Institution: Before the second quarter of next year, the gold price is expected to reach 3850, and may even rise to 5355

2025-08-06 13:16:38

Analysts noted that since hitting an all-time high of $3,500 on April 22, gold prices have been range-bound between $3,180 and $3,400 per ounce. They stated: "The lower end aligns with the 76.4% Fibonacci retracement level, and while our forecast suggests a potential break below this level in the short term, we anticipate strong support around the 61.8% level ($3,024/oz), paving the way for a rebound. Based on consensus macroeconomic inputs, we anticipate gold prices could reach $3,850/oz by the second quarter of 2026. We view the current period as a 'load-bearing spring' phase, setting the stage for a strong upward move in gold prices."

WisdomTree lists five major macro risks to watch between now and the second quarter of 2026, all of which are bullish for gold prices: trade uncertainty, debt trajectory, institutional quality, geopolitical risks, and ambiguous dollar policy.

1. On trade uncertainty, analysts noted that while preliminary agreements were reached with the Asian giant and the UK, "negotiations with Canada, Mexico and the 27 EU countries are still ongoing" and that the preliminary agreement "fell short of market expectations and introduced significant tariff increases."

“While the final tariffs were lower than the initial headline figure, they still represent a significant shift from the status quo. Gold remains a hedge against adverse trade developments,” they added.

2. The second macro risk that could push up gold prices is rising government debt, especially in the United States.

“The newly passed OBBB bill provides unfunded tax cuts and is projected to increase the U.S. deficit by $2.4 trillion between 2025 and 2034 (excluding debt service impacts). Including interest payments, the cumulative deficit exceeds $3 trillion. The debt-to-GDP ratio is projected to rise from 117.1% in 2025 to 123.8% by 2034,” they wrote.

The analysts noted that the U.S. is not the only country facing unsustainable growth in government debt. “Historically, rising government debt has been associated with higher gold prices, especially amidst heightened concerns about debt sustainability and potential policy intervention,” they said.

3. The third risk is institutional risk. WisdomTree points out that the pressure on the Federal Reserve is increasing.

They stated: "President Trump's repeated criticism of Chair Powell, whose term expires in May 2026, has heightened concerns about the central bank's independence. As debt-servicing obligations grow, the risk of political influence on monetary policy grows. A scenario similar to the G. William Miller era of 1978-1979, with its weakened institutions and high inflation, could emerge. During this period, gold saw a historic rally. Fed Chair Volcker used his power to reverse the damage done to the Fed, but his bold efforts triggered recessions. Yes, two recessions, the so-called double dip (January-July 1980 and July 1981-November 1982). Gold, as a defensive asset, performs well during recessions."

4. Geopolitical risk is the fourth biggest area of concern, and analysts point out that the international situation remains tense.

They noted: "Following the US and Israeli attacks, Iran suspended its cooperation with the International Atomic Energy Agency (IAEA). There are currently no firm dates for diplomatic talks scheduled, and US-Israeli coordination appears to be fragmented."

The Russia-Ukraine conflict continues to deteriorate. They stated: "Trump's failure to broker a peace agreement within his first 24 hours in office has backfired. The personal relationship between Putin and Zelensky continues to deteriorate, reducing hopes for a resolution in the near future."

5. The last macro risk that may push gold prices to new highs is the Trump administration’s dollar policy, which WisdomTree believes is ambiguous.

"While there is no official policy to devalue the dollar, the actions taken by the administration suggest a weak dollar policy," the analysts said. "We comment on the hypothetical 'Mar-a-Lago Agreement'... We believe this would shock the global economic system. While this is not our base case, such a policy would be significantly bullish for gold, especially as the credibility of U.S. debt is questioned and U.S. Treasury yields become volatile."

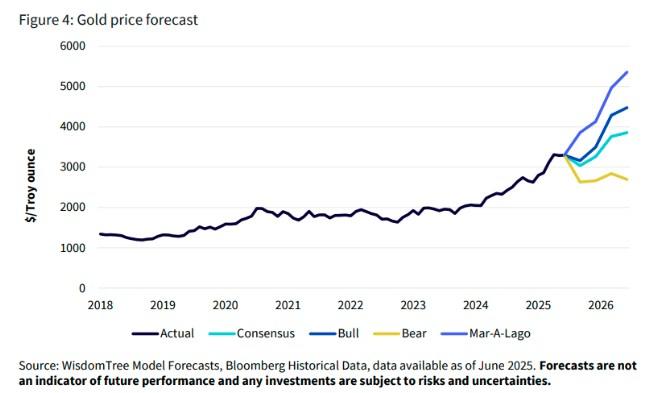

After detailing their gold price attribution formula, the analysts proposed four different gold price scenarios based on WisdomTree’s quantitative model, noting that “the macro consensus forecast was made before the ‘trade truce’ was extended.”

Figure 4: WisdomTree model predicts gold prices under four scenarios (black: actual, turquoise: consensus, dark blue: bull market, yellow: bear market, light blue: Mar-a-Lago agreement)

WisdomTree made its prediction in the "Mar-a-Lago Agreement Scenario," with analysts writing: "In this scenario, the United States pursues a policy objective of devaluing the dollar. While we believe there is no clear policy objective, there are many things about this US administration that have surprised us, so modeling the outcome may be a worthwhile task."

In this extreme scenario, WisdomTree believes that gold demand will strengthen significantly. "Because this scenario is so far out of sample, we expect our forecast of $5,355 to be conservative."

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.