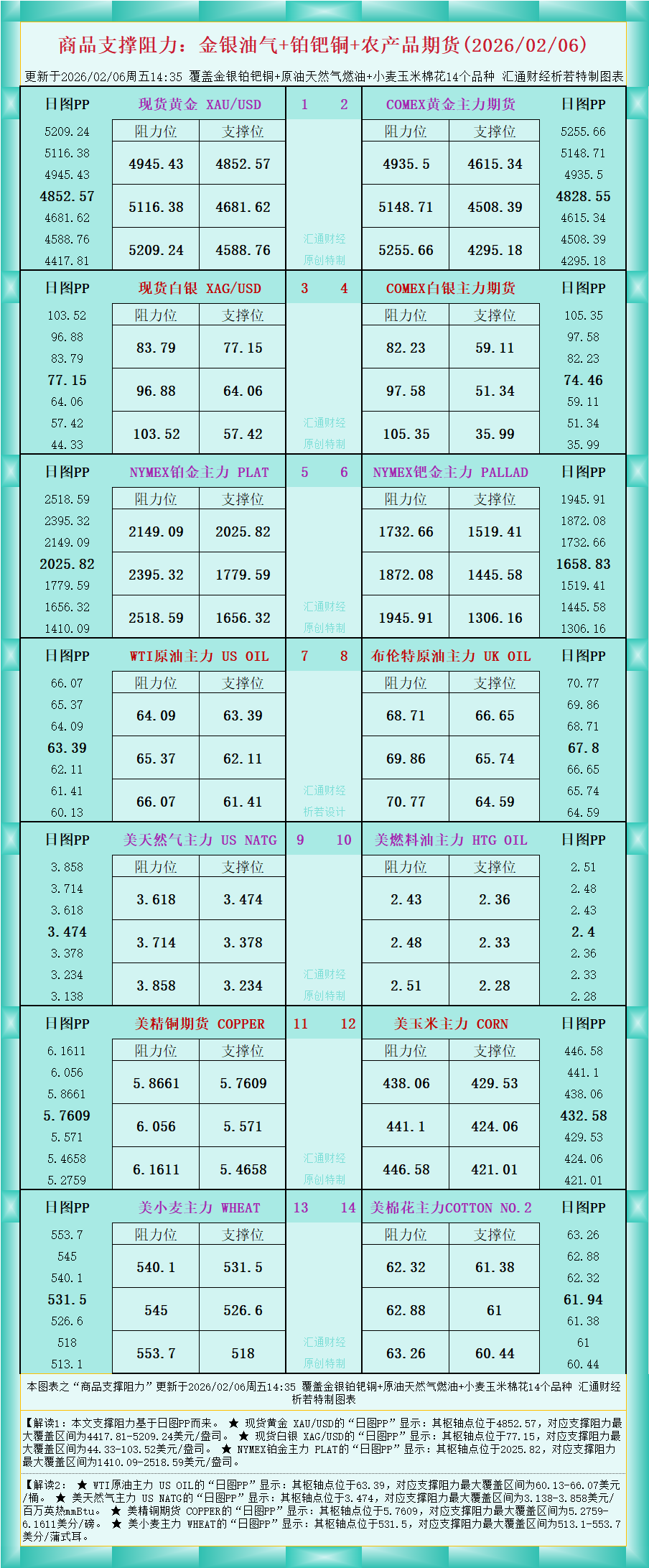

A chart showing support and resistance levels for commodities: Gold, Silver, Oil & Gas, Platinum, Palladium, Copper, and Agricultural Commodities Futures (February 6, 2026)

2026-02-06 14:37:10

As shown in the chart, Interpretation 1: The support and resistance levels in this article are based on the daily chart's price movement (PP).

★ The daily chart for spot gold XAU/USD shows that its pivot point is at 4852.57, corresponding to a maximum support and resistance range of 4417.81-5209.24 USD/oz.

★ The daily chart for spot silver XAG/USD shows that its pivot point is at 77.15, corresponding to a maximum support and resistance range of $44.33-$103.52 per ounce.

★ The daily chart of NYMEX Platinum futures contract PLAT shows that its pivot point is at 2025.82, corresponding to a maximum support and resistance range of $1410.09-$2518.59 per ounce.

Interpretation 2:

★ The daily chart of WTI crude oil futures (US OIL) shows that its pivot point is at 63.39, corresponding to a maximum support and resistance range of $60.13-$66.07 per barrel.

★ The daily chart of the main US natural gas contract, US NATG, shows that its pivot point is at 3.474, corresponding to a maximum support and resistance range of $3.138-3.858 per million British thermal units (mmBtu).

★ The daily chart for US copper futures (COPPER) shows that its pivot point is at 5.7609, corresponding to a maximum support and resistance range of 5.2759-6.1611 cents/pound.

★ The daily chart of the US wheat futures contract WHEAT shows that its pivot point is at 531.5, with the corresponding support and resistance range covering 513.1-553.7 cents per bushel.

For more detailed analysis of various product categories, please see the charts. This article is an original production by FX678, all rights reserved, and is for reference only.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.