Trump's tariff threats roiled markets, weakening the dollar and boosting safe-haven currencies.

2026-01-20 01:19:27

Over the weekend, Trump announced an additional 10% tariff on goods from eight countries, including Denmark, Norway, and Switzerland, effective February 1, until the US is authorized to acquire Greenland. EU leaders strongly opposed the move and prepared retaliatory measures to counter potential tariffs.

European currencies rebounded collectively after a brief overnight downturn, with the euro, pound, and Scandinavian krona all recovering from their lows. The Swiss franc performed strongly and is on track for its biggest one-day gain against the dollar in a month.

The market's sell-off of the dollar is similar to the crisis of confidence in US assets triggered by tariffs last April.

Despite significant dollar outflows and a sharp rise in the Swiss franc on Monday, analysts warned that investors might return to the dollar if the situation escalates. Kit Jax, chief foreign exchange strategist at Societe Generale, stated that an escalation of the trade war may not necessarily be bad for the dollar, but it would be detrimental to Europe, which relies heavily on the US market for exports.

Technical Analysis

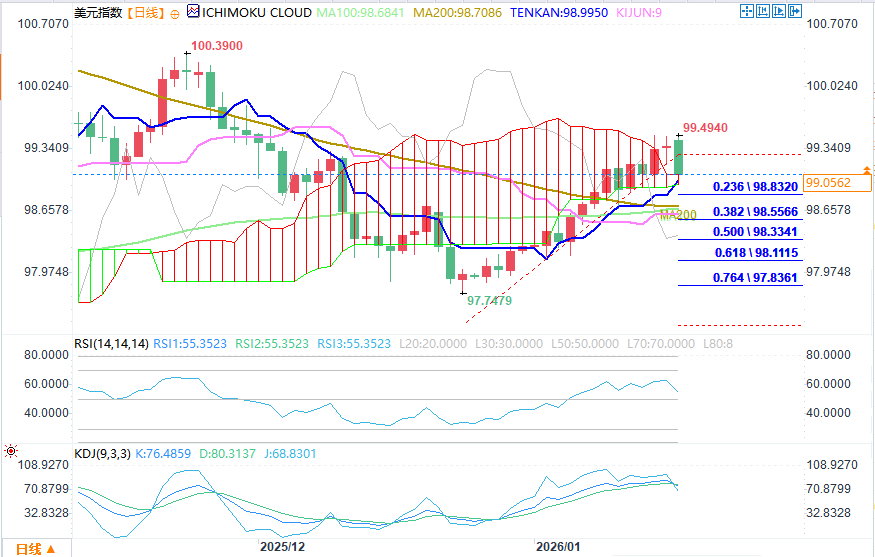

(US Dollar Index Daily Chart Source: FX678)

On the daily chart, bullish momentum continues to weaken, with both the Relative Strength Index (RSI) and the Stochastic Oscillator (KDJ) trending lower. The previous bearish divergence in the Stochastic Oscillator indicated that the current rebound has stalled, and multiple signals still point to medium- to long-term pressure on the US dollar. Furthermore, the exchange rate formed a double bullish trap at the Fibonacci resistance level of $99.20. Currently, the exchange rate has rebounded to $99.04 and is temporarily stabilizing above the support level of $99.00, but it is still under pressure in the short term. To completely reverse the weak trend, it needs to break through the upper resistance level. Conversely, if it falls below the support of $99.00 again, there is still a possibility of further decline to the key support range of $98.83-$98.73. This range corresponds to the 23.6% Fibonacci support level of the upward wave from $97.39 to $99.27, the daily conversion line, and the bottom of the Ichimoku Cloud. Further support levels below are the 38.2%, 50%, and 61.8% Fibonacci levels, corresponding to prices of $98.55, $98.33, and $98.11, respectively.

The current political situation remains fragile, and the EU's retaliatory measures against the US tariff threats could escalate further, remaining a core factor suppressing the dollar. However, positive technical signals are providing some support for the exchange rate: the daily conversion line has formed a golden cross with the baseline, and the 100-day moving average and 200-day moving average are converging and poised to form a golden cross, providing short-term support for the dollar and offsetting some of the bearish pressure. This is a significant factor contributing to the current rebound of the exchange rate to 99.04 USD.

Resistance levels: 99.30, 99.49, 99.63, 100

Support levels: 99.00, 98.71, 98.55, 98.33

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.