Euro bulls are building momentum! Stabilizing at high levels awaits non-farm payrolls data; the policy divergence between the US and European central banks may continue to provide upward pressure.

2026-02-11 10:07:10

Meanwhile, the ECB's neutral stance helps maintain strong market confidence in the euro. If market expectations for a Fed rate cut continue to rise, and the ECB maintains its neutral position, buying pressure on the euro/dollar exchange rate could intensify further in the coming trading days.

Non-farm payroll data release time approaching

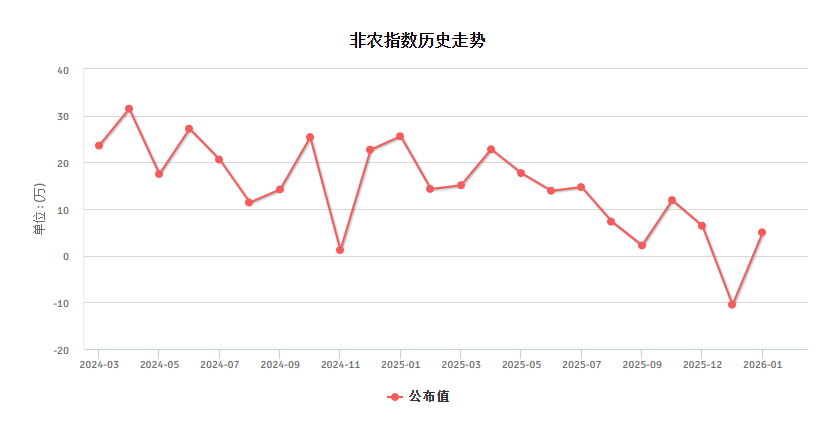

The US January non-farm payroll data will be released on Wednesday (February 11th) at 21:30 Beijing time. Market forecasts predict an increase of 70,000 jobs, higher than the 50,000 reported in December 2025, with the unemployment rate remaining at 4.4%, unchanged from the previous figure. If these forecasts are confirmed, this would support the gradual recovery of the job market after a sharp contraction of over 100,000 jobs lost by the end of 2025.

(Historical trend chart of non-farm payrolls, source:)

This data release is particularly important for assessing the dollar's trajectory. A key factor driving the Federal Reserve's decision to begin cutting interest rates at the end of 2025 was the apparent weakness in the labor market, which ultimately weighed on the dollar's performance. If this non-farm payroll data fails to meet—or at least exceed—market expectations, it could reinforce the market's assessment that the slowdown in US job growth is continuing, prompting the Fed to reassess its future policy decisions and adopt a more neutral interest rate policy .

This potential scenario is already reflected in the market's implied probability. While the market currently sees a 78.4% probability that the Fed will keep interest rates unchanged at its March meeting, expectations for the April meeting have begun to shift, with the probability of rates remaining neutral now down to 57.3%, a significant decline from 70% a week ago. This highlights the increasing market hesitation and opens the door to a potential rate cut scenario—the specific path of which will depend on the evolution of future employment data.

Against this backdrop, a potential environment of interest rate cuts could further diminish the attractiveness of dollar-denominated assets, thus continuing to put pressure on the dollar in the short term. If this trend persists, the euro is expected to continue its upward trend in a more sustainable manner, thereby providing stable buying support for the euro/dollar exchange rate.

The European Central Bank maintained a neutral stance.

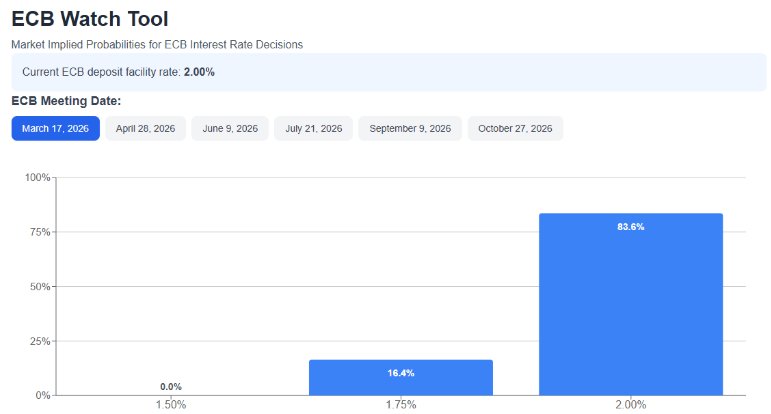

In addition to developments in the US, market implied probabilities indicate an 83.6% chance that the European Central Bank will maintain its interest rate at 2.00% at its March 17 meeting. Furthermore, the probability of interest rates remaining in the neutral range until October 2026 remains above 50%. This suggests that, unlike the potential scenario in the US, the ECB is not currently considering initiating an aggressive rate-cutting cycle .

This policy stance, with its neutral outlook in the long term, enhances the stability of the European fixed-income market and helps maintain market confidence in the relative strength of the euro. As long as the ECB avoids sending any major surprises, this position is likely to continue to provide stable support for euro demand in the short term .

EUR/USD Technical Outlook

A potential bullish trend is re-emerging: Despite recent volatility in EUR/USD, the pair has maintained sustained buying pressure, reinforcing the likelihood of a new uptrend line forming, especially after the price broke out of the wide sideways channel that had dominated the price action for months. If the bullish bias holds, a more robust bullish structure could form in the upcoming trading session.

RSI Indicator: The RSI line continues to remain above the neutral level of 50, indicating that the average momentum over the past 14 trading days is still dominated by a bullish bias. As long as this trend continues, buying pressure on the chart is expected to remain dominant.

MACD indicator: The MACD indicator shows a similar situation, with its line holding steady above the zero axis and the histogram also rising back above the zero axis, implying bullish momentum, which further confirms that the dominant bullish tendency still exists.

Key levels :

1.2081 - Key Resistance Level: This level coincides with the recent high and forms a major upward resistance level. If the exchange rate continues to rise towards this level, it may strengthen the bullish momentum and open up more clear upward trend space in the next few trading days.

1.1850 - Recent Support Level: This level corresponds to the upper edge of the wide trading range for this currency pair. If the exchange rate continues to fall below this level, the short-term focus may shift back to a consolidation phase.

1.1750 - Key Support Level: This level is close to the 50-period moving average (MA, 1.1746), forming a major downside barrier. A sustained break below this level could allow bearish sentiment to dominate in the coming weeks.

(Euro/USD daily chart, source: FX678)

At 10:05 Beijing time, the euro was trading at 1.1903/04 against the US dollar.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.