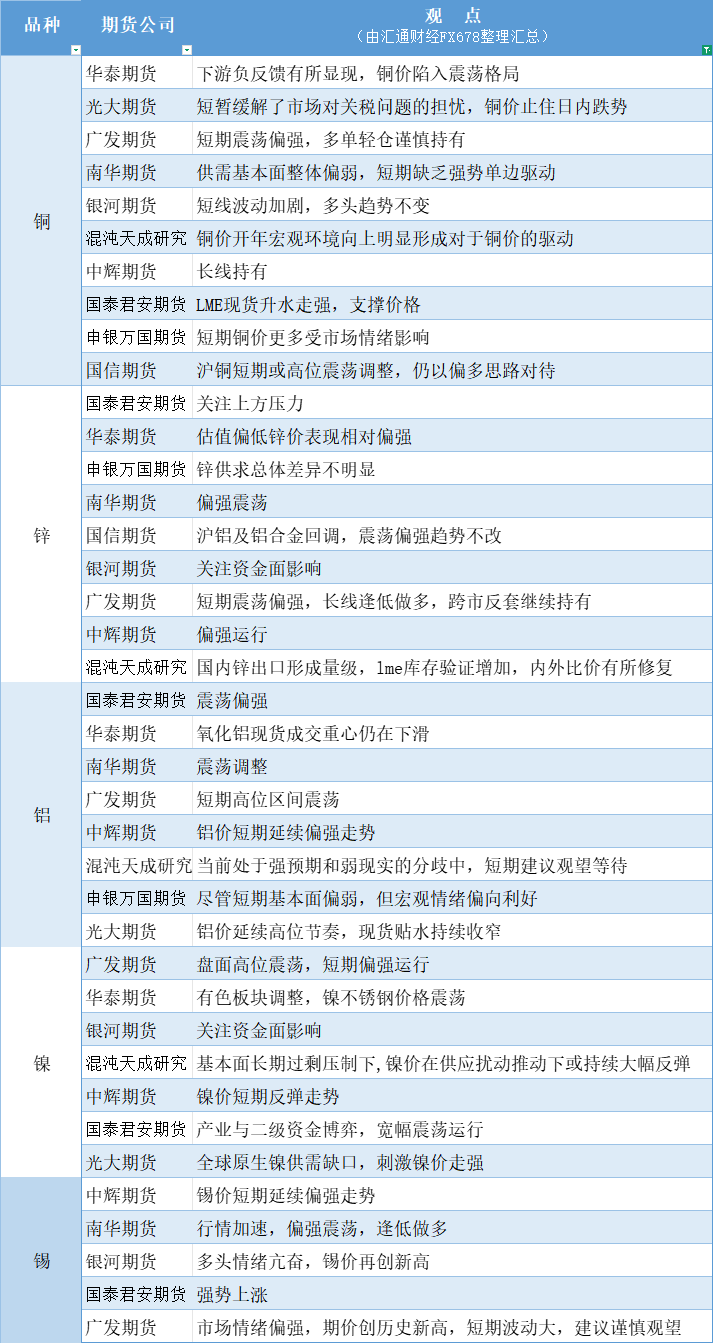

A summary chart of futures company viewpoints: Non-ferrous metals (copper, zinc, aluminum, nickel, tin, etc.) on January 15th

2026-01-15 12:35:58

Copper: Market concerns about tariffs eased briefly, halting the intraday decline in copper prices. Overall supply and demand fundamentals remain weak, lacking strong unilateral drivers in the short term. Zinc: Domestic zinc exports have reached significant levels, LME inventory increases have been confirmed, and the domestic-international price ratio has somewhat recovered, resulting in a slightly bullish oscillation. Aluminum: Shanghai aluminum and aluminum alloys have corrected, but the overall upward trend remains unchanged. Nickel: Under long-term oversupply pressure, nickel prices may continue to rebound sharply driven by supply disruptions. Prices are currently oscillating at high levels, with a slightly bullish short-term trend. Tin: Market sentiment is strong, with futures prices hitting record highs. Short-term volatility is high; a cautious wait-and-see approach is recommended.

This chart was specially created and compiled by FX678 and is copyrighted.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.