JPMorgan predicts that the average price of silver will be $81 and $85 in the next two years, respectively.

2026-02-12 14:32:46

In a report released on Tuesday, analysts said silver is trying to emerge from gold's shadow by 2026, but it remains unclear whether it can do so.

They wrote: “Silver has long been considered a perennial partner in the world of precious metals, often overlooked. Despite silver’s practical applications in industrial processes and outputs, including as a paste for collecting and transporting electricity on solar panels and arrays, the price ratio of gold to silver sometimes exceeds 100/1.”

They added, "However, currently, this ratio is close to 15-year levels. Both gold and silver prices experienced extreme volatility at the start of 2026, and for a period of time, at least in terms of net value appreciation, silver began to outperform gold."

JPMorgan Chase believes these gains are largely a result of U.S. tariff policy. Analysts wrote, “For months, the U.S. Commerce Department had been reviewing critical minerals under Section 232 of the Trade Expansion Act. Section 232 is a specific provision of the Trade Expansion Act of 1962 that allows the president to impose tariffs or other trade restrictions on imported goods if they are deemed a threat to national security. This uncertainty ended in mid-January when President Trump postponed new tariffs on imports of critical minerals such as silver, instead seeking bilateral agreements with trading partners to secure adequate supplies. Silver prices fell after the executive order was issued, then rebounded.”

The next immediate cause of the silver price drop was on January 30, when the president announced the nomination of Warsh as the next Federal Reserve Chairman. They noted: "Silver plummeted 27%, and gold prices fell 10%."

While Warsh's nomination, coupled with the recent strengthening of the dollar, appears to have slowed the huge demand for precious metals, analysts say certain structural drivers remain and could continue to limit silver supply.

They pointed out: "One is that, in general, silver is mined as a byproduct of other metals, which means that production is less elastic to increases in silver prices; another is the role of silver in industrial processes such as solar panel manufacturing."

Gregory Shearer, head of base and precious metals strategy at JPMorgan Chase, believes that in this scenario, high silver prices may force solar panel manufacturers to switch to silver-free technologies to control costs, while also finding ways to reduce the amount of silver required per solar panel.

Shearer said, “In the long run, we believe the biggest risk to silver comes from the wider adoption of silver-free technologies. Although it is a core precious metal, silver remains a very industrial metal, with industrial applications accounting for about 60% of total demand (excluding ETF flows). From a fundamental perspective, we believe the surge in silver prices may have already significantly accelerated the trend of substitution and conservation.”

However, Shearer acknowledges that these changes could take several years. In the short term, he still believes that fluctuations in investment demand are the primary driver of prices.

JPMorgan Global Research believes that the floor for silver prices is rising, but the ceiling is still unclear.

The report states: "One reason why gold has more reliable demand than silver is that gold has a broader buyer base, including central banks around the world that buy gold to diversify their reserves, as well as its advantages as an inflation hedge and a liquid asset without counterparty risk, while silver does not have the same underlying demand."

He said, "Without central banks acting as structural downside buyers, we do believe there is still a risk of further upside for the gold-silver ratio." But he added that global demand, particularly from major Asian powers and India, will play a key role in determining where silver prices will find support after the recent pullback.

He stated, "With the expanding investment demand from major Asian countries significantly impacting the price formation of metal compounds, we believe this remains another catalyst for silver prices in the coming weeks. Ultimately, we are more cautious about re-entering the silver market in the short term until it becomes clearer that some of the recent price bubbles have completely deflated."

JPMorgan Global Research projects that the average price of silver will be $81 per ounce in 2026, with the highest average price expected in the fourth quarter at $85, while they also project an average price of $85 in 2027.

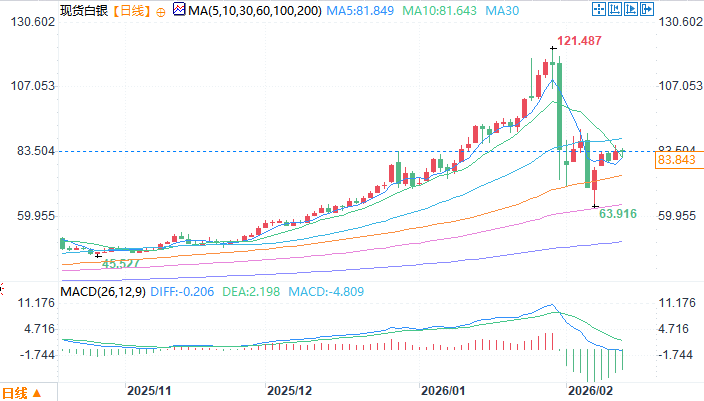

Spot silver daily chart source: EasyForex

At 14:32 Beijing time on February 12, spot silver was trading at $83.39 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.