February 17th Financial Breakfast: Tightening market liquidity puts downward pressure on gold prices; Iran's live-fire military exercises in the Strait of Hormuz boost oil prices.

2026-02-17 07:16:24

Key Focus Today

Global Markets

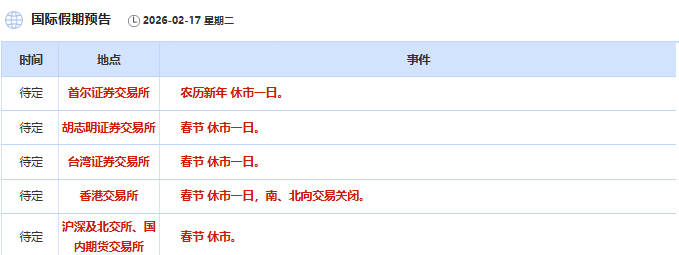

Global markets stabilized on Monday, recovering some of the losses incurred on Friday due to concerns about artificial intelligence. Trading was generally light as many Asian markets were closed for the Lunar New Year holiday and U.S. stock markets were closed for Presidents' Day.

European stocks rose, driven by a rebound in the banking sector, with the pan-European STOXX 600 index closing up about 0.3%. U.S. stock index futures also edged higher, suggesting a possible higher opening for U.S. stocks.

On the economic data front, Japan's preliminary annualized quarterly GDP growth rate for the fourth quarter was only 0.2%, far below market expectations of 1.6%. This weak data highlights the challenges facing the Japanese economy, and the market believes this may provide more justification for Prime Minister Sanae Takaichi to push for more aggressive fiscal stimulus policies. Nevertheless, some investors remain optimistic about the long-term positive impact of her reflation policy on the Japanese stock market.

Market attention is now focused on a series of key data releases and events this week, including revised US fourth-quarter GDP figures, preliminary Purchasing Managers' Index (PMI) readings from several countries, and inflation data from the UK, Canada, and Japan. Walmart's earnings report is also closely watched, with the market hoping to glean insights into US consumer spending.

Massive capital expenditure plans in the field of artificial intelligence continue to be a focus of market attention. Goldman Sachs points out that as these expenditures surge, share buybacks by S&P 500 companies have declined compared to a year ago. This reflects that while companies are increasing their investment in AI infrastructure, they may be adjusting their capital allocation.

In the commodities market, investor sentiment remained cautious, with precious metals and energy commodities showing divergent trends. Gold prices came under downward pressure, with spot gold falling to $4,965.06 per ounce at one point on Monday. Recent volatility in the gold market has intensified, mainly due to some investors being forced to unwind leveraged positions, leading to a tightening of market liquidity. Silver also performed weakly.

In the crude oil market, oil prices rebounded slightly by over 1.4%. Brent crude reached a high of $68.73 per barrel, while WTI crude reached a high of $63.87 per barrel. This price rebound was mainly driven by supply-side news. OPEC is inclined to resume increasing oil production starting in April, and the market is digesting this potential supply adjustment. Analysts point out that the commodity market will continue to face multiple intertwined factors in the coming weeks, including the demand outlook of major economies, geopolitical risks, and the production policies of major oil-producing countries.

International News

The probability of the Federal Reserve keeping interest rates unchanged in March is 92.2%.

According to CME's "FedWatch": The probability of the Federal Reserve cutting interest rates by 25 basis points by March is 7.8%, and the probability of keeping rates unchanged is 92.2%. The probability of a cumulative 25 basis point rate cut by the Fed by April is 25.3%, the probability of keeping rates unchanged is 73.1%, and the probability of a cumulative 50 basis point rate cut is 1.6%. The probability of a cumulative 25 basis point rate cut by June is 52.6%.

Swiss Foreign Ministry: Geneva talks between Russia, the US, and Ukraine will be held behind closed doors.

The Swiss Foreign Ministry stated in a press release on the evening of the 16th that the third round of trilateral talks between Russia, the United States, and Ukraine, scheduled to begin on the 17th, will be held behind closed doors, and the media will not be allowed inside. The third round of talks is scheduled to take place in Geneva, Switzerland, from the 17th to the 18th. The Russian delegation is led by Presidential Aide Medinsky, and US President Trump's special envoy Witkov and son-in-law Kushner will attend the talks as the main representatives of the US side. The Ukrainian delegation includes Umerov, Secretary of the National Security and Defense Council.

Iran conducts live-fire military exercises in the Strait of Hormuz

According to Iranian state media reports on February 16, a "complex and targeted" live-fire exercise led by the Iranian Islamic Revolutionary Guard Corps Navy is being held in the Strait of Hormuz. Revolutionary Guard Commander-in-Chief Pakpour is overseeing and directing the exercise. The main objectives of the exercise are to test the combat readiness of naval forces, review the Strait of Hormuz security control plan and contingency plans for reciprocal military operations, and intelligently utilize Iran's geopolitical advantages. (CCTV International News)

The US and Iran engaged in indirect negotiations again today.

