Non-farm payrolls outlook: July jobs report expected to show further slowdown in US hiring, unemployment rate may rise

2025-08-01 09:11:42

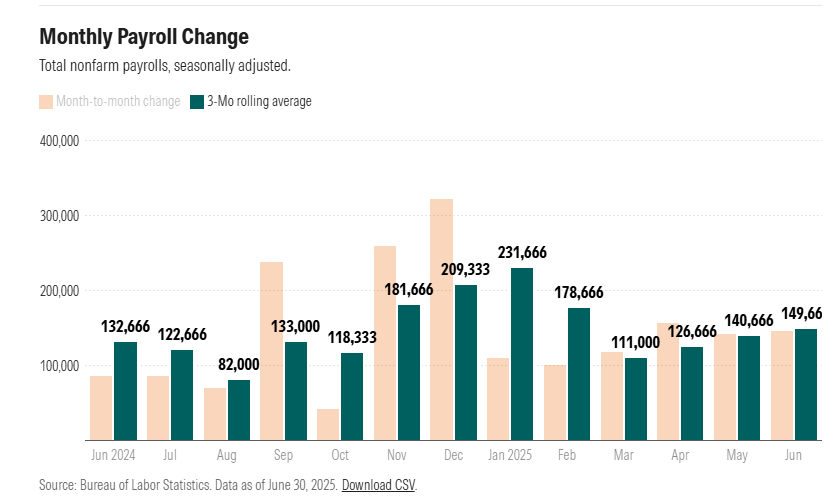

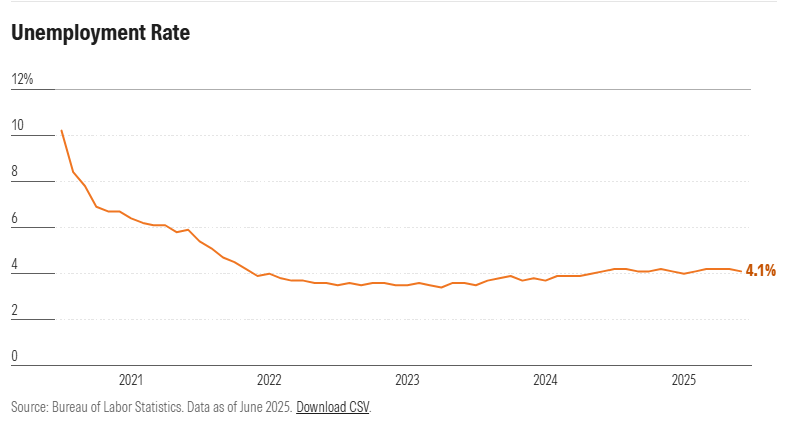

Nonfarm payrolls are expected to increase by 117,500 in July, down from 147,000 in June, according to a FactSet consensus forecast. The unemployment rate is expected to rise slightly to 4.2% in July from 4.1% in June.

“We think the economy will continue to soften, particularly in the private cyclical sectors of the economy,” said Kathy Bostjancic, chief economist at Nationwide. “The private sector remains subdued, and the knock-on effect is that overall income growth is modest.”

While the impact of tariffs appears to be less significant than expected, Bostjancic said the effect is subtle. "I think the uncertainty around tariffs is primarily impacting businesses' concerns about overall demand for goods and services," she said. Rather than mass layoffs, businesses are taking a cautious approach to job creation.

(Changes in U.S. non-farm payrolls, yellow bars represent monthly changes, and green bars represent three-month rolling averages)

July employment report forecast highlights

Employment report release time: 21:30 Beijing time on August 1 (Friday)

FactSet forecasts: Nonfarm payrolls are expected to increase by 117,500, down from 147,000 in June.

The unemployment rate is expected to rise to 4.2% from 4.1% in June.

Hourly earnings are expected to rise 0.3%, accelerating from a 0.2% gain in June.

Focus on private sector job growth

Despite relatively healthy overall job growth, Bostjancic highlighted concerns about employment in economically sensitive, cyclical sectors. “We think it will continue to be weak,” she said. “There were no net new jobs in the sector.”

Meanwhile, despite an increase in average hourly earnings, Bostjancic observed that overall income growth was "essentially flat" due to a reduction in work hours. She said the weakness in private cyclical sectors isn't just an isolated trend, but provides insight into the broader private economy. "It tells us that, at least in the private sector, the overall economy is somewhat subdued. Overall job growth remains weak, and the knock-on effect is that overall income growth isn't strong."

June employment report expected to appear strong but not

However, Goldman Sachs economists believe that "private sector job growth will rebound to a slightly firmer (but still weak) pace," with an expected increase of 100,000, down from 147,000 in June.

At UBS, economists expect a "soft" July jobs report, with nonfarm payrolls rising by 95,000 and the unemployment rate rising to 4.2%. "We expect nonfarm payroll growth to slow in July from 147,000 in June, primarily due to a slowdown in government payrolls, which unexpectedly rose by 73,000 in June," they wrote.

Unemployment is expected to rise slightly

Bostjancic expects the unemployment rate to rise slightly in July. "We expect the unemployment rate to rise by 0.1 percentage point," she said, noting that last month's decline in the unemployment rate was largely due to a drop in the labor force participation rate. "Last month we recorded a record monthly increase in so-called 'discouraged workers.' People who want to work are having a hard time finding work." After adjusting for the decline in the labor force participation rate, Bostjancic believes the unemployment rate has risen to 4.7%.

(Overview of changes in the U.S. unemployment rate)

Analysis of the impact on gold prices

A weak labor market is bullish for gold: if slowing job growth and rising unemployment indicate weakening economic activity, it could bolster market expectations of a Federal Reserve rate cut, which typically reduces the opportunity cost of holding gold and drives up prices.

Policy uncertainty supports gold prices: If the report reflects that uncertainty over tariffs and immigration policies is suppressing corporate investment and hiring, such uncertainty may increase market demand for safe-haven assets, and gold as a safe-haven asset may be boosted.

Weak income growth limits inflationary pressure: Although hourly wages are expected to increase slightly, the expected reduction in working hours will lead to mediocre overall income growth and limited inflationary pressure. This may further support the Federal Reserve to maintain an accommodative policy, which will indirectly benefit gold prices.

Short-term volatility: If actual data falls short of expectations (e.g., non-farm payrolls fall far short of 117,500 or the unemployment rate rises above 4.2%), gold prices could rise due to increased risk aversion and expectations of rate cuts. Conversely, if data exceeds expectations, gold prices could come under short-term pressure.

At 09:07 Beijing time, spot gold was trading at $3290.16 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.