World Gold Council: Gold demand surges to a new record of $132 billion in the second quarter of 2025

2025-08-01 09:39:44

The report shows that global total gold demand (including over-the-counter investment) increased by 3% year-on-year to 1,249 tons in the second quarter of 2025. In terms of value, global total gold demand jumped significantly by 45% year-on-year to US$132 billion.

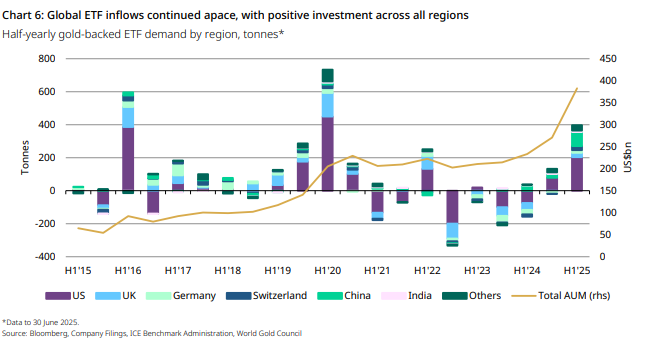

Global gold ETFs maintained strong demand for two consecutive quarters, a key factor driving overall demand growth in the second quarter. Continued uncertainty in global trade policies and intensified geopolitical turmoil, coupled with rising gold prices, have driven inflows into gold ETFs.

Attracted by rising gold prices and its safe-haven properties, investors in gold bars and coins also flocked to the market. Demand in this sector also outperformed for two consecutive quarters, helping push gold bar and coin investment in the first half of 2025 to its highest level since 2013.

Central banks remain a key pillar of global gold demand, with global official gold reserves increasing by 166 tons in the second quarter. Despite a slowdown in gold purchases, the outlook for central bank gold demand remains positive.

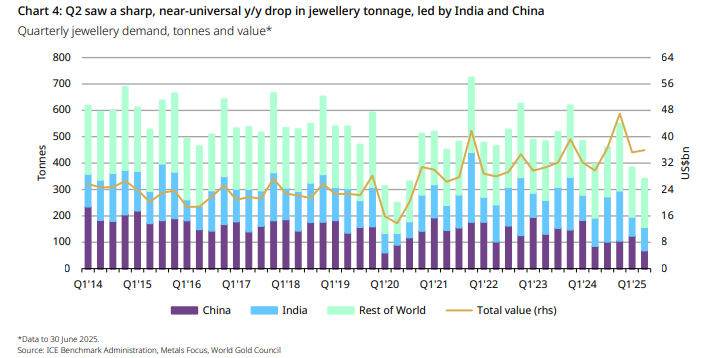

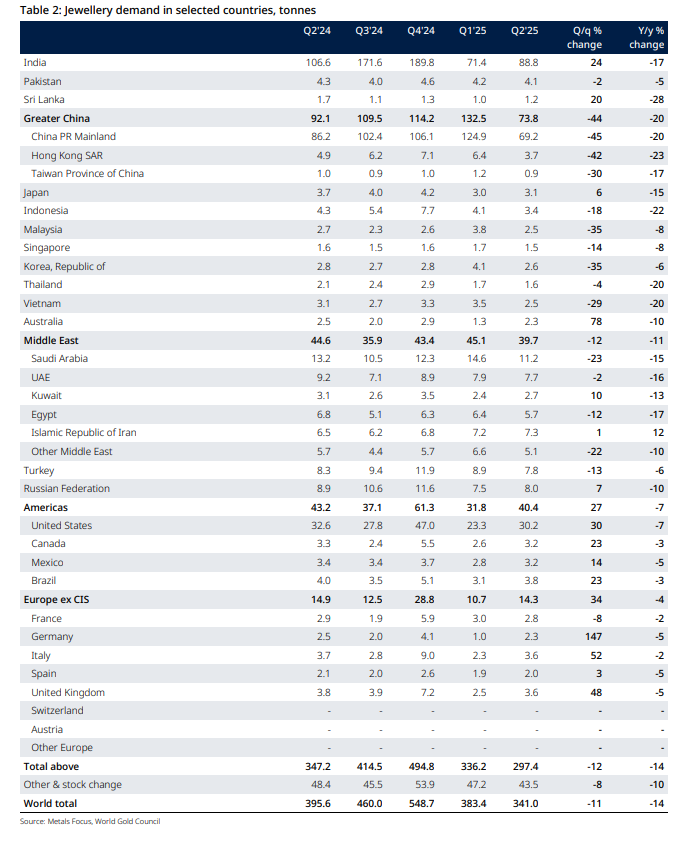

The demand for gold jewelry and the amount of consumption continued to diverge: the tonnage of gold jewelry demand in most regions declined year-on-year, and the sluggish performance almost returned to the level during the 2020 epidemic; however, the amount of gold jewelry consumption generally increased.