On February 17, the United States and Iran will hold a new round of indirect talks in Geneva, Switzerland. A delegation led by Iranian Foreign Minister Araqchi arrived in Geneva on February 16. US Presidential Special Envoy Witkov and Trump's son-in-law Kushner will serve as the main US representatives. Omani representatives will continue to mediate. The Omani Ministry of Foreign Affairs posted on social media on February 16 that Foreign Minister Bader met with Araqchi in Geneva that day to discuss preparations for the new round of talks. The Omani Ministry of Foreign Affairs stated that both Oman and Iran believe that efforts should be made to actively promote understanding and consensus among all parties to reach an agreement that meets the interests and expectations of all parties. The US and Iran held indirect talks in Muscat, the capital of Oman, on February 6. Both sides stated after the talks that they would continue negotiations, but judging from their public statements, neither side will compromise on its core differences. (CCTV International News)

The German Interior Minister announced a six-month extension of border control measures.

German Federal Interior Minister Dobrinth announced on the 16th that the German government will extend the temporary border control measures, originally scheduled to expire on March 15, 2026, for another six months. He revealed that border controls are part of a readjustment of Germany's immigration policy. The relevant notification is currently being submitted to the European Commission. According to current EU regulations, the Schengen Area does not have systematic border checks in principle; therefore, member states must follow formal notification procedures when reinstating or extending border controls. (CCTV News)

Bank of Japan Governor Kazuo Ueda stated that Prime Minister Sanae Takaichi did not raise any specific demands during their meeting.

Bank of Japan Governor Kazuo Ueda said that during his regular meeting with Prime Minister Sanae Takaichi to discuss economic issues and exchange general views, Takaichi did not make any specific requests. "We discussed the overall economic and financial situation," Ueda said after meeting with Takaichi at the Prime Minister's Official Residence in Tokyo on Monday. Investors and economists are trying to determine whether Takaichi, with her political position more secure, will try to slow the pace of interest rate hikes to protect economic growth, or urge the Bank of Japan to take action to support the yen. Hideo Kumano, executive economist at the Dai-Ichi Life Research Institute and a former Bank of Japan official, said, "Takaichi probably wanted to finish this meeting quickly to avoid unnecessary market speculation if it happened a long time after the election. Ueda likely felt the same way." Given that the meeting lasted only 20 minutes, it is unlikely that the two sides had a lengthy and in-depth discussion on policy paths. Ueda declined to comment on whether Takaichi agreed with his views on the Bank of Japan's policy stance.

The EU may consider expediting the selection of Lagarde's successor to avoid the possibility of a far-right takeover in France.

European governments may choose to expedite the selection of Christine Lagarde's successor at the European Central Bank to avoid dealing with a far-right French president after the 2027 French election. Lagarde's term will last until next October, and her successor is typically chosen that summer. However, the risk that Marine Le Pen or her "successor," Jordan Bardella, might win the French election starting in April 2027 could prompt European leaders to adjust their timelines.

Domestic News

The Spring Festival Gala with the highest concentration of robots ever held; they performed on stage.

The 2026 CCTV Spring Festival Gala featured the highest density of robots ever. Four robot manufacturers partnered with the gala, showcasing their products through skits, martial arts performances, songs and dances, and New Year's short films. At the main venue, six MagicBot Z1 humanoid robots and two MagicBot Gen1 robots performed alongside celebrities like Jackson Yee and Jerry Yan. At the Yibin branch venue, over a hundred quadruped robots, shaped like pandas, presented a large-scale group performance. Songyan Power's skit, "Grandma's Favorite," marked the first time humanoid robots appeared in a Spring Festival Gala comedy segment, with its N2, E1, and Xiaobumi products, as well as actress Cai Ming's bionic humanoid robot, all performing. (CCTV)

Low-altitude economy "flies" into the Spring Festival Gala: Peakfly Aviation unveils the world's first eVTOL seaplane airport.

SUNSHIP Aviation's independently developed world's first eVTOL (Electric Vertical Take-Off and Landing) seaplane airport made its debut at the Yibin branch venue of the Spring Festival Gala on the evening of February 16th, creating a "dedicated stage" for actress Dilraba Dilmurat's dance. The SUNSHIP seaplane airport, which was showcased this time, is the world's first seaplane airport built specifically for eVTOLs. It is 36.5 meters long and has a deck of over 300 square meters, serving as the take-off, landing, and docking area for eVTOLs. (CCTV)

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.