The US government is expected to experience a "Valentine's Day shutdown," tearing apart the faith in the dollar.

2026-02-12 13:52:03

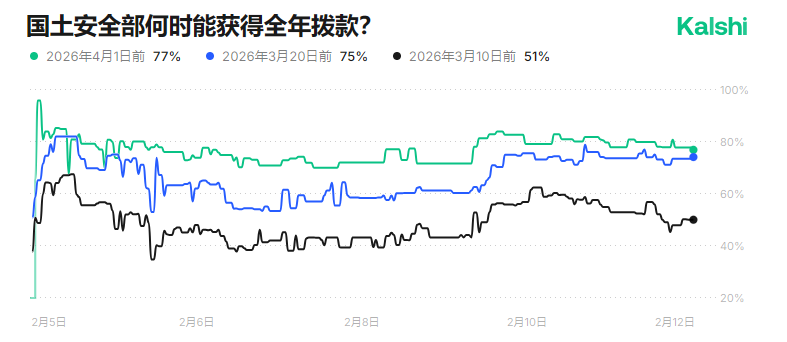

With funding negotiations between the two parties in the US Congress breaking down, markets anticipate a partial government shutdown this weekend. Data from the Kalshi forecasting platform shows that the probability of a shutdown starting this Saturday is approaching 80%.

The shutdown farce continues

Earlier in 2026, the most recent U.S. government shutdown ended after only a few days when Democrats and Republicans reached an agreement to split a spending bill into separate bills. President Donald Trump signed these separate bills on February 3, ending the government deadlock.

However, one of the bills only provided funding for the Department of Homeland Security for two weeks. While the agreement ended the broader funding dispute, a long-term funding plan for the Department of Homeland Security remains pending.

Current status of negotiations

Negotiations appear to have broken down again. Neither side holds out hope of avoiding a second partial government shutdown. Democrats are demanding reforms to Immigration and Customs Enforcement and Customs and Border Protection before they will vote on any new funding for the Department of Homeland Security, but Republicans are adamant.

According to reports, an anonymous Democratic senator revealed that the eight Senate Democrats who voted to abruptly end the record 43-day government shutdown in November 2025 are now firmly committed to their position. These senators will not even agree to a short-term agreement unless Republicans agree to major reforms to agencies under the Department of Homeland Security. Senate Minority Leader Chuck Schumer stated that he "finds it hard to believe" Democratic senators would vote again for another temporary measure.

Which organizations might be shut down?

While a potential government shutdown may be partial, it could lead to significant disruptions beyond the operations of Immigration and Customs Enforcement (ICE) and Customs and Border Protection (CBP), including temporary disruptions and payroll delays for agencies such as the Transportation Security Administration (TSA), Federal Emergency Management Agency (FEMA), and the U.S. Coast Guard.

Short-term safe-haven distortions and long-term credit erosion of the US dollar

The US government's renewed shutdown crisis is not an isolated incident, but rather the second concentrated outbreak of fiscal governance failure since 2026, forming a "back-to-back" stalemate with the brief shutdown that just ended in early February. This constitutes a complex negative factor for the US dollar—weakening its safe-haven appeal through short-term sentiment disturbances, and continuously eroding the credibility of the US system, a core source of the dollar's premium, in the medium term. During Thursday's Asian trading session, the US dollar index fluctuated narrowly around 96.95.

(US Dollar Index Daily Chart, Source: FX678)

At 13:51 Beijing time, the US dollar index is currently at 96.97.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.