Demand for gold used in technology is under pressure from the potential impact of US tariffs, but growth in gold demand related to AI applications remains a bright spot.

The long-term strategic support for central bank gold purchases

The central bank's gold purchase is a long-term strategic behavior aimed at reducing dependence on US dollar assets (such as US Treasury bonds) and enhancing the diversification of reserve assets.

Central banks remain the core pillar of global demand, with 166 tons of official gold reserves added in the second quarter of 2025. This represents a 33% year-on-year decrease, but the slowdown in gold purchases is merely a rhythm adjustment, not a reversal of the trend.

This trend will not be reversed by short-term fluctuations in gold prices, especially in the context of increasing global geopolitical and economic uncertainties, as gold's attributes as "crisis insurance" continue to be strengthened.

Medium-term expectations for a structural weakening of the US dollar

The US dollar's status as the world's main reserve currency is facing challenges, with the widening US trade deficit, high debt and policy uncertainties (such as tariffs) accelerating its depreciation trend.

A weaker dollar directly reduces the cost of holding dollar-denominated gold, while driving funds to non-dollar assets such as gold.

This structural change will continue to affect gold prices. Since the beginning of 2025, the US dollar index has fallen by about 10%, significantly boosting the attractiveness of gold.

The long-term game between manufacturers' expansion and recycling restrictions

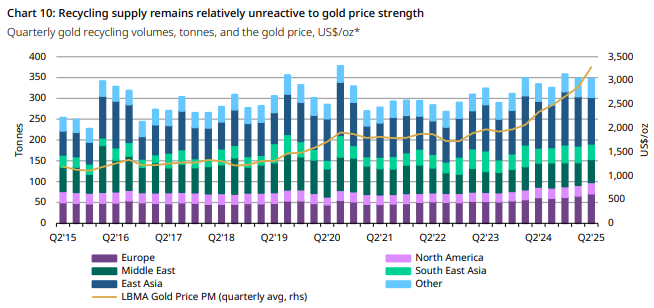

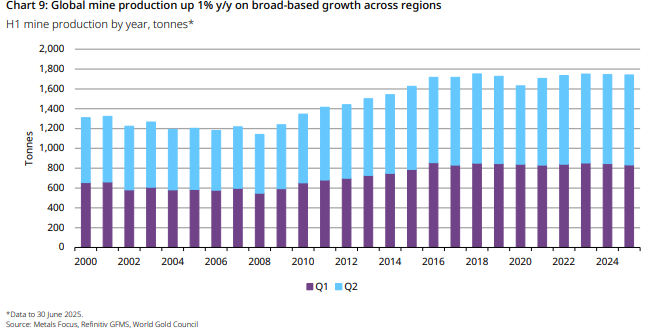

High gold prices are stimulating the expansion of gold production in new projects in countries such as Ghana, Canada and Chile. Global mine production is expected to exceed 3,600 tons in 2025, a record high.

But recycling volumes are limited by cultural habits, such as Indian consumers preferring to trade in old gold rather than sell it, and the absence of a major economic recession that would require people to sell their gold, so the increase in gold production cannot fully offset the supply gap.

In the long run, the growth of mineral gold may suppress the upward space of gold prices, but the recycling bottleneck provides support, forming a long-term game of "dual-track supply system".

ETFs and continued inflows of institutional investments

Gold ETF holdings have continued to grow from their 2020 lows, with net inflows of 397 tons (approximately $40 billion) in the first half of 2025, pushing assets under management (AUM) to over $450 billion. Chinese insurance companies will be permitted to invest in the gold market in 2025, which is expected to generate an average annual increase in demand of 50-80 tons.

Institutional investors (such as sovereign wealth funds and pension funds) include gold in their strategic allocations to hedge against inflation and stock market volatility. This allocation demand is long-term.

Structural demand shifts in China and India

China has shifted from "jewelry consumption-driven" to "investment + consumption dual-driven". In the first half of 2025, the demand for gold bars and gold coins increased by 26% year-on-year, and retail investment in gold in China exceeded jewelry demand.

Due to high gold prices and cultural habits (such as rigid holiday demand), India has formed a unique model of "low recovery + high collateral", which has long suppressed the release of supply.

The two countries together account for 45% of global gold demand, and their structural changes will have a profound impact on the long-term trend of gold prices.

Policy interest rate cuts and the long-term reconstruction of opportunity costs

The Federal Reserve is expected to cut interest rates by 75 basis points in 2025, and the real interest rate (nominal interest rate - inflation) may turn negative, reducing the cost of holding gold.

