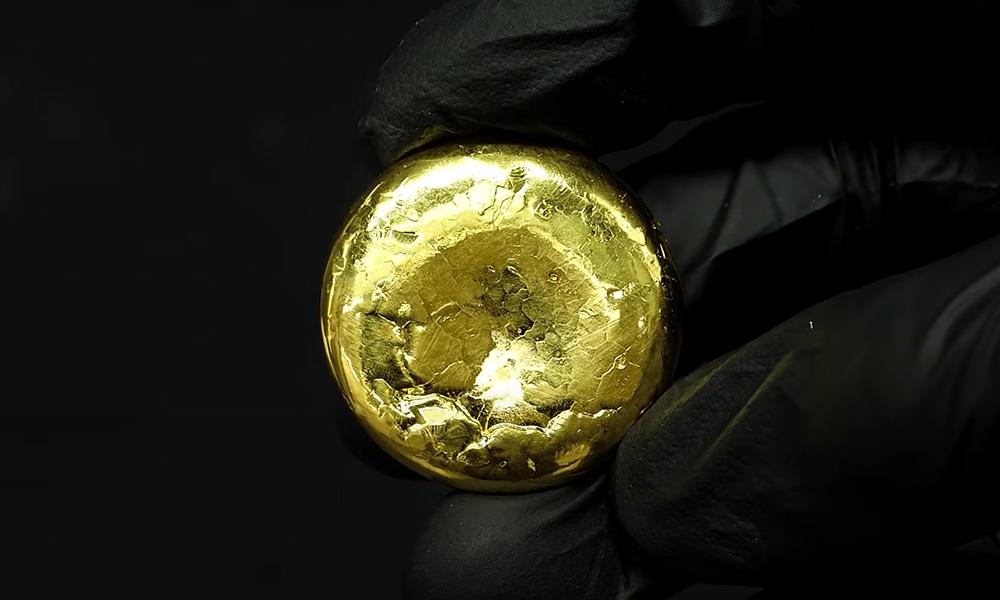

The US Treasury Department calls gold a bubble, while banks see prices reaching $6,000 in the short term.

2026-02-11 10:45:41

Feneck highlighted the apparent contradiction between U.S. Treasury Secretary Bessant's recent denunciation of the gold price surge as a "speculative outburst" and the bullish forecasts emerging on Wall Street.

Feneck stated, "Anytime Bessant or Powell or anyone in the U.S. government is talking, you have to listen." "However... if U.S. banks are on the other side of the deal, you'd wonder why these people are belittling the deal? Banks have been raising their target prices over the past few months."

Feneck points out that some of the world’s largest financial institutions have set aggressive near-term target prices, proving that “smart money” is betting against official narratives.

Feneck points out: "JPMorgan's $6,000 per ounce, Goldman Sachs' $5,400 per ounce, and Bank of America's $6,000 per ounce are for the next few months, not the end of the year." He emphasizes that these bullish statements have a very short timeframe.

Commodity wars and tungsten surge by 100%

Beyond gold and silver, Feneck believes the market is entering a broader “commodity war,” driven by geopolitical tensions and the weaponization of supply chains. He cites the tungsten market as a prime example of this volatility, noting that the price of this crucial defense metal doubled in just 90 days after the East Asian University imposed new export restrictions.

He said, "Tokyo University has been very frank in saying that 'starting from January 1, 2026, we will not export any tungsten.'"

Feneck's warning aligns with recent geopolitical developments. On February 4, 2026, the University of Tokyo, citing national security interests, formally announced strict export controls on tungsten and other critical minerals, reinforcing restrictions that had already been effectively suspended earlier this year.

According to Feneck, the average spot price of tungsten surged from around $673 in early November 2025 to $1,375 on February 6, 2026, an increase of over 100% in three months. He attributes this to the metal's crucial role in the defense sector.

Feneck revealed that, in response to the supply shock, he is acquiring tungsten mines in the United States, with Guardian Metal (GMTLF), American tungsten (TUNGF), and Spartan (SPRMF) as his top choices.

Silver price fluctuations

Regarding the brutal sell-off that saw silver prices plummet by nearly 30% on January 30, Feneck described it as a result of excessive liquidity exacerbated by algorithmic trading rather than a fundamental collapse.

Feneck advises investors to view these sharp corrections as buying opportunities rather than reasons to panic, but he cautions against using leverage.

He warned, "This is not a casino, don't treat it like one. You have to be able to withstand a 20% to 30% drop during a stock correction."

Investment Strategy

Despite the risks, Feneck remains aggressive, showing a 50% allocation to small-cap mining companies in his portfolio, which he believes provides superior leverage in the current bull market.

He said, "We're in a bull market now, and you have to buy on dips." He noted that his company was a net buyer during the recent pullback.

Regarding exposure to the industry, Feneck mentioned holding major producers through ETFs such as GDX and GDXJ, while also engaging in specific "rifle shots" in smaller sectors. In addition to the tungsten option, he highlighted PZG Corporation, which received federal approval for its gold project in Oregon on January 29, 2026, marking a historic licensing milestone.

He also pointed out that PNPN is the preferred copper business due to strong drilling results and the support of billionaire investors.

Spot gold daily chart source: EasyForex

At 10:45 AM Beijing time on February 11, spot gold was trading at $5053.05 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.