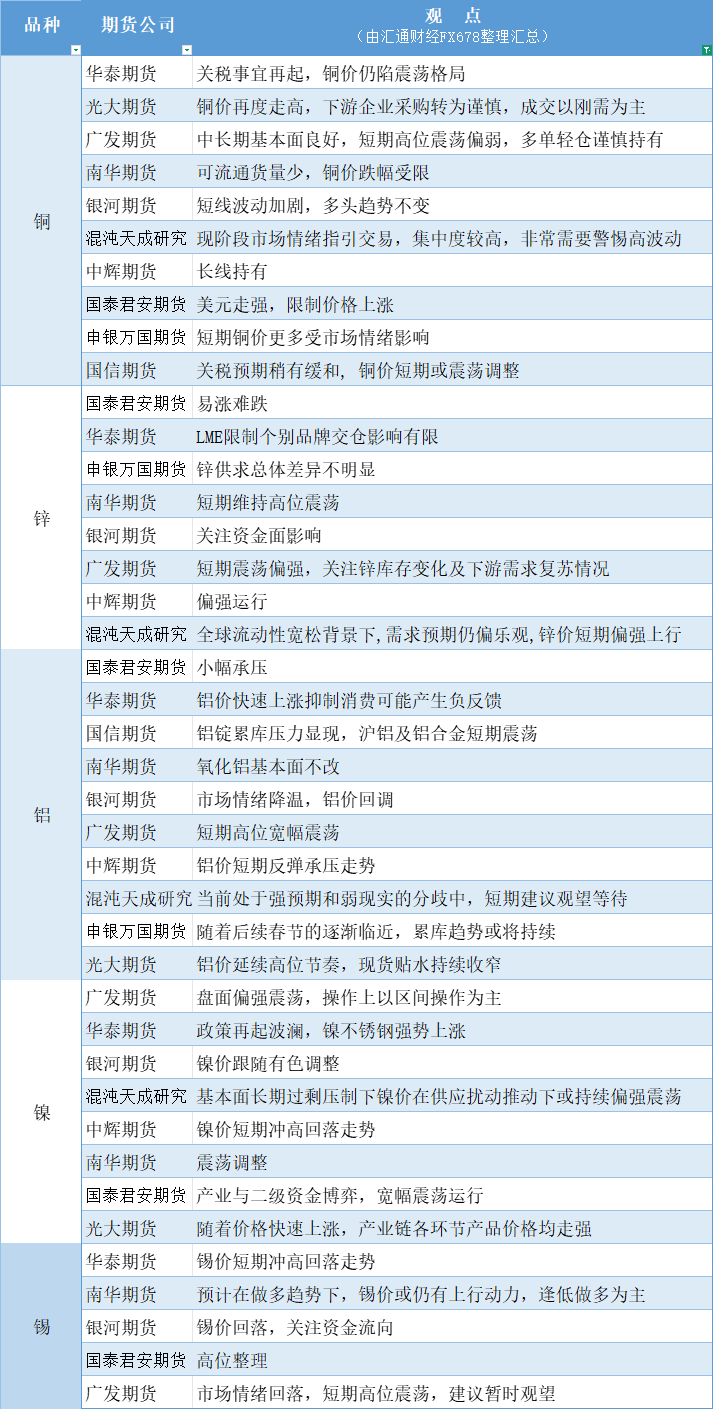

A summary chart of futures company viewpoints: Non-ferrous metals (copper, zinc, aluminum, nickel, tin, etc.) on January 16th

2026-01-16 12:22:19

Copper: Market sentiment is currently driving trading, with high concentration, so high volatility needs to be carefully monitored. The medium- to long-term fundamentals are sound, but short-term high-level fluctuations are expected with a slight downward bias. Long positions should be held cautiously with light positions. Zinc: Against the backdrop of global liquidity easing, demand expectations remain optimistic, and zinc prices are expected to rise in the short term. Aluminum: Currently, there is a divergence between strong expectations and weak reality; a wait-and-see approach is recommended in the short term, with wide fluctuations at high levels expected. Nickel: Under the long-term pressure of oversupply, nickel prices may continue to fluctuate with a slight upward bias driven by supply disruptions. Tin: Tin prices are expected to continue to rise under the bullish trend; buying on dips is recommended. Market sentiment has declined, and short-term high-level fluctuations are expected; a wait-and-see approach is advised for now.

This chart was specially created and compiled by FX678 and is copyrighted.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.