Even if short-term interest rates fluctuate, the low correlation between gold and US Treasuries (the correlation coefficient in 2025 was only 0.12) makes it a "stabilizer" for long-term asset allocation.

Historical data shows that for every 1% drop in real interest rates, the average annual return on gold increases by 8-10%. This pattern is particularly evident during interest rate cut cycles.

On the other side of the chessboard

Expansion of mineral gold supply suppresses gold prices

As mentioned above, global mined gold production continues to grow, reaching a quarterly record of 909 tons in the second quarter of 2025, and is expected to reach a new high for the full year. Producer profit margins increased and remained high in the first half of the year, incentivizing production expansion and new project development, resulting in a long-term downward pressure on gold prices due to increased supply.

Jewelry demand continues to weaken

High gold prices have severely hampered consumer affordability, leading to a general decline in global gold jewelry demand. India's jewelry consumption fell 17% year-on-year to 89 tons in the second quarter, with demand reaching 160 tons in the first half of the year, only surpassing the 2020 pandemic period. The United States and Europe have experienced consecutive quarters of declining tonnage, with Europe's tonnage down 4% year-on-year and the United States down to 30 tons.

Consumers are turning to lighter, lower-purity jewelry (such as 18K pure gold from India and 9K certified jewelry), or even opting for gold-plated silver jewelry. While the value of jewelry consumption has increased due to rising gold prices, shrinking physical demand has directly weakened gold's commodity attributes.

Technology uses of finance face multiple challenges

The US tariff policy has had a direct impact on the use of gold in technology. Coupled with the slowdown in economic growth and high gold prices, demand in the traditional technology sector has come under pressure.

While demand for AI-related applications (such as data center cooling materials) is growing, it's unlikely to fully offset overall downward pressure. Demand in the consumer electronics sector, impacted by tariffs, is weak, and AI spending growth is still in its early stages, with no significant substitution effect yet to materialize.

This structural contradiction limits the supporting role of gold for technological use.

The pace of central bank gold purchases has temporarily slowed down

Global central banks added 166 tons of gold reserves in the second quarter. While gold reserves remain a core pillar of demand, the pace of gold purchases slowed significantly compared to the first quarter. This has led institutions to slightly lower their forecasts for central bank demand in 2025. While demand may recover in the second half of the year as price headwinds ease, the short-term decline in gold purchases will reduce bullish market momentum.

It is worth noting that some central banks have begun to shift to a diversified reserve strategy, and the rate of increase in the proportion of gold in foreign exchange reserves has slowed down.

Dollar short-covering risks exacerbate volatility

The sharp sell-off of the US dollar in the first half of the year due to concerns about tariffs and taxes pushed the US dollar exchange rate well below the fair value implied by the interest rate differential, posing a risk of short covering.

If the US dollar rebounds in the short term, the price of gold denominated in US dollars may come under pressure, especially hindering the short-term allocation willingness of institutional investors.

Although there are strong expectations for a structural weakening of the US dollar in the medium term, a reversal of market sentiment may trigger a temporary outflow of funds from gold ETFs. Global gold ETF holdings saw a slight decline in May.

The stock market diversion effect is emerging

The stock market performance of China and India has a substitution effect on gold investment.

If China introduces loose policies to stimulate the economy, it may drive a rebound in undervalued stock markets and curb the appeal of gold as a safe-haven asset; the Indian stock market has performed strongly in recent years and has a high valuation. Although the economic slowdown in the second half of the year may ease the "gold demand resistance", the stock market wealth effect may still divert some funds.

Affordability issues limit investment demand

The stimulating effect of high gold prices on retail investment has a diminishing marginal effect. US gold bar and coin demand fell 35% year-on-year to 9 tons, the lowest level since 2019, reflecting the cautious attitude of ordinary investors in the face of high gold prices.

In Japan, a structural divide, with younger investors buying gold and older investors selling, has led to increased volatility in investment demand. Furthermore, emerging markets such as Vietnam and Indonesia have seen a 20% year-on-year decline in physical investment demand due to currency depreciation and high gold prices, demonstrating that affordability issues have spread to more regions.

Policy uncertainty disturbs market sentiment

The potential adjustment of the US tariff policy, changes in tax policies of various countries (such as capital gains tax), and the spillover effects of geopolitical conflicts have increased uncertainty in the gold market. The US imposed tariffs on some gold products, resulting in a decrease in demand for US gold bars and coins in the second quarter.

Gold prices plummeted due to supply chain disruptions; while safe-haven demand triggered by military conflict in the Middle East boosted investment in the short term, profit-taking is likely to follow once the conflict ends. This dual disruption of policy and geopolitical factors amplifies gold's safe-haven properties and causes volatility in short-term trading.